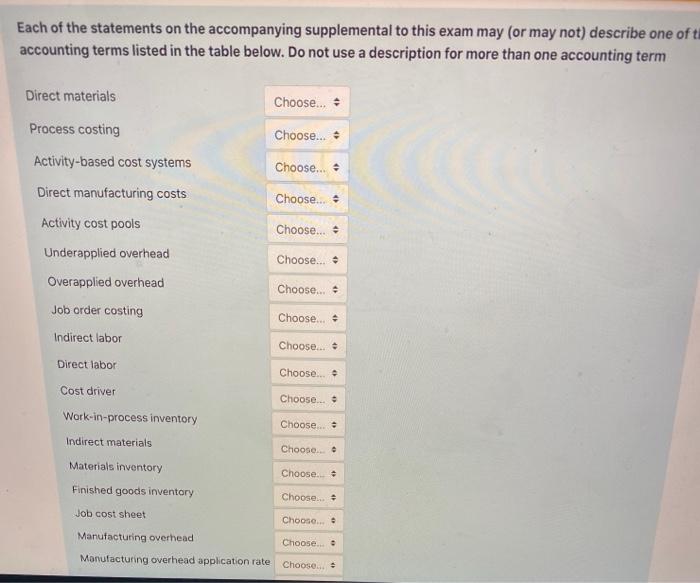

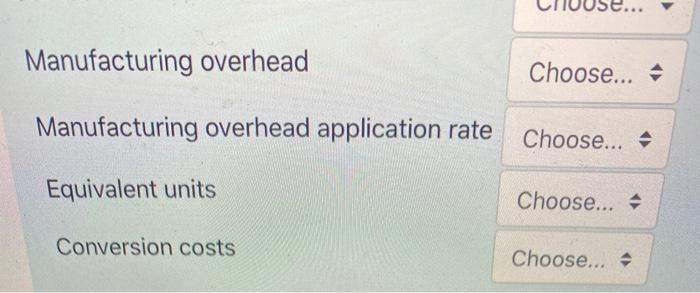

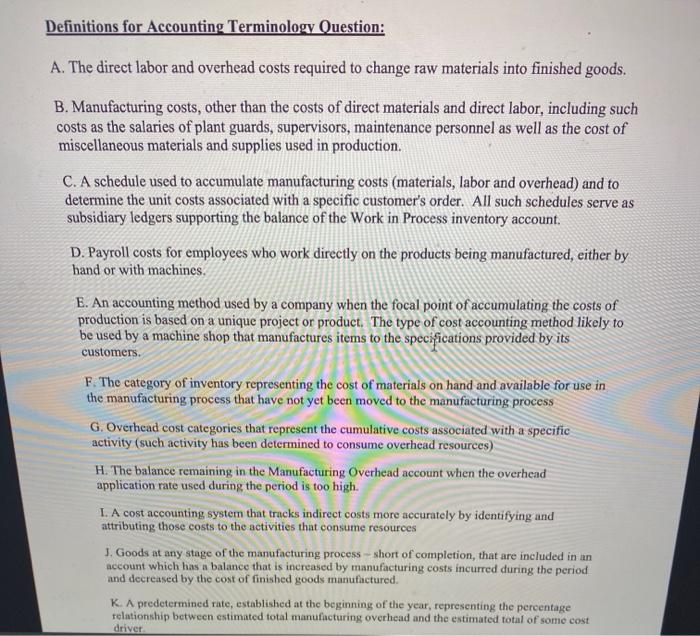

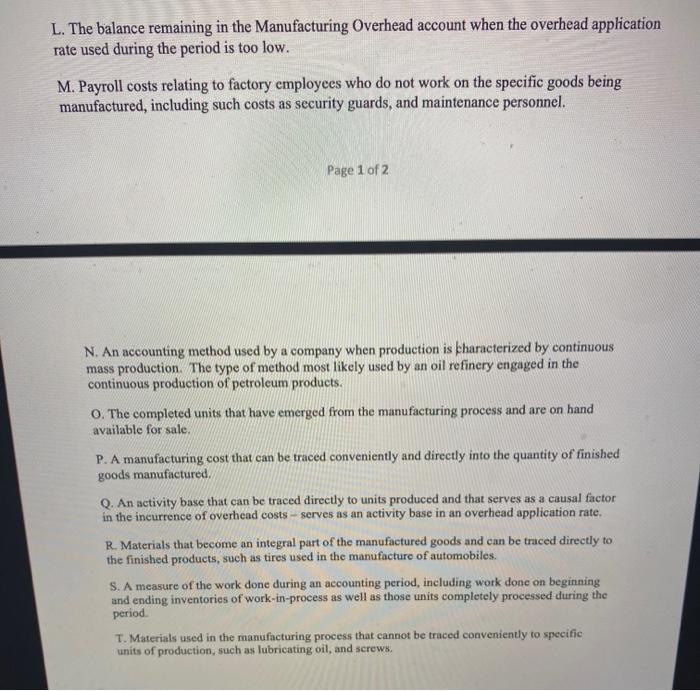

Each of the statements on the accompanying supplemental to this exam may (or may not) describe one of ti accounting terms listed in the table below. Do not use a description for more than one accounting term Direct materials Choose... - Process costing Choose... - Activity-based cost systems Choose... Direct manufacturing costs Choose... Choose... - Choose.... Choose... Activity cost pools Underapplied overhead Overapplied overhead Job order costing Indirect labor Direct labor Cost driver Work-in-process inventory Choose.. Choose. Choose.... Choose.... Choose Indirect materials Choose... Materials inventory Finished goods inventory Choose Choose Job cost sheet Choose Manufacturing overhead Choose. Manufacturing overhead application rate Choose Manufacturing overhead Choose... - Manufacturing overhead application rate Choose... A Equivalent units Choose... - Conversion costs Choose... - Definitions for Accounting Terminology Question: A. The direct labor and overhead costs required to change raw materials into finished goods. B. Manufacturing costs, other than the costs of direct materials and direct labor, including such costs as the salaries of plant guards, supervisors, maintenance personnel as well as the cost of miscellaneous materials and supplies used in production. C. A schedule used to accumulate manufacturing costs (materials, labor and overhead) and to determine the unit costs associated with a specific customer's order. All such schedules serve as subsidiary ledgers supporting the balance of the Work in Process inventory account D. Payroll costs for employees who work directly on the products being manufactured, either by hand or with machines E. An accounting method used by a company when the focal point of accumulating the costs of production is based on a unique project or product. The type of cost accounting method likely to be used by a machine shop that manufactures items to the specifications provided by its customers. F. The category of inventory representing the cost of materials on hand and available for use in the manufacturing process that have not yet been moved