Answered step by step

Verified Expert Solution

Question

1 Approved Answer

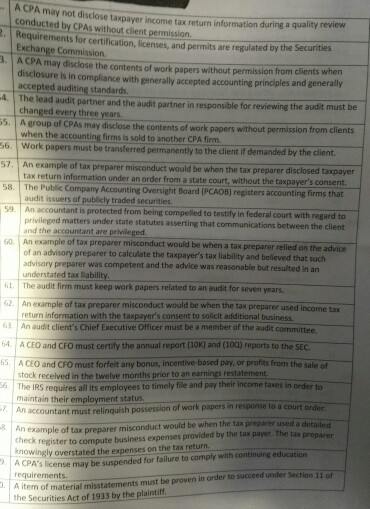

each True and False question i. A CPA may not disclose taxpayer income tax return information during a quality review permits are regulated by the

each True and False question

i. A CPA may not disclose taxpayer income tax return information during a quality review permits are regulated by the Securit of work papers and contents client certification, licenses without the by disclose CPAs for may ge Commission conducted Requirements ACPA disclosure is in compliance without permission from clients when enerally accepted accounting principles and generally accepted auditing standards 4. The lead audit partner and the audit partner in respon chan for reviewing the audit must be 5, A group of CPAs may disclose the contents of work papers without permission from clients when the accoun Work ting firms to another cpA firm. papers must be transferred permanently to the client if demanded by the client. 57, An example preparer misconduct be when the tax disclosed taxpayer 8. return nformation under an order from a without the taxpayer's consent. The state court, Public Company Accounting oversight Board (PCAOB) registers accounting firms that issuers of publicly traded securities, leged matters under irom being compelied to testifyin federalcourt with regard to and the accountant state statutes asserting that communications between the client 60. An example of tax preparer misco would be when a tax preparer relied on the advice of an advisory preparer to calculate the taxpayer's tax liability and beli that advisory preparer was competent and the advice was reasonable but resulted in an rstated tax liabi 61. The audit firm must keep work papers related to an audit for seven years 62 An ple of tax preparer misconduct would be when the tax used income tax formation with the taxpayer's consent to solicit additional busi An audit client's Chief Executive officer must be a member of the audit committee. and CFO must certify the annual report l10K) and (100) reports to the SEC. 65 ACEO and CFO must forfeit any bonus, incentive-based pay, or profits from the saie of eceived in the twelve months prior to an earni to timely file and pay their income taxes in order to The IRS requires all its employ Anaccountant must relinquish possession work papers in response a court orde: maintain their employmel An example of misconduct would be when the tax preparer used a deta check register tax preparer by the taxpayer The knowingly overstated the expenses expenses retur license may be suspended for to sueceedunder Section 11 requirements misstatements must be proven in order A item of material the Securities Act of 1933 by the plaintiffStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started