EACH PROBLEM ALREADY HAS THE CORRECT ANSWER HIGHLIGHTED IN YELLOW I JUST NEED TO KNOW HOW TO SOLVE THEM., (PLEASE TYPE OUT THE STEPS NICELY (PREFERRED TYPING) I APPRECIATE IT !

EACH PROBLEM ALREADY HAS THE CORRECT ANSWER HIGHLIGHTED IN YELLOW I JUST NEED TO KNOW HOW TO SOLVE THEM., (PLEASE TYPE OUT THE STEPS NICELY (PREFERRED TYPING) I APPRECIATE IT !

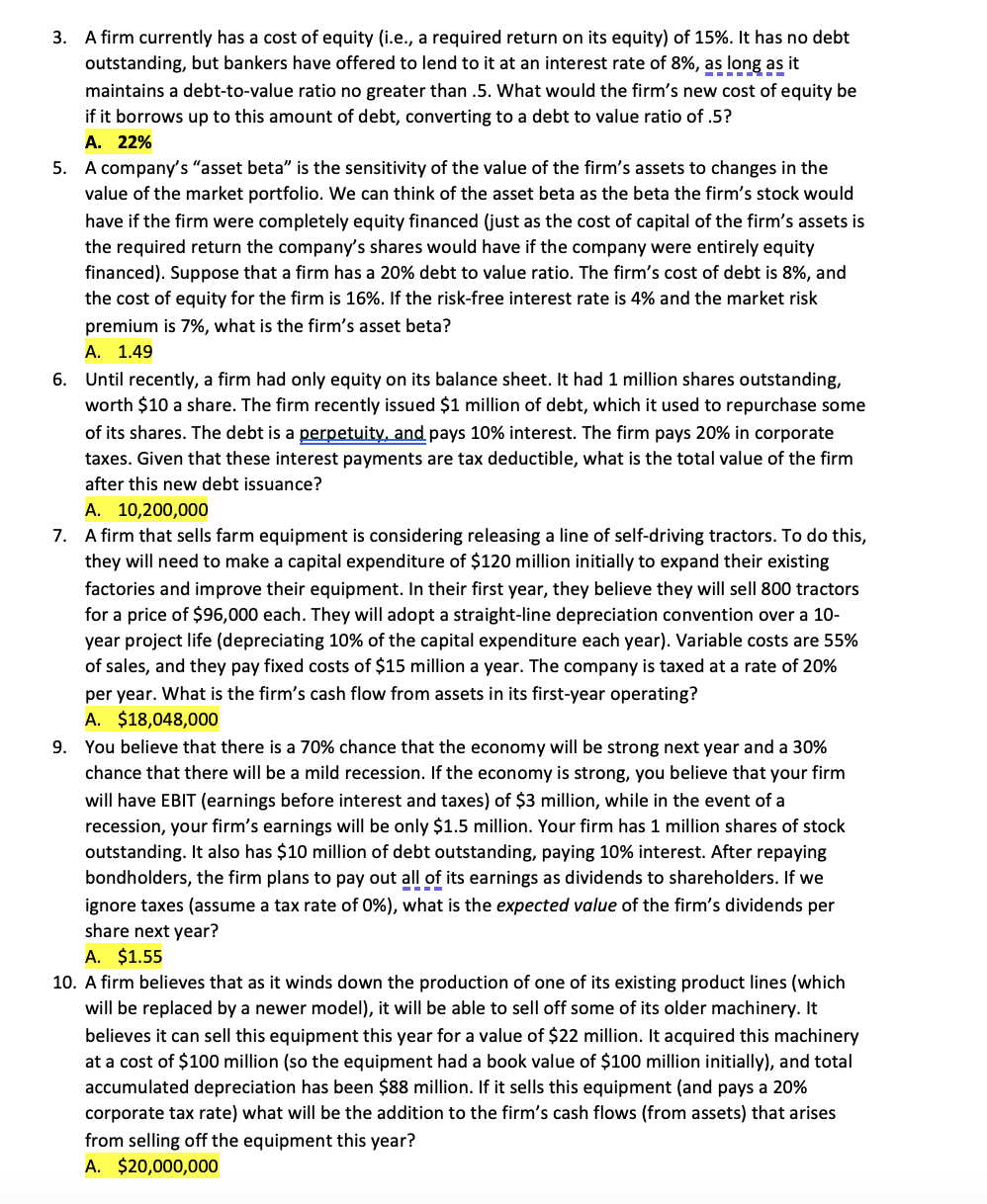

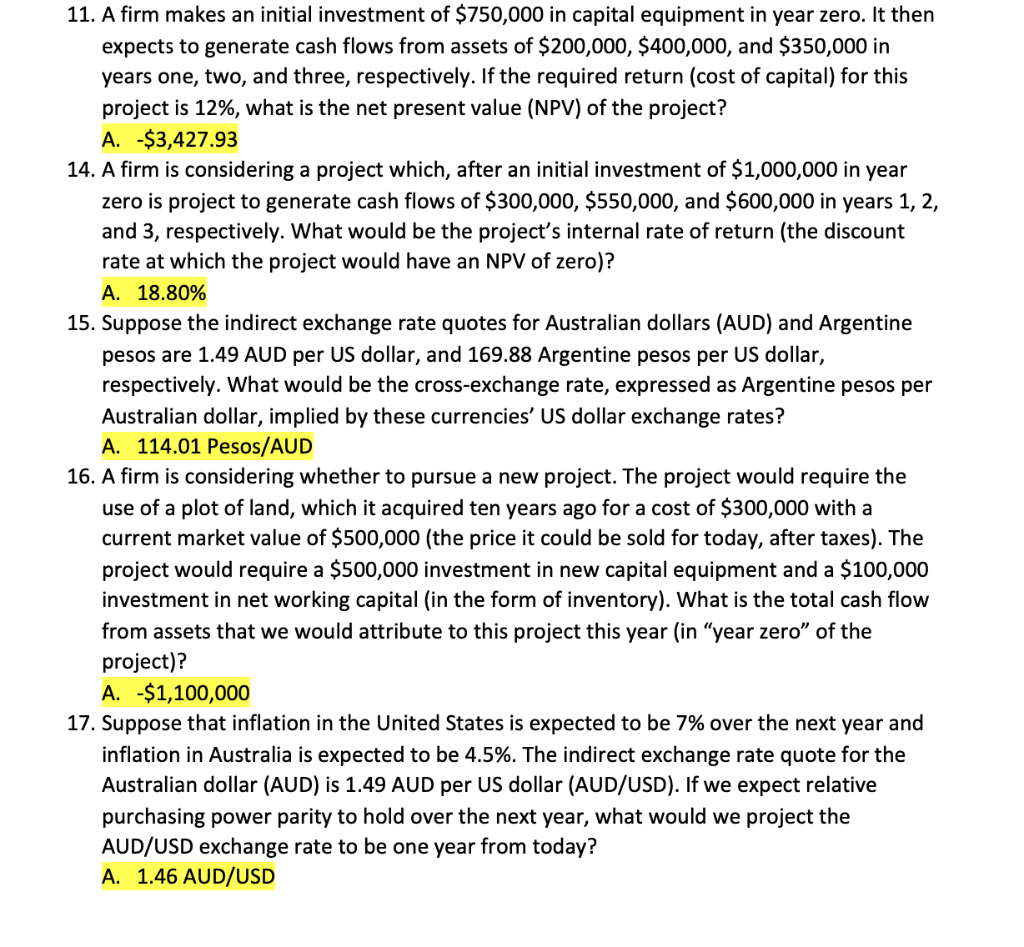

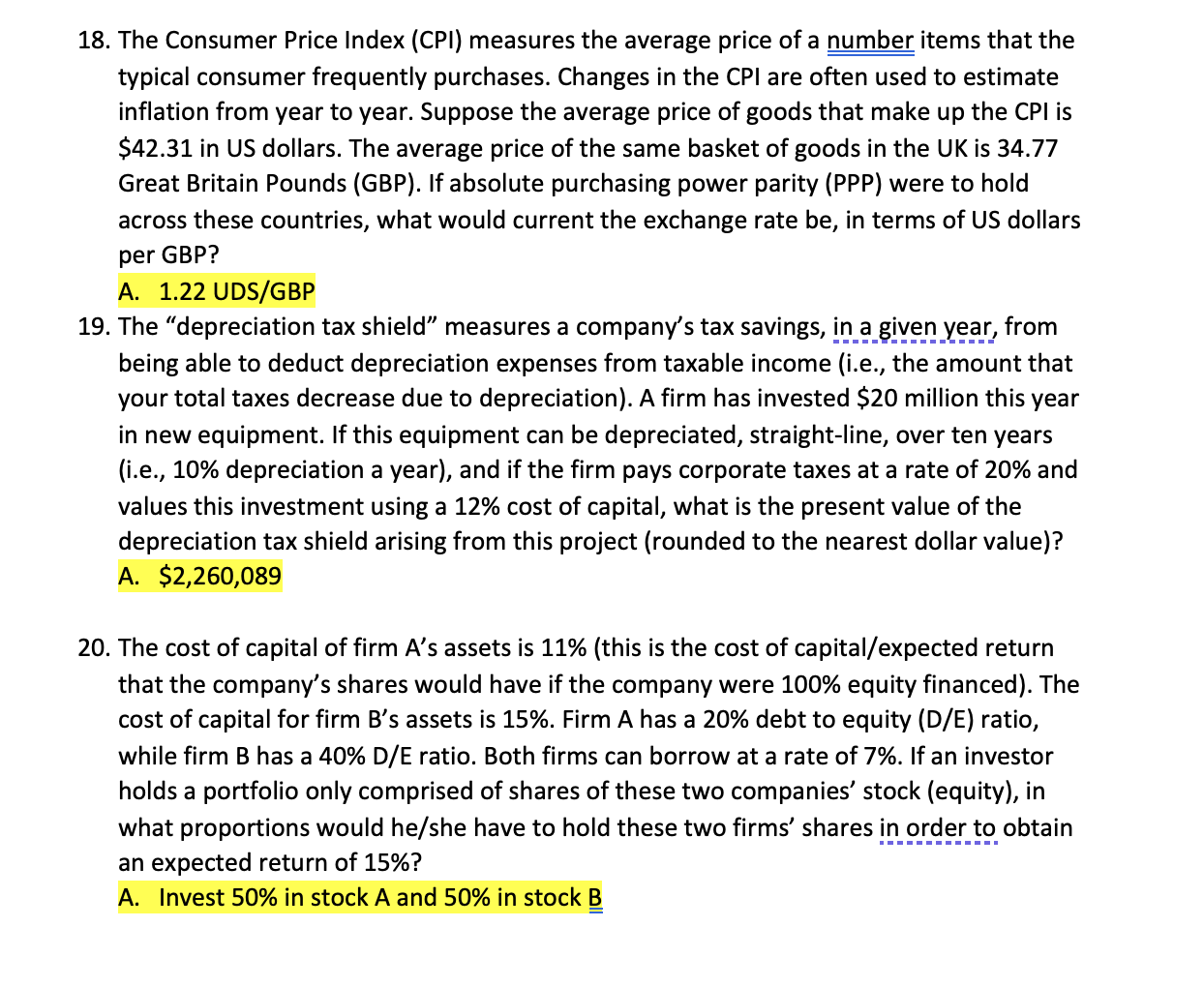

3. A firm currently has a cost of equity (i.e., a required return on its equity) of 15%. It has no debt outstanding, but bankers have offered to lend to it at an interest rate of 8%, as long as it maintains a debt-to-value ratio no greater than .5. What would the firm's new cost of equity be if it borrows up to this amount of debt, converting to a debt to value ratio of .5 ? A. 22% 5. A company's "asset beta" is the sensitivity of the value of the firm's assets to changes in the value of the market portfolio. We can think of the asset beta as the beta the firm's stock would have if the firm were completely equity financed (just as the cost of capital of the firm's assets is the required return the company's shares would have if the company were entirely equity financed). Suppose that a firm has a 20% debt to value ratio. The firm's cost of debt is 8%, and the cost of equity for the firm is 16%. If the risk-free interest rate is 4% and the market risk premium is 7%, what is the firm's asset beta? A. 1.49 6. Until recently, a firm had only equity on its balance sheet. It had 1 million shares outstanding, worth $10 a share. The firm recently issued $1 million of debt, which it used to repurchase some of its shares. The debt is a perpetuity, and pays 10% interest. The firm pays 20% in corporate taxes. Given that these interest payments are tax deductible, what is the total value of the firm after this new debt issuance? A. 10,200,000 7. A firm that sells farm equipment is considering releasing a line of self-driving