Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $185,000 are payable at the beginning of

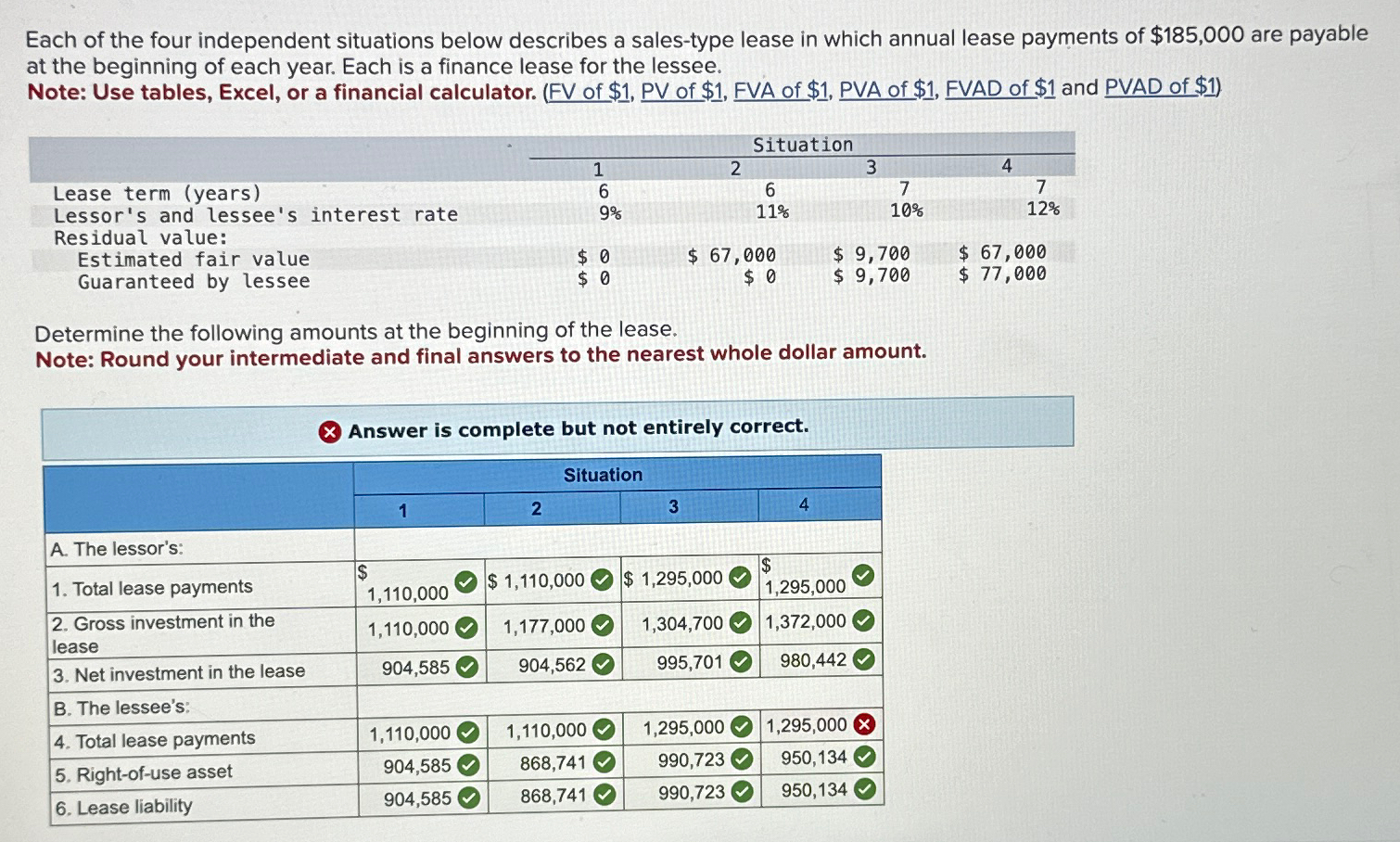

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $185,000 are payable at the beginning of each year. Each is a finance lease for the lessee. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) Situation 1 2 3 4 Lease term (years) 6 Lessor's and lessee's interest rate 9% 6 11% 7 10% 7 12% Residual value: Estimated fair value $ 0 $ 0 $ 67,000 $ 0 $ 9,700 $ 67,000 $ 9,700 $ 77,000 Guaranteed by lessee Determine the following amounts at the beginning of the lease. Note: Round your intermediate and final answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Situation 1 2 3 4 A. The lessor's: 1. Total lease payments $ $ $ 1,110,000 $ 1,295,000 1,110,000 1,295,000 2. Gross investment in the 1,110,000 1,177,000 lease 3. Net investment in the lease 904,585 904,562 1,304,700 995,701 1,372,000 980,442 B. The lessee's: 4. Total lease payments 1,110,000 1,110,000 5. Right-of-use asset 904,585 868,741 990,723 6. Lease liability 904,585 868,741 990,723 1,295,000 1,295,000 950,134 950,134 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amounts at the beginning of the lease for the lessor and lessee we need to calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started