Answered step by step

Verified Expert Solution

Question

1 Approved Answer

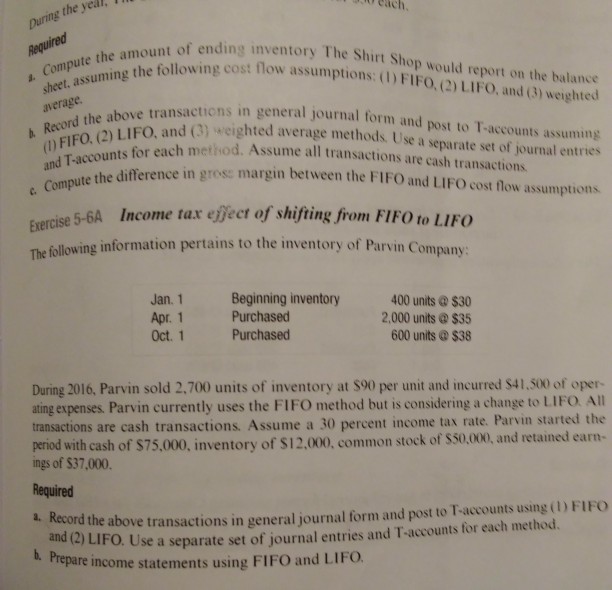

each the yedl, Required , Compasuming the following cost flow assumptions: (U of ending inventory The Shirt Shop would report on the balance FIFO, 2)

each the yedl, Required , Compasuming the following cost flow assumptions: (U of ending inventory The Shirt Shop would report on the balance FIFO, 2) LIFO, and (3) weighted sheet, assumin mount ns in general journal form and post to T-accounts assuming a ecord the above tam3) eighted average methods Use a separate set of journal entries average LIFO, and (3) weighted avera h method. Assume all transactions are cash transactions te t he difference in grose margin between the FIFO and LIFO cost flow assumptions 5-6A Income tax efect of shifting from FIFO to LIFO Exercise 5 Thefollowing information pertains to the inventory of Parvin Company Jan. 1 Apr. 1 Oct. 1 Beginning inventory Purchased Purchased 400 units @ $30 2000 units @ s35 600 units @ $38 During 2016, Parvin sold 2.700 units of inventory at $90 per unit and incurred $41,500 of oper- ating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $75.000, inventory of $12.000, common stock of $50,00, and retained earn- ings of $37,000. Required a. Record T-accounts using () FIFO the above transactions in general journal form and post to and (2) LIF Pre O. Use a separate set of journal entries and T-accounts for each method. re income statements using FIFO and LIFO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started