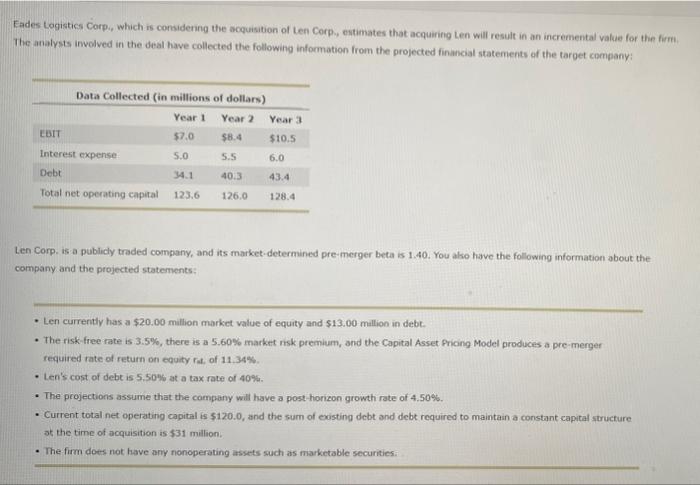

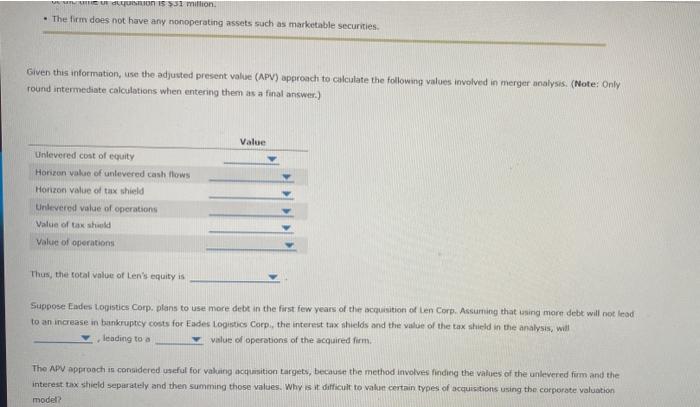

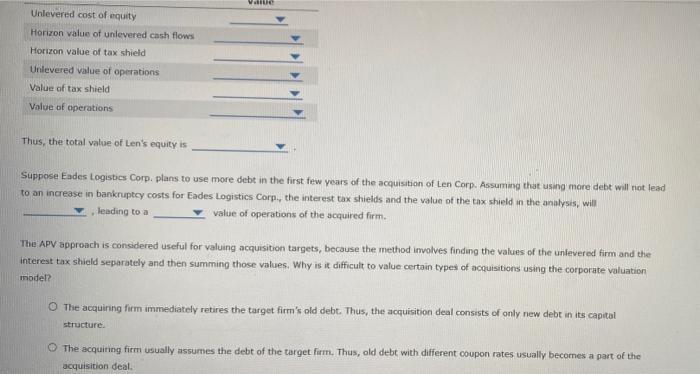

Eades Logistics Corpi, which is considening the acquisition of Len Corp. entimates that acquiring Len will result in an incremental value for the firm The analysts involved in the deal have collected the following infommotion from the projected finaineial statements of the target company: Len Corp. is a publicly traded company, and its market-determined pre-merger beta is 1.40. You also have the following information about the company and the projected statements: - Len currently has a $20.00 mallion market value of equity and $13,00 million in debt. - The risk-free rate is 3.5%, there is a 5.60% market risk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity rat, of 11,34%. - Len's cost of debt is 5.5046 at a tax rate of 4095 . - The projections assume that the campany will have a post-horicon growth rate of 4.50%6. - Current total net operating capital is $120.0, and the sum of existing debt and debt required to maintain a constant capital structure ot the time of acquisition is $31 million. - The firm does not have any nonoperating arssets such as marketable securitiesi. - The firm does not have any nonoperating assets such as marketable securities. Given this information, use the adjusted present value (APV) approach to calculate the follow values involved in merger analysis: (Wote: Only round intermediate calculations when entering them as a final answer.) Thus, the total value of ten's equity is Suppose Eaden lopistics Comp. plans to use more debt in the first few years of the ocquisition of Len Corp. Assurning that using mare debt will not leod to an increase in bankruptcy costs for Eades Logistics Corpi, the interest tax shields and the value of the tax shield in the analysis, will le leading to a value of operabons of the bequaired firm. The APV approoch is conaidered useful for valuang acquasition targets, becausa the method involves findieig the values of the unlevered firm and the interest tax shicid separately and then summing those values. Why is it difficult to value certain types of acquisitions using the corporate valuation model? Thus, the total value of Len's equity is Suppose Eades Logistics Corp. plans to use more debt in the first few yoars of the acquisition of Len Corp. Assuming that usang more debt will not lead to an increase in banikruptcy costs for Eades Logistics Corp., the interest tax shields and the value of the tax shield in the analysis, will leading to a value of operations of the acquired firm. The ApV approach is concidered useful for valuing acquisition targets, bocause the method imvolves finding the values of the unlevered firm and the interest tax shield separately and then summing those values, Why is is difficult to value certain types of acquisitions using the corporate valuation model? The acquining firm immediately retires the target firm's old debt. Thus, the acquisition deal consists of only new debt in its capital stracture. The acquiring firm usually assumes the debt of the target firm. Thus, old debt with different