Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Early in 2022, Alex's father died of cancer and left him a very large inheritance which Alex used to purchase real estate and create

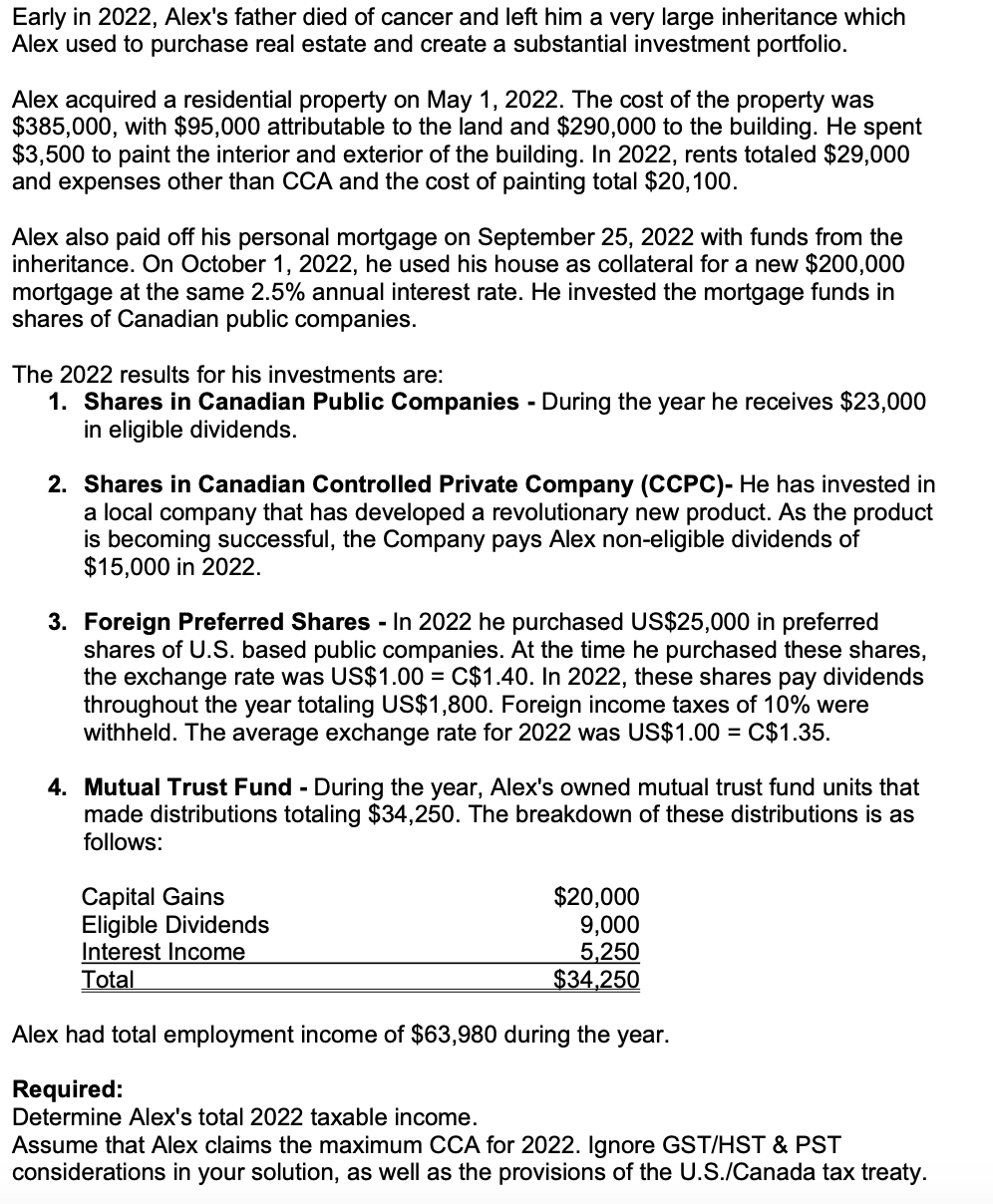

Early in 2022, Alex's father died of cancer and left him a very large inheritance which Alex used to purchase real estate and create a substantial investment portfolio. Alex acquired a residential property on May 1, 2022. The cost of the property was $385,000, with $95,000 attributable to the land and $290,000 to the building. He spent $3,500 to paint the interior and exterior of the building. In 2022, rents totaled $29,000 and expenses other than CCA and the cost of painting total $20,100. Alex also paid off his personal mortgage on September 25, 2022 with funds from the inheritance. On October 1, 2022, he used his house as collateral for a new $200,000 mortgage at the same 2.5% annual interest rate. He invested the mortgage funds in shares of Canadian public companies. The 2022 results for his investments are: 1. Shares in Canadian Public Companies - During the year he receives $23,000 in eligible dividends. 2. Shares in Canadian Controlled Private Company (CCPC)- He has invested in a local company that has developed a revolutionary new product. As the product is becoming successful, the Company pays Alex non-eligible dividends of $15,000 in 2022. 3. Foreign Preferred Shares - In 2022 he purchased US$25,000 in preferred shares of U.S. based public companies. At the time he purchased these shares, the exchange rate was US$1.00 = C$1.40. In 2022, these shares pay dividends throughout the year totaling US$1,800. Foreign income taxes of 10% were withheld. The average exchange rate for 2022 was US$1.00 = C$1.35. 4. Mutual Trust Fund - During the year, Alex's owned mutual trust fund units that made distributions totaling $34,250. The breakdown of these distributions is as follows: $20,000 9,000 5,250 $34,250 Alex had total employment income of $63,980 during the year. Required: Determine Alex's total 2022 taxable income. Capital Gains Eligible Dividends Interest Income Total Assume that Alex claims the maximum CCA for 2022. Ignore GST/HST & PST considerations in your solution, as well as the provisions of the U.S./Canada tax treaty.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Alexs total taxable income for the year 2022 we need to consider all the income sources ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started