Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eanes Co. established a $200 petty cash fund on January 1, 2011. One week later, on January 8, E the fund contained $27.50 in cash

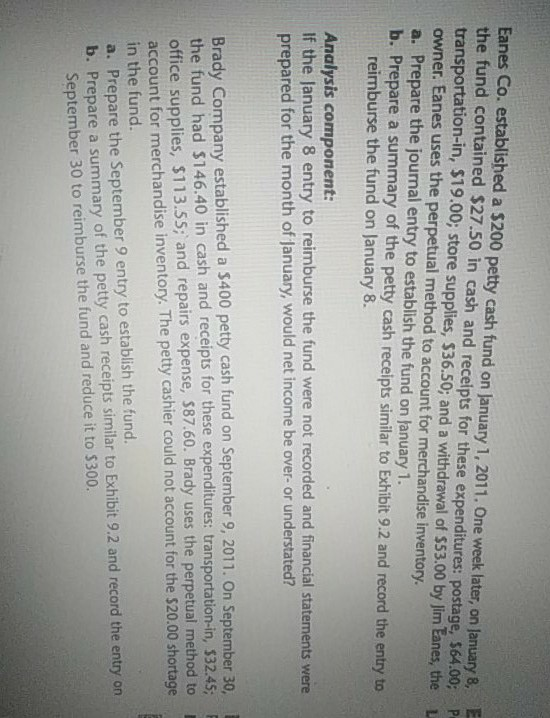

Eanes Co. established a $200 petty cash fund on January 1, 2011. One week later, on January 8, E the fund contained $27.50 in cash and receipts for these expenditures: postage, 564.00;P transportation-in, $19.00; store supplies, $36.50; and a withdrawal of $53.00 by Jim Eanes, the L owner. Eanes uses the perpetual method to account for merchandise inventory. a. Prepare the journal entry to establish the fund on January 1. b. Prepare a summary of the petty cash receipts similar to Exhibit 9.2 and record the entry to reimburse the fund on January 8. Analysis component: If the January 8 entry to reimburse the fund were not recorded and financial statements were prepared for the month of January, would net income be over- or understated? Brady Company established a $400 petty cash fund on September 9, 2011. On September 30, the fund had $146.40 in cash and receipts for these expenditures: transportation-in, $32.45; office supplies, $113.55; and repairs expense, 587.60. Brady uses the perpetual method to account for merchandise inventory. The petty cashier could not account for the $20.00 shortage in the fund. a. Prepare the September 9 entry to establish the fund. b. Prepare a summary of the petty cash receipts similar to Exhibit 9.2 and record the entry on September 30 to reimburse the fund and reduce it to $300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started