Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each unit can be sold for $200 in the first year. In what cash flows will $200 play a direct role? A.All of the other

Each unit can be sold for $200 in the first year. In what cash flows will $200 play a direct role?

A.All of the other choices are correct B Annual operating revenues C. Annual operating expenses D. After-tax resale value in time 4 E. Annual depreciation

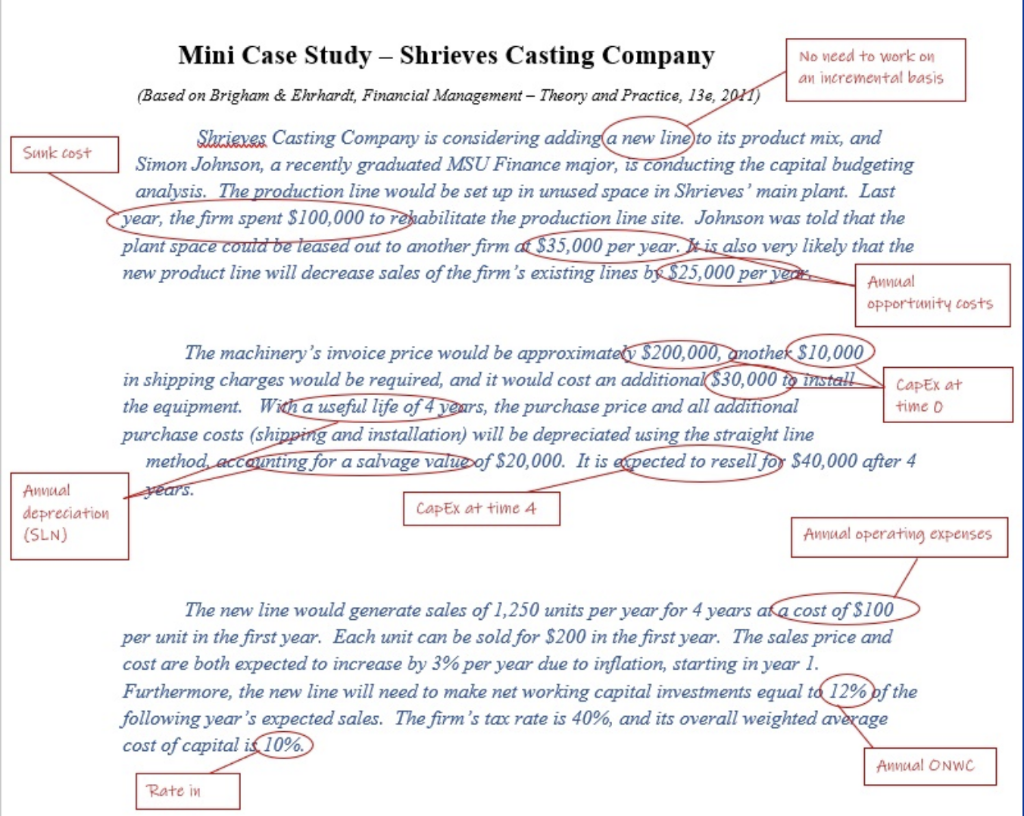

Sunk cost Annual depreciation (SLN) Mini Case Study - Shrieves Casting Company No need to work on an incremental basis (Based on Brigham & Ehrhardt, Financial Management - Theory and Practice, 13e, 2011) Shriexes Casting Company is considering adding a new line to its product mix, and Simon Johnson, a recently graduated MSU Finance major, is conducting the capital budgeting analysis. The production line would be set up in unused space in Shrieves' main plant. Last year, the firm spent $100,000 to rehabilitate the production line site. Johnson was told that the plant space could be leased out to another firm at $35,000 per year. It is also very likely that the new product line will decrease sales of the firm's existing lines by $25,000 per year. Annual opportunity costs The machinery's invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. With a useful life of 4 years, the purchase price and all additional purchase costs (shipping and installation) will be depreciated using the straight line CapEx at time D method, accounting for a salvage value of $20,000. It is expected to resell for $40,000 after 4 years. CapEx at time 4 Annual operating expenses The new line would generate sales of 1,250 units per year for 4 years at a cost of $100 per unit in the first year. Each unit can be sold for $200 in the first year. The sales price and cost are both expected to increase by 3% per year due to inflation, starting in year 1. Furthermore, the new line will need to make net working capital investments equal to 12% of the following year's expected sales. The firm's tax rate is 40%, and its overall weighted average cost of capital is 10% Annual ONWC Rate inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started