Answered step by step

Verified Expert Solution

Question

1 Approved Answer

each step has to be answered in this format June 1: Jeremy made an investment in Byte of Accounting, Inc., by purchasing 2,650 shares of

each step has to be answered in this format

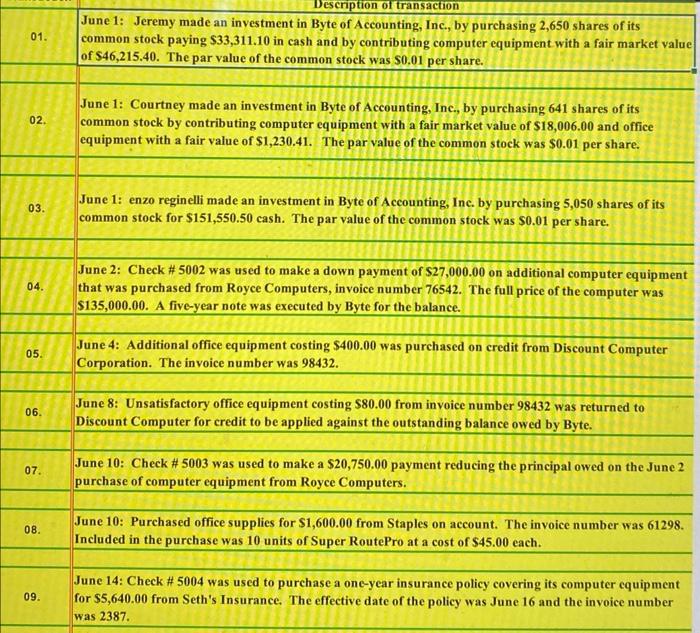

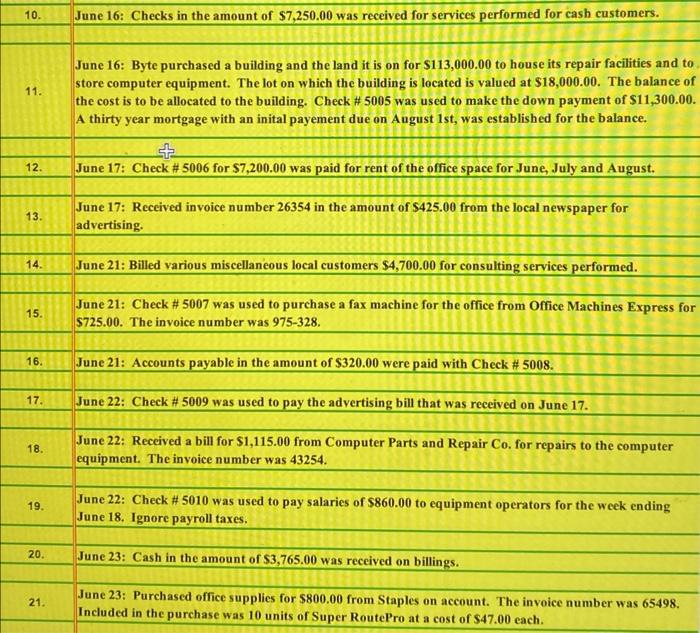

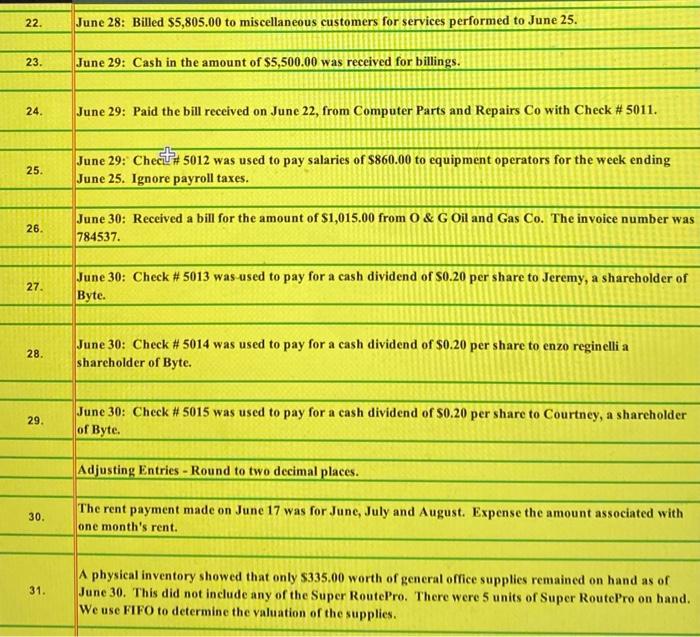

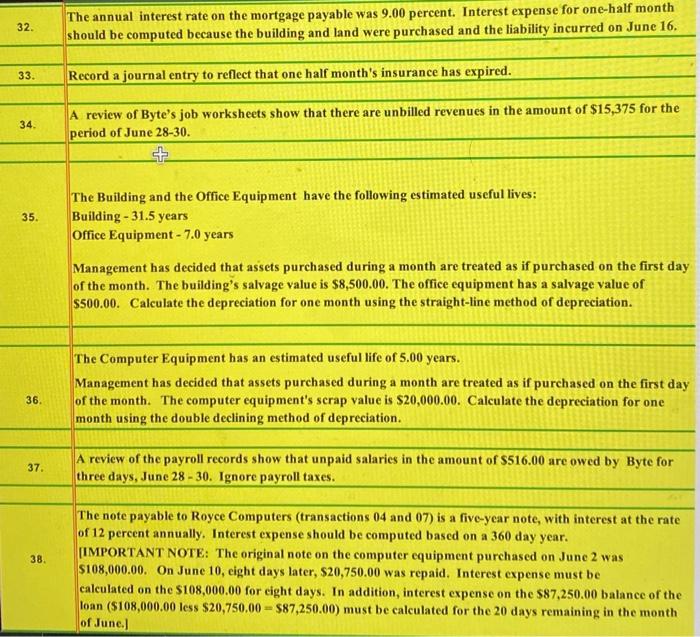

June 1: Jeremy made an investment in Byte of Accounting, Inc., by purchasing 2,650 shares of its common stock paying $33,311.10 in cash and by contributing computer equipment with a fair market value of $46,215.40. The par value of the common stock was $0,01 per share. 10. June 16: Checks in the amount of $7,250.00 was received for services performed for cash customers. 14. June 21: Billed various miscellaneous local customers $4,700.00 for consulting services performed. 15. June 21: Check # 5007 was used to purchase a fax machine for the office from Office Machines Express for \$725.00. The invoice number was 975-328. 16. June 21: Accounts payable in the amount of $320.00 were paid with Check # 5008 . 17. June 22: Check # 5009 was used to pay the advertising bill that was received on June 17. 18. June 22: Received a bill for $1,115.00 from Computer Parts and Repair Co. for repairs to the computer equipment. The invoice number was 43254. 19. June 22: Check # 5010 was used to pay salaries of $860.00 to equipment operators for the week ending June 18. Ignore payroll taxes. 20. June 23: Cash in the amount of $3,765.00 was received on billings. 21. June 23: Purchased office supplies for $800.00 from Staples on account. The invoice number was 65498. Included in the purchase was 10 units of Super RoutePro at a cost of $47.00 each. 22. June 28: Billed $5,805.00 to miscellaneous customers for services performed to June 25. \begin{tabular}{l|l|l|} \hline 23. June 29: Cash in the amount of $5,500.00 was received for billings. \\ \hline 24. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check # 5011. \\ \hline \end{tabular} 39. Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to increases cash. 40. Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to decreases cash. 41. Our CPA has informed us to estimate that 1.00% of Computer \& Consulting Revenue will be uncollectable. 42. Income taxes are to be computed at the rate of 25 percent of net income before taxes. [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] Closing Entries 43. Close the revenue accounts. 44. Close the expense accounts. 45. Close the income summary account. 46. Close the dividends account. Note: You can only enter data into the yellow filled cells

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started