tractors. To do this, they will need to make a capital expenditure of $120 million initially to expand their existing factories and improve their equipment. In their first year, they believe they will sell 800 tractors for a price of $96,000 each. They will adopt a straight-line depreciation convention over a 10year project life (depreciating 10% of the capital expenditure each year). Variable costs are 55% of sales, and they pay fixed costs of $15 million a year. The company is taxed at a rate of 20% per year. What is the firm's cash flow from assets in its first-year operating? A. $18,048,000 9. You believe that there is a 70% chance that the economy will be strong next year and a 30% chance that there will be a mild recession. If the economy is strong, you believe that your firm will have EBIT (earnings before interest and taxes) of $3 million, while in the event of a recession, your firm's earnings will be only $1.5 million. Your firm has 1 million shares of stock outstanding. It also has $10 million of debt outstanding, paying 10% interest. After repaying bondholders, the firm plans to pay out all of its earnings as dividends to shareholders. If we ignore taxes (assume a tax rate of 0% ), what is the expected value of the firm's dividends per share next year? A. $1.55 10. A firm believes that as it winds down the production of one of its existing product lines (which will be replaced by a newer model), it will be able to sell off some of its older machinery. It believes it can sell this equipment this year for a value of $22 million. It acquired this machinery at a cost of $100 million (so the equipment had a book value of $100 million initially), and total accumulated depreciation has been $88 million. If it sells this equipment (and pays a 20% corporate tax rate) what will be the addition to the firm's cash flows (from assets) that arises from selling off the equipment this year? A. $20,000,000 11. A firm makes an initial investment of $750,000 in capital equipment in