to the manufacturing process G. Overhead cost categories that represent the cumulative costs associated with a specific activity (such activity has been determined to consume overhead resources) H. The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too high. I. A cost accounting system that tracks indirect costs more accurately by identifying and attributing those costs to the activities that consume resources J. Goods at any stage of the manufacturing process - short of completion, that are included in an account which has a balance that is increased by manufacturing costs incurred during the period and decreased by the cost of finished goods manufactured. K. A predetermined rate, established at the beginning of the year, representing the percentage relationship between estimated total manufacturing overhead and the estimated total of some cost driver L. The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low. M. Payroll costs relating to factory employees who do not work on the specific goods being manufactured, including such costs as security guards, and maintenance personnel. Page 1 of 2 N. An accounting method used by a company when production is characterized by continuous mass production. The type of method most likely used by an oil refinery engaged in the continuous production of petroleum products. O. The completed units that have emerged from the manufacturing process and are on hand available for sale. P. A manufacturing cost that can be traced conveniently and directly into the quantity of finished goods manufactured Q. An activity base that can be traced directly to units produced and that serves as a causal factor in the incurrence of overhead costs - serves as an activity base in an overhead application rate. R. Materials that become an integral part of the manufactured goods and can be traced directly to the finished products, such as tires used in the manufacture of automobiles. S. A measure of the work done during an accounting period, including work done on beginning and ending inventories of work-in-process as well as those units completely processed during the period. T. Materials used in the manufacturing process that cannot be traced conveniently to specific units of production, such as lubricating oil, and screws