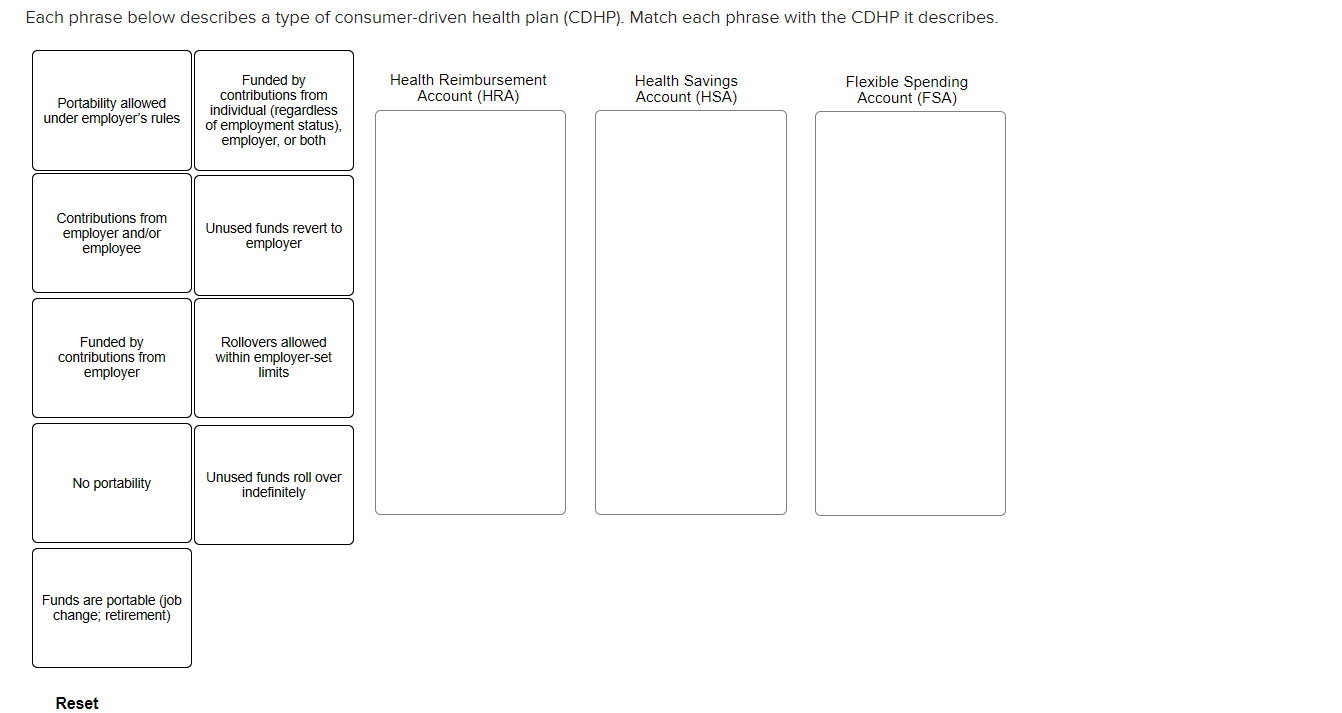

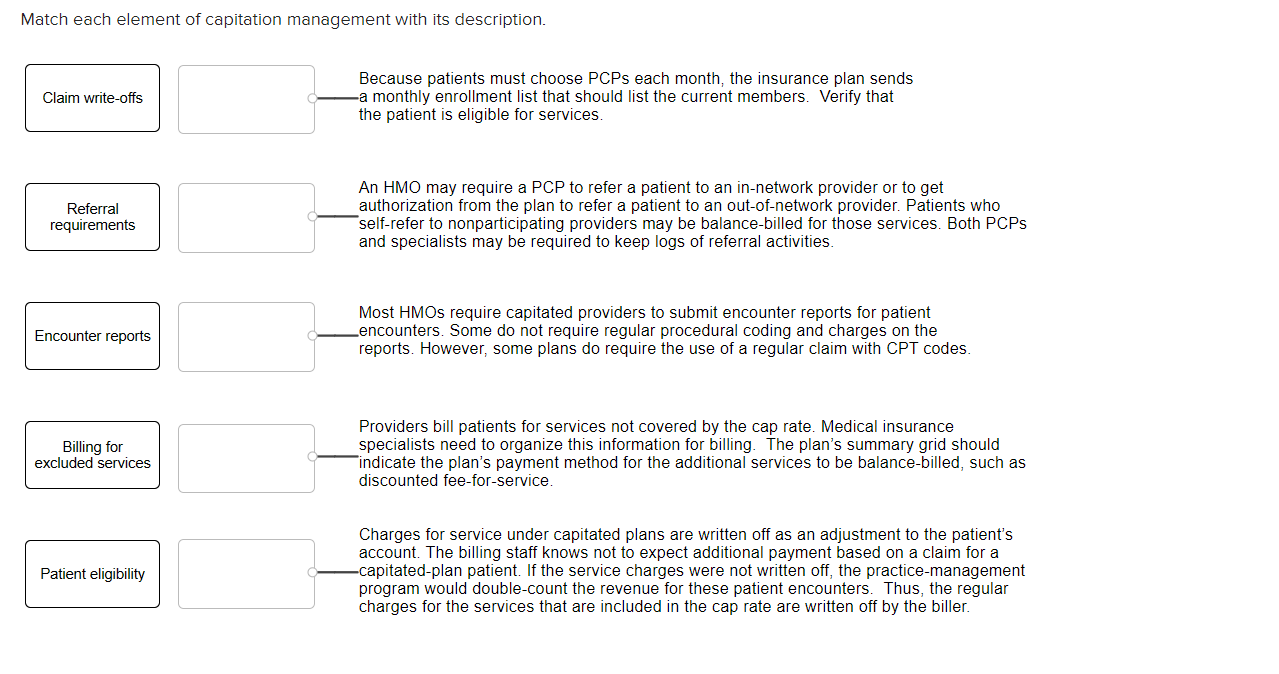

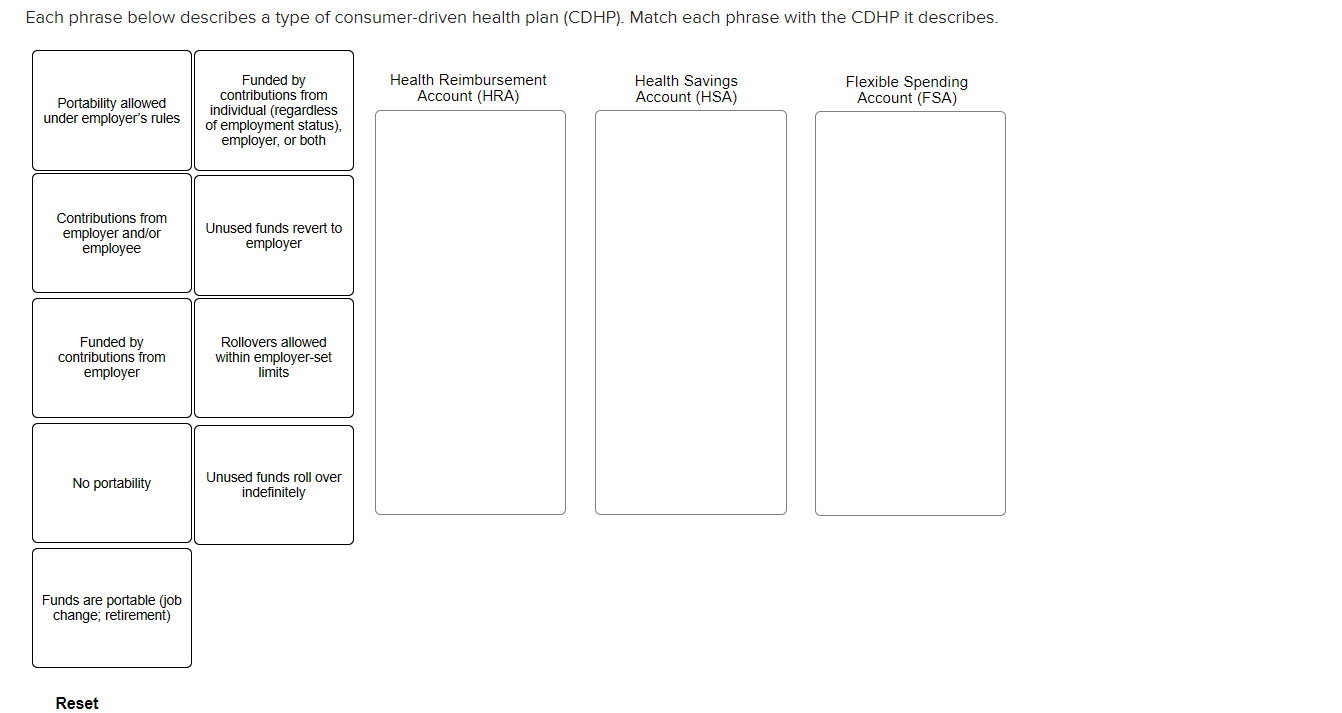

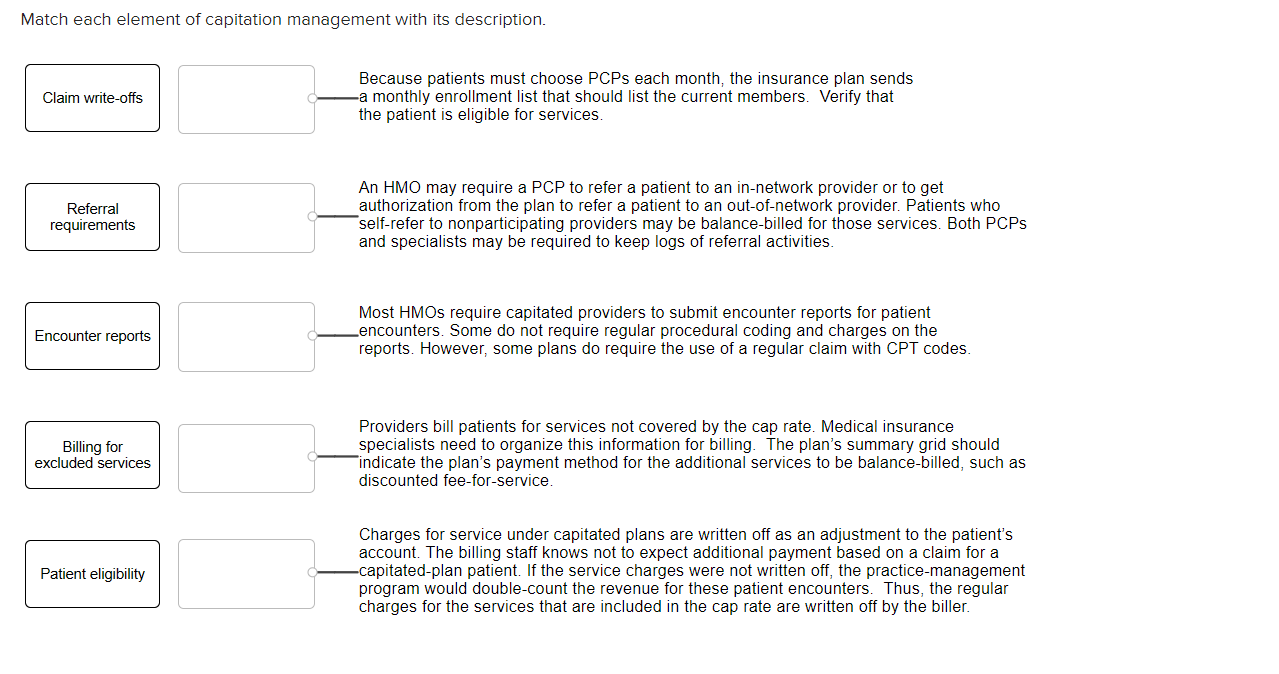

Each phrase below describes a type of consumer-driven health plan (CDHP). Match each phrase with the CDHP it describes. Health Reimbursement Account (HRA) Health Savings Account (HSA) Flexible Spending Account (FSA) Portability allowed under employer's rules Funded by contributions from individual (regardless of employment status). employer, or both Contributions from employer and/or employee Unused funds revert to employer Funded by contributions from employer Rollovers allowed within employer-set limits No portability Unused funds roll over indefinitely Funds are portable (job change; retirement) Reset Match each element of capitation management with its description. Claim write-offs Because patients must choose PCPs each month, the insurance plan sends -a monthly enrollment list that should list the current members. Verify that the patient is eligible for services. Referral requirements An HMO may require a PCP to refer a patient to an in-network provider or to get authorization from the plan to