year zero. It then expects to generate cash flows from assets of $200,000,$400,000, and $350,000 in years one, two, and three, respectively. If the required return (cost of capital) for this project is 12%, what is the net present value (NPV) of the project? A. $3,427.93 14. A firm is considering a project which, after an initial investment of $1,000,000 in year zero is project to generate cash flows of $300,000,$550,000, and $600,000 in years 1,2 , and 3, respectively. What would be the project's internal rate of return (the discount rate at which the project would have an NPV of zero)? A. 18.80% 15. Suppose the indirect exchange rate quotes for Australian dollars (AUD) and Argentine pesos are 1.49 AUD per US dollar, and 169.88 Argentine pesos per US dollar, respectively. What would be the cross-exchange rate, expressed as Argentine pesos per Australian dollar, implied by these currencies' US dollar exchange rates? A. 114.01 Pesos/AUD 16. A firm is considering whether to pursue a new project. The project would require the use of a plot of land, which it acquired ten years ago for a cost of $300,000 with a current market value of $500,000 (the price it could be sold for today, after taxes). The project would require a $500,000 investment in new capital equipment and a $100,000 investment in net working capital (in the form of inventory). What is the total cash flow from assets that we would attribute to this project this year (in "year zero" of the project)? A. $1,100,000 17. Suppose that inflation in the United States is expected to be 7% over the next year and inflation in Australia is expected to be 4.5%. The indirect exchange rate quote for the Australian dollar (AUD) is 1.49 AUD per US dollar (AUD/USD). If we expect relative purchasing power parity to hold over the next year, what would we project the AUD/USD exchange rate to be one year from today? A. 1.46 AUD/USD 18. The Consumer Price Index (CPI) measures the average price of a number items that the typical consumer frequently