Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EagleNet Trustmark Swimcloud a Amazon Quillbot Budgeting Beyond LIVE Weverse Makestar MyMusicTaste Choice Music LA In-Class Assignment for 9-6-2022 i 4 Saved 1 points

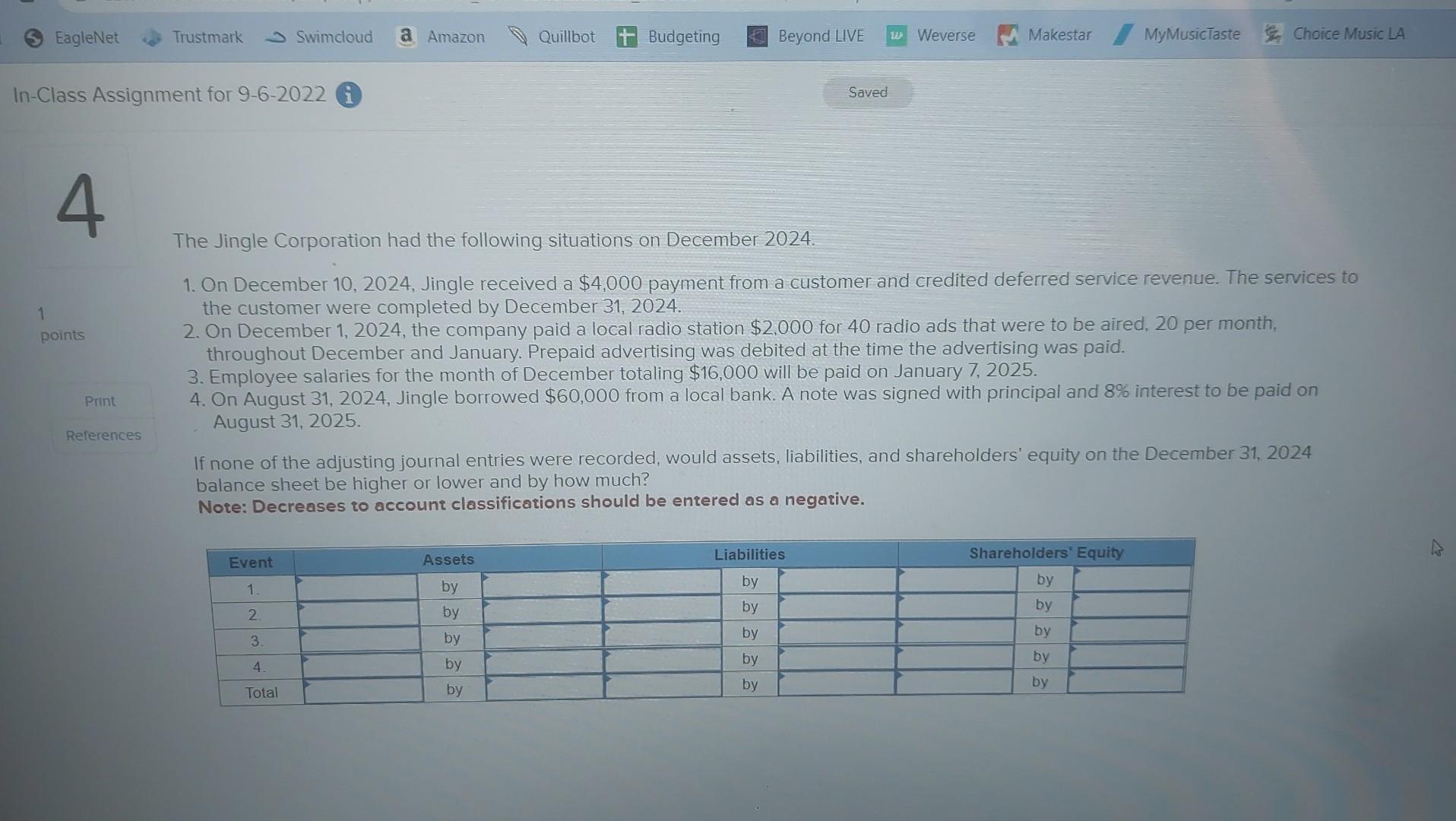

EagleNet Trustmark Swimcloud a Amazon Quillbot Budgeting Beyond LIVE Weverse Makestar MyMusicTaste Choice Music LA In-Class Assignment for 9-6-2022 i 4 Saved 1 points Print References The Jingle Corporation had the following situations on December 2024. 1. On December 10, 2024, Jingle received a $4,000 payment from a customer and credited deferred service revenue. The services to the customer were completed by December 31, 2024. 2. On December 1, 2024, the company paid a local radio station $2,000 for 40 radio ads that were to be aired, 20 per month, throughout December and January. Prepaid advertising was debited at the time the advertising was paid. 3. Employee salaries for the month of December totaling $16,000 will be paid on January 7, 2025. 4. On August 31, 2024, Jingle borrowed $60,000 from a local bank. A note was signed with principal and 8% interest to be paid on August 31, 2025. If none of the adjusting journal entries were recorded, would assets, liabilities, and shareholders' equity on the December 31, 2024 balance sheet be higher or lower and by how much? Note: Decreases to account classifications should be entered as a negative. Liabilities Shareholders' Equity Event 1. Assets by by by by by 2. by by by 3. by by by 4. by by by Total by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started