refer a patient to an out-of-network provider. Patients who self-refer to nonparticipating providers may be balance-billed for those services. Both PCPs and specialists may be required to keep logs of referral activities. Encounter reports Most HMOs require capitated providers to submit encounter reports for patient Lencounters. Some do not require regular procedural coding and charges on the reports. However, some plans do require the use of a regular claim with CPT codes. Billing for excluded services Providers bill patients for services not covered by the cap rate. Medical insurance specialists need to organize this information for billing. The plan's summary grid should ate the plan's payment method for the additional services to be balance-billed, such as discounted fee-for-service. Patient eligibility Charges for service under capitated plans are written off as an adjustment to the patient's account. The billing staff knows not to expect additional payment based on a claim for a -capitated-plan patient. If the service charges were not written off, the practice-management program would double-count the revenue for these patient encounters. Thus, the regular charges for the services that are included in the cap rate are written off by the biller. Each phrase below describes a type of consumer-driven health plan (CDHP). Match each phrase with the CDHP it describes. Health Reimbursement Account (HRA) Health Savings Account (HSA) Flexible Spending Account (FSA) Portability allowed under employer's rules Funded by contributions from individual (regardless of employment status). employer, or both Contributions from employer and/or employee Unused funds revert to employer Funded by contributions from employer Rollovers allowed within employer-set limits No portability Unused funds roll over indefinitely Funds are portable (job change; retirement) Reset Match each element of capitation management with its description. Claim write-offs Because patients must choose PCPs each month, the insurance plan sends -a monthly enrollment list that should list the current members. Verify that the patient is eligible for services. Referral requirements An HMO may require a PCP to refer a patient to an in-network provider or to get authorization from the plan to refer a patient to an out-of-network provider. Patients who self-refer to nonparticipating providers may be balance-billed for those services. Both PCPs and specialists may be required to keep logs of referral activities. Encounter reports Most HMOs require capitated providers to submit encounter reports for patient Lencounters. Some do not require regular procedural coding and charges on the reports. However, some plans do require the use of a regular claim with CPT codes. Billing for excluded services Providers bill patients for services not covered by the cap rate. Medical insurance specialists need to organize this information for billing. The plan's summary grid should ate the plan's payment method for the additional services to be balance-billed, such as discounted fee-for-service. Patient eligibility Charges for service under capitated plans are written off as an adjustment to the patient's account. The billing staff knows not to expect additional payment based on a claim for a -capitated-plan patient. If the service charges were not written off, the practice-management program would double-count the revenue for these patient encounters. Thus, the regular charges for the services that are included in the cap rate are written off by the biller