purchases. Changes in the CPI are often used to estimate inflation from year to year. Suppose the average price of goods that make up the CPI is $42.31 in US dollars. The average price of the same basket of goods in the UK is 34.77 Great Britain Pounds (GBP). If absolute purchasing power parity (PPP) were to hold across these countries, what would current the exchange rate be, in terms of US dollars per GBP? A. 1.22 UDS/GBP 19. The "depreciation tax shield" measures a company's tax savings, in a given year, from being able to deduct depreciation expenses from taxable income (i.e., the amount that your total taxes decrease due to depreciation). A firm has invested $20 million this year in new equipment. If this equipment can be depreciated, straight-line, over ten years (i.e., 10% depreciation a year), and if the firm pays corporate taxes at a rate of 20% and values this investment using a 12% cost of capital, what is the present value of the depreciation tax shield arising from this project (rounded to the nearest dollar value)? A. $2,260,089 20. The cost of capital of firm A s assets is 11% (this is the cost of capital/expected return that the company's shares would have if the company were 100% equity financed). The cost of capital for firm B s assets is 15%. Firm A has a 20% debt to equity (D/E) ratio, while firm B has a 40%D/E ratio. Both firms can borrow at a rate of 7%. If an investor holds a portfolio only comprised of shares of these two companies' stock (equity), in what proportions would he/she have to hold these two firms' shares in order to obtain an expected return of 15% ? A. Invest 50% in stock A and 50% in stock B

EACH PROBLEM ALREADY HAS THE CORRECT ANSWER HIGHLIGHTED IN YELLOW I JUST NEED TO KNOW HOW TO SOLVE THEM., (PLEASE TYPE OUT THE STEPS NICELY (PREFERRED TYPING) I APPRECIATE IT !

EACH PROBLEM ALREADY HAS THE CORRECT ANSWER HIGHLIGHTED IN YELLOW I JUST NEED TO KNOW HOW TO SOLVE THEM., (PLEASE TYPE OUT THE STEPS NICELY (PREFERRED TYPING) I APPRECIATE IT !