coupon rates usually becornes a part of the acquisition deat. Eades Logistics Corpi, which is considening the acquisition of Len Corp. entimates that acquiring Len will result in an incremental value for the firm The analysts involved in the deal have collected the following infommotion from the projected finaineial statements of the target company: Len Corp. is a publicly traded company, and its market-determined pre-merger beta is 1.40. You also have the following information about the company and the projected statements: - Len currently has a $20.00 mallion market value of equity and $13,00 million in debt. - The risk-free rate is 3.5%, there is a 5.60% market risk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity rat, of 11,34%. - Len's cost of debt is 5.5046 at a tax rate of 4095 . - The projections assume that the campany will have a post-horicon growth rate of 4.50%6. - Current total net operating capital is $120.0, and the sum of existing debt and debt required to maintain a constant capital structure ot the time of acquisition is $31 million. - The firm does not have any nonoperating arssets such as marketable securitiesi. - The firm does not have any nonoperating assets such as marketable securities. Given this information, use the adjusted present value (APV) approach to calculate the follow values involved in merger analysis: (Wote: Only round intermediate calculations when entering them as a final answer.) Thus, the total value of ten's equity is Suppose Eaden lopistics Comp. plans to use more debt in the first few years of the ocquisition of Len Corp. Assurning that using mare debt will not leod to an increase in bankruptcy costs for Eades Logistics Corpi, the interest tax shields and the value of the tax shield in the analysis, will le leading to a value of operabons of the bequaired firm. The APV approoch is conaidered useful for valuang acquasition targets, becausa the method involves findieig the values of the unlevered firm and the interest tax shicid separately and then summing those values. Why is it difficult to value certain types of acquisitions using the corporate valuation model? Thus, the total value of Len's equity is Suppose Eades Logistics Corp. plans to use more debt in the first few yoars of the acquisition of Len Corp. Assuming that usang more debt will not lead to an increase in banikruptcy costs for Eades Logistics Corp., the interest tax shields and the value of the tax shield in the analysis, will leading to a value of operations of the acquired firm. The ApV approach is concidered useful for valuing acquisition targets, bocause the method imvolves finding the values of the unlevered firm and the interest tax shield separately and then summing those values, Why is is difficult to value certain types of acquisitions using the corporate valuation model? The acquining firm immediately retires the target firm's old debt. Thus, the acquisition deal consists of only new debt in its capital stracture. The acquiring firm usually assumes the debt of the target firm. Thus, old debt with different coupon rates usually becornes a part of the acquisition deat