Answered step by step

Verified Expert Solution

Question

1 Approved Answer

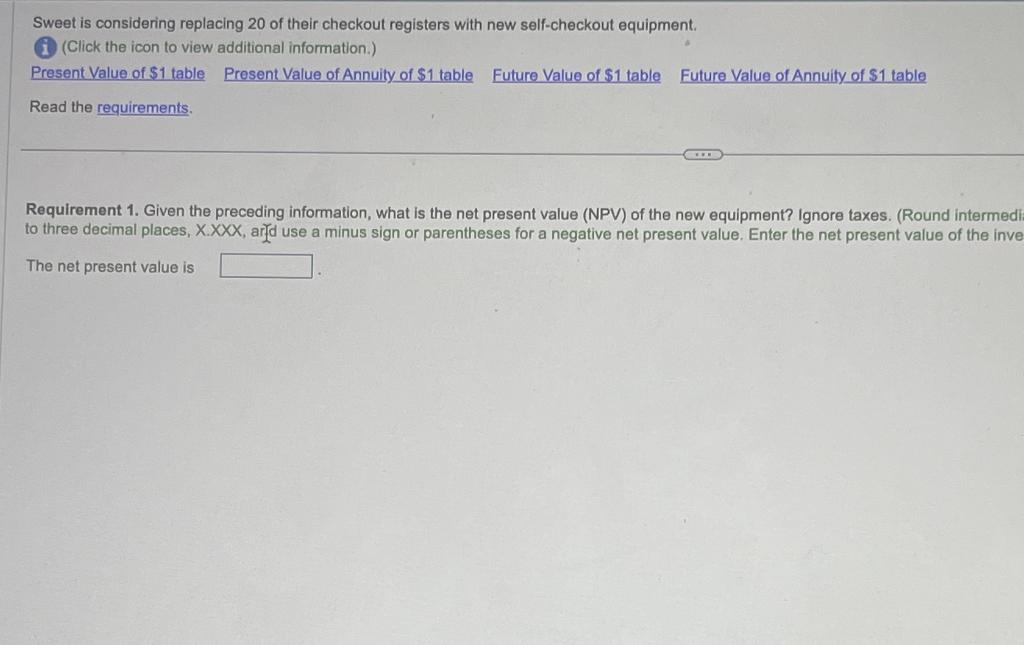

Each requirement pleasw Sweet is considering replacing 20 of their checkout registers with new self-checkout equipment. (Click the icon to view additional information.) Read the

