Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eagle Sports Systems (ESS) Inc. is considering a project (Project 2020) that requires an investment of $4 million for new manufacturing equipment. This project is

Eagle Sports Systems (ESS) Inc. is considering a project (Project 2020) that requires an investment of $4 million for new manufacturing equipment. This project is in the same line of business as the firms current operations and is therefore not expected to alter the risk of the firm. ESSs manager of finance is estimating the discount rate required to evaluate the project.

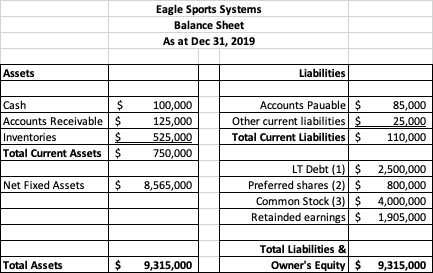

The most recent balance sheet is provided below.

Notes to financial statements:

- The 7% semi-annual coupon bonds have a face value of $1,000, were issued 5 years ago and have 15 years to maturity. Flotation costs to issue new bonds = 4%

- The preferred shares have a $50 par value and 8% dividend. Flotation costs to issue new preferred = 5%.

- There are 250,000 common shares outstanding. Flotation costs to issue new common = 6%

Additional information you may find useful:

- The current market price of ESSs securities: common stock = $47.50 per share; preferred shares = $44 per share and their bonds are selling for a quoted price = 104

- The return on Government of Canada TBills = 1%, the S&P/TSX Composite Index has a standard deviation = 12% and a return = 8%.

- ESS shares have a correlation with the market portfolio = 0.85 and a standard deviation = 27.5%

- The marginal tax rate = 35%

- Present value of the CCA tax shield associated for this project = $657,080

- Present value of the ending cashflows for this project = $392,320

- Present value of the after-tax operating cashflows for this project = $3,255,800

- The firm does not have enough internally funds to finance the equity portion of this project.

- Calculate the discount rate that should be used to evaluate Project 2020. (2 marks)

- Calculate the total initial investment for Project 2020. (6 marks)

- Based on a NPV analysis, should Project 2020 be accepted? Show your work. (6 marks)

- The firm is also considering another project (Project X) that has less risk than the firm. This new project will be financed using 45% Debt and 55% Equity. A pure-play firm has been identified that has a beta = 0.9; D/E ratio = 1 and a tax rate = 40%. The cost of debt and tax rate for the new project will be the same as ESSs. Calculate the cost of equity for this new project (Project X). (5 marks)

- Calculate the discount rate that should be used to evaluate this new project (Project X). (3 marks)

- Suppose the IRR of Project X = 7%. Should the firm accept or reject the project? Explain. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started