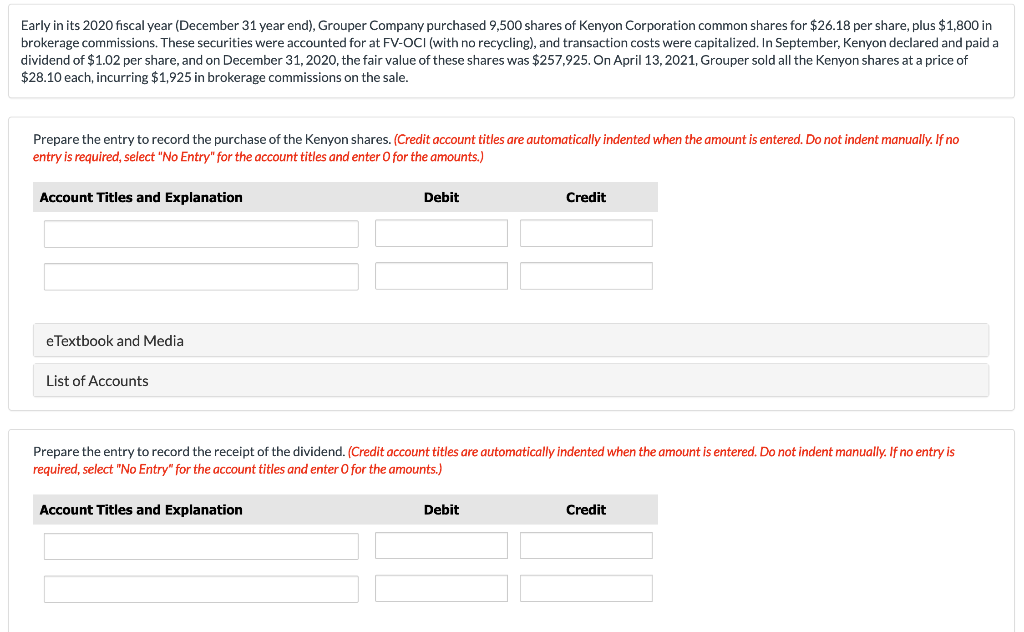

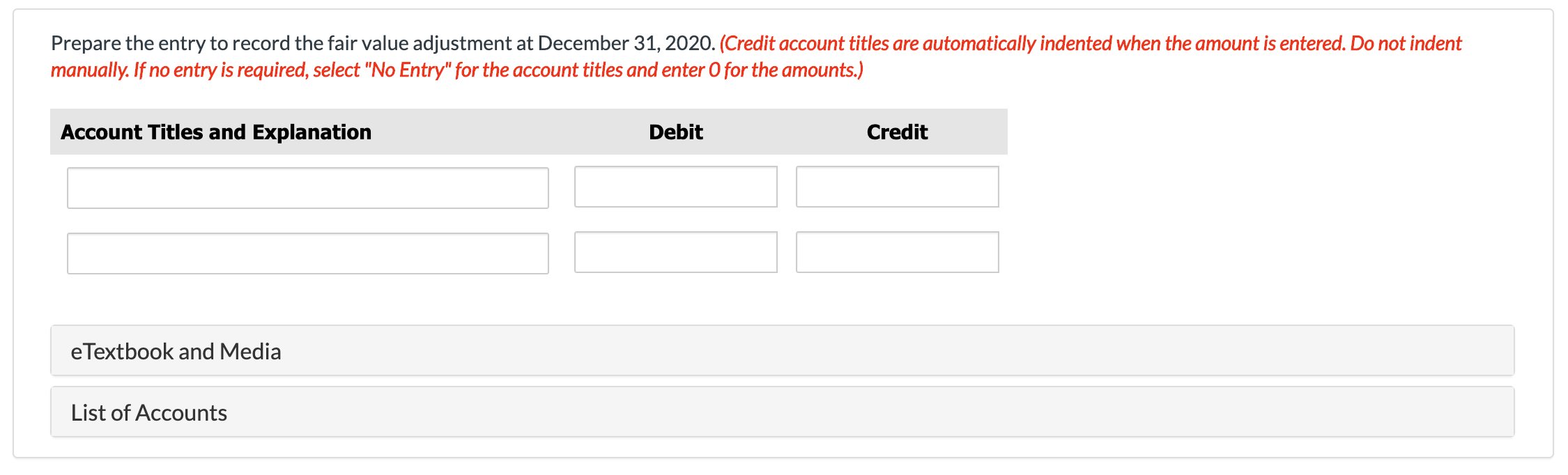

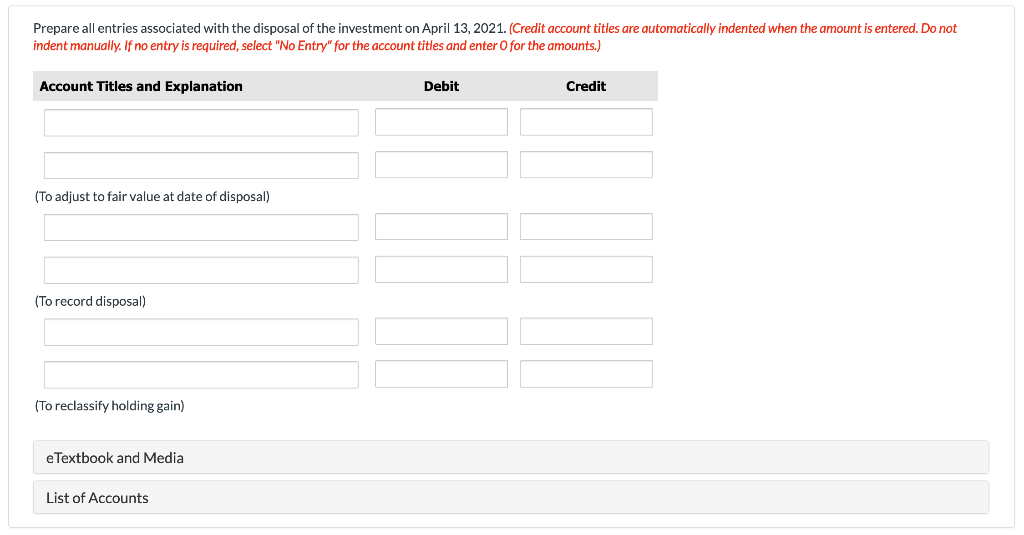

