Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EACH QUESTION WILL BE CHECKED AGAINST AI USAGE LIKE GPT, PLEASE DON'T USE THEM CAN YOU PROVIDE THE DETAILED CALCULATION? THANK YOU!! A firm must

EACH QUESTION WILL BE CHECKED AGAINST AI USAGE LIKE GPT, PLEASE DON'T USE THEM

CAN YOU PROVIDE THE DETAILED CALCULATION? THANK YOU!!

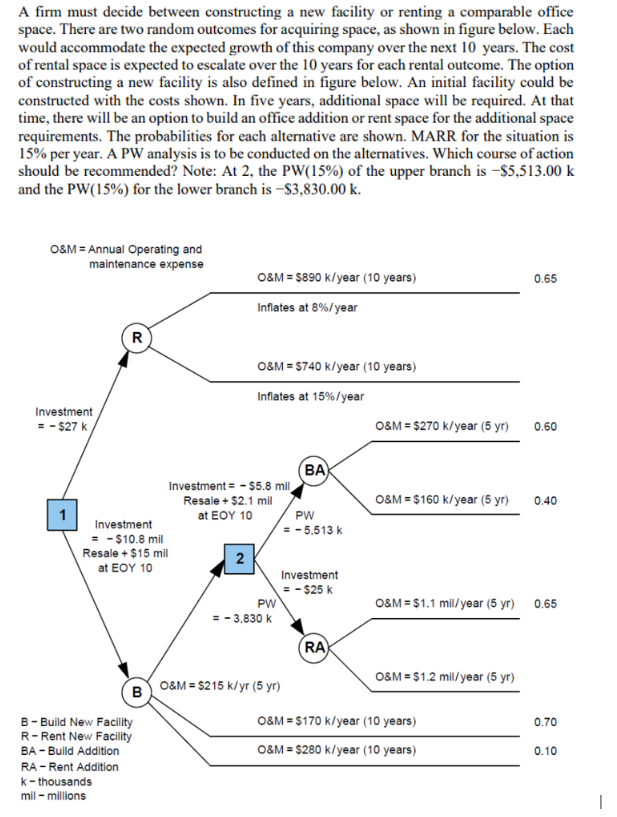

A firm must decide between constructing a new facility or renting a comparable office space. There are two random outcomes for acquiring space, as shown in figure below. Each would accommodate the expected growth of this company over the next 10 years. The cost of rental space is expected to escalate over the 10 years for each rental outcome. The option of constructing a new facility is also defined in figure below. An initial facility could be constructed with the costs shown. In five years, additional space will be required. At that time, there will be an option to build an office addition or rent space for the additional space requirements. The probabilities for each alternative are shown. MARR for the situation is 15% per year. A PW analysis is to be conducted on the alternatives. Which course of action should be recommended? Note: At 2 , the PW (15%) of the upper branch is $5,513.00k and the PW(15%) for the lower branch is $3,830.00k. A firm must decide between constructing a new facility or renting a comparable office space. There are two random outcomes for acquiring space, as shown in figure below. Each would accommodate the expected growth of this company over the next 10 years. The cost of rental space is expected to escalate over the 10 years for each rental outcome. The option of constructing a new facility is also defined in figure below. An initial facility could be constructed with the costs shown. In five years, additional space will be required. At that time, there will be an option to build an office addition or rent space for the additional space requirements. The probabilities for each alternative are shown. MARR for the situation is 15% per year. A PW analysis is to be conducted on the alternatives. Which course of action should be recommended? Note: At 2 , the PW (15%) of the upper branch is $5,513.00k and the PW(15%) for the lower branch is $3,830.00k

A firm must decide between constructing a new facility or renting a comparable office space. There are two random outcomes for acquiring space, as shown in figure below. Each would accommodate the expected growth of this company over the next 10 years. The cost of rental space is expected to escalate over the 10 years for each rental outcome. The option of constructing a new facility is also defined in figure below. An initial facility could be constructed with the costs shown. In five years, additional space will be required. At that time, there will be an option to build an office addition or rent space for the additional space requirements. The probabilities for each alternative are shown. MARR for the situation is 15% per year. A PW analysis is to be conducted on the alternatives. Which course of action should be recommended? Note: At 2 , the PW (15%) of the upper branch is $5,513.00k and the PW(15%) for the lower branch is $3,830.00k. A firm must decide between constructing a new facility or renting a comparable office space. There are two random outcomes for acquiring space, as shown in figure below. Each would accommodate the expected growth of this company over the next 10 years. The cost of rental space is expected to escalate over the 10 years for each rental outcome. The option of constructing a new facility is also defined in figure below. An initial facility could be constructed with the costs shown. In five years, additional space will be required. At that time, there will be an option to build an office addition or rent space for the additional space requirements. The probabilities for each alternative are shown. MARR for the situation is 15% per year. A PW analysis is to be conducted on the alternatives. Which course of action should be recommended? Note: At 2 , the PW (15%) of the upper branch is $5,513.00k and the PW(15%) for the lower branch is $3,830.00k Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started