Answered step by step

Verified Expert Solution

Question

1 Approved Answer

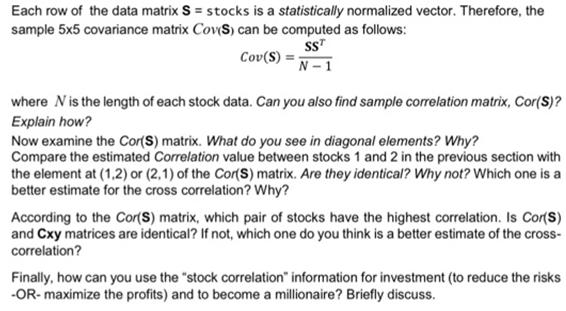

Each row of the data matrix S = stocks is a statistically normalized vector. Therefore, the sample 5x5 covariance matrix Cov(S) can be computed

Each row of the data matrix S = stocks is a statistically normalized vector. Therefore, the sample 5x5 covariance matrix Cov(S) can be computed as follows: Cov(S) = SST N-1 where N is the length of each stock data. Can you also find sample correlation matrix, Cor(S)? Explain how? Now examine the Cor(S) matrix. What do you see in diagonal elements? Why? Compare the estimated Correlation value between stocks 1 and 2 in the previous section with the element at (1,2) or (2,1) of the Cor(S) matrix. Are they identical? Why not? Which one is a better estimate for the cross correlation? Why? According to the Cor(S) matrix, which pair of stocks have the highest correlation. Is Cor(S) and Cxy matrices are identical? If not, which one do you think is a better estimate of the cross- correlation? Finally, how can you use the "stock correlation" information for investment (to reduce the risks -OR- maximize the profits) and to become a millionaire? Briefly discuss.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To find the sample correlation matrix CorS we can use the following formula CorS CovS where CovS is the sample covariance matrix and and are the stand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started