Each requirement pleasw

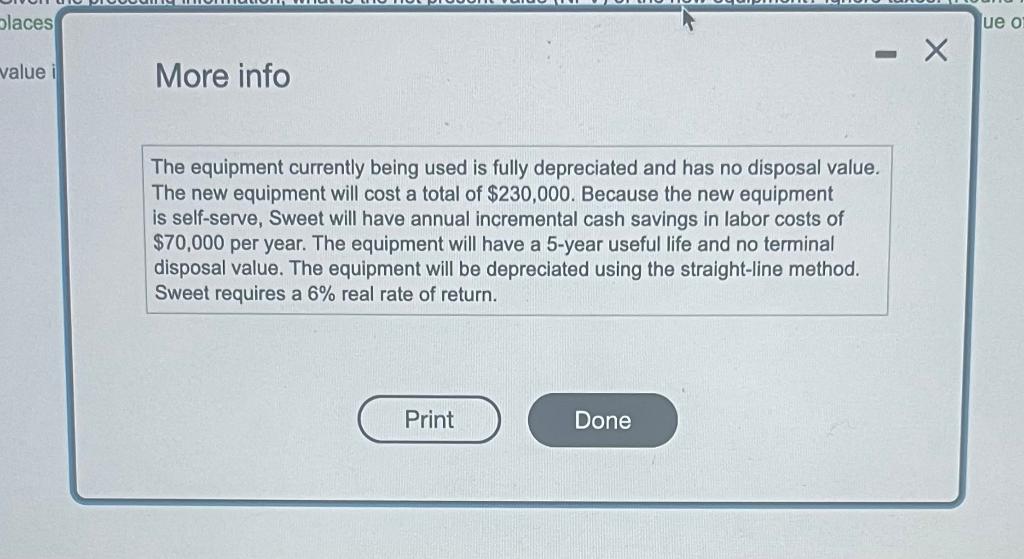

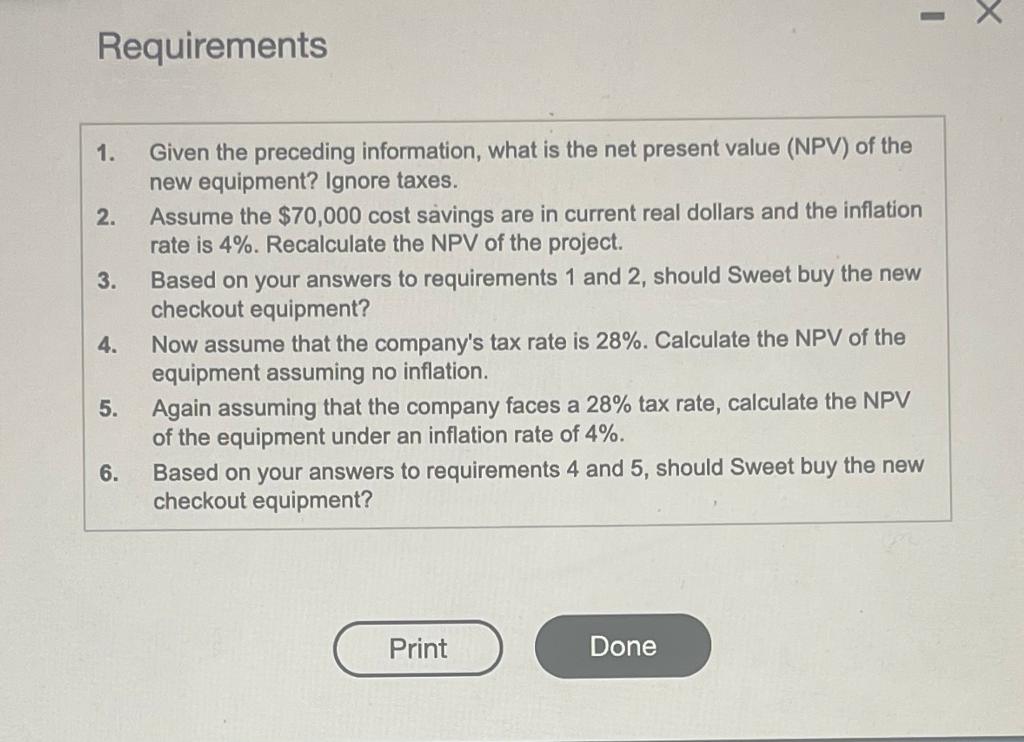

Sweet is considering replacing 20 of their checkout registers with new self-checkout equipment. (Click the icon to view additional information.) Read the requirements. Requirement 1. Given the preceding information, what is the net present value (NPV) of the new equipment? Ignore taxes. (Round intermed to three decimal places, X.XXX, arif use a minus sign or parentheses for a negative net present value. Enter the net present value of the inve The net present value is More info The equipment currently being used is fully depreciated and has no disposal value. The new equipment will cost a total of $230,000. Because the new equipment is self-serve, Sweet will have annual incremental cash savings in labor costs of $70,000 per year. The equipment will have a 5 -year useful life and no terminal disposal value. The equipment will be depreciated using the straight-line method. Sweet requires a 6% real rate of return. Requirements 1. Given the preceding information, what is the net present value (NPV) of the new equipment? Ignore taxes. 2. Assume the $70,000 cost savings are in current real dollars and the inflation rate is 4%. Recalculate the NPV of the project. 3. Based on your answers to requirements 1 and 2 , should Sweet buy the new checkout equipment? 4. Now assume that the company's tax rate is 28%. Calculate the NPV of the equipment assuming no inflation. 5. Again assuming that the company faces a 28% tax rate, calculate the NPV of the equipment under an inflation rate of 4%. 6. Based on your answers to requirements 4 and 5 , should Sweet buy the new checkout equipment? Sweet is considering replacing 20 of their checkout registers with new self-checkout equipment. (Click the icon to view additional information.) Read the requirements. Requirement 1. Given the preceding information, what is the net present value (NPV) of the new equipment? Ignore taxes. (Round intermed to three decimal places, X.XXX, arif use a minus sign or parentheses for a negative net present value. Enter the net present value of the inve The net present value is More info The equipment currently being used is fully depreciated and has no disposal value. The new equipment will cost a total of $230,000. Because the new equipment is self-serve, Sweet will have annual incremental cash savings in labor costs of $70,000 per year. The equipment will have a 5 -year useful life and no terminal disposal value. The equipment will be depreciated using the straight-line method. Sweet requires a 6% real rate of return. Requirements 1. Given the preceding information, what is the net present value (NPV) of the new equipment? Ignore taxes. 2. Assume the $70,000 cost savings are in current real dollars and the inflation rate is 4%. Recalculate the NPV of the project. 3. Based on your answers to requirements 1 and 2 , should Sweet buy the new checkout equipment? 4. Now assume that the company's tax rate is 28%. Calculate the NPV of the equipment assuming no inflation. 5. Again assuming that the company faces a 28% tax rate, calculate the NPV of the equipment under an inflation rate of 4%. 6. Based on your answers to requirements 4 and 5 , should Sweet buy the new checkout equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started