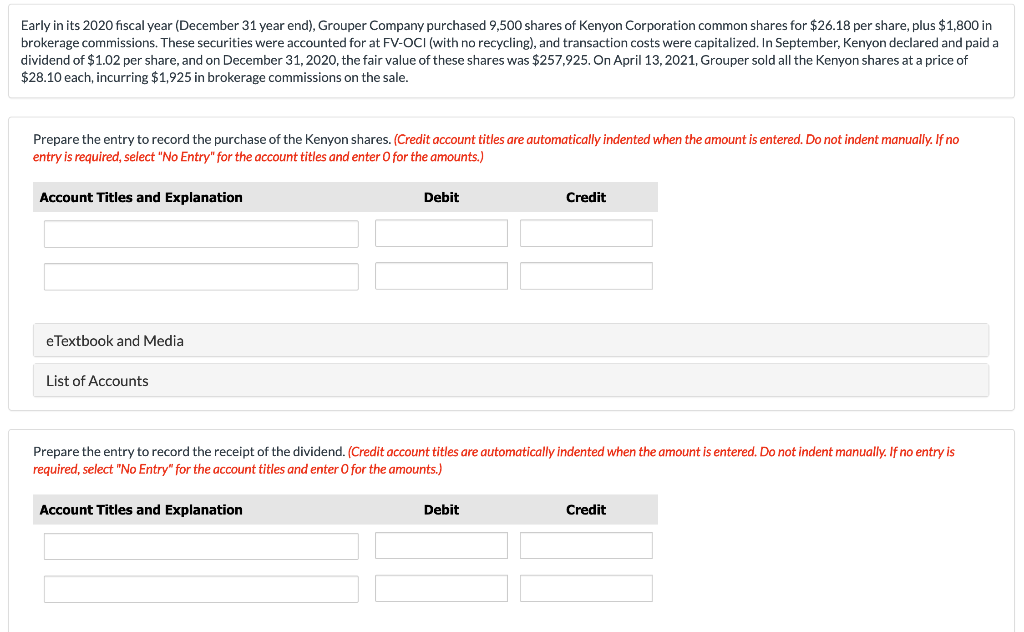

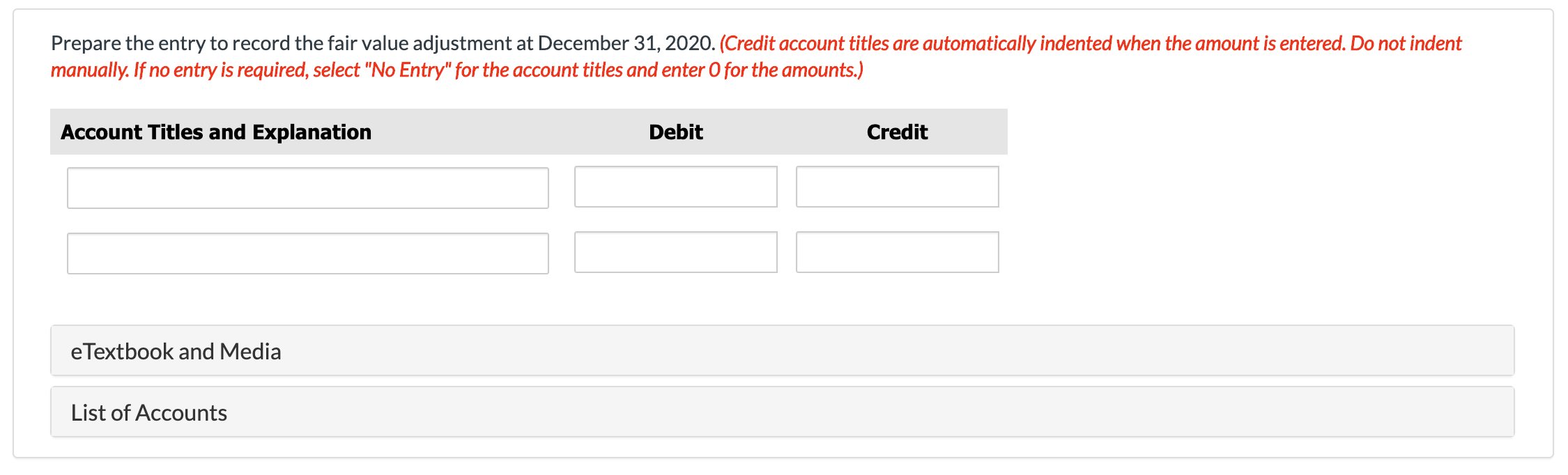

