Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EAR Mr. Anderson plans to buy a house in 5 years. He expects it to cost $700,000 at that time. He has the following

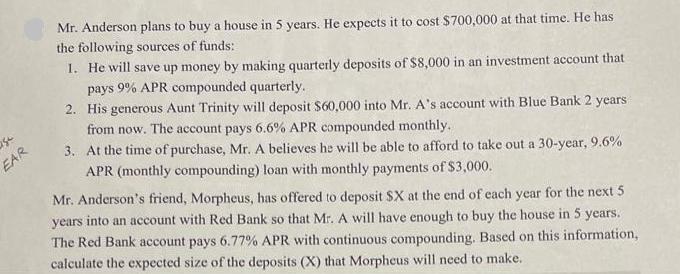

EAR Mr. Anderson plans to buy a house in 5 years. He expects it to cost $700,000 at that time. He has the following sources of funds: 1. He will save up money by making quarterly deposits of $8,000 in an investment account that pays 9% APR compounded quarterly. 2. His generous Aunt Trinity will deposit $60,000 into Mr. A's account with Blue Bank 2 years from now. The account pays 6.6% APR compounded monthly. 3. At the time of purchase, Mr. A believes he will be able to afford to take out a 30-year, 9.6% APR (monthly compounding) loan with monthly payments of $3,000. Mr. Anderson's friend, Morpheus, has offered to deposit SX at the end of each year for the next 5 years into an account with Red Bank so that Mr. A will have enough to buy the house in 5 years. The Red Bank account pays 6.77% APR with continuous compounding. Based on this information, calculate the expected size of the deposits (X) that Morpheus will need to make.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected size of the deposits X that Morpheus will need to make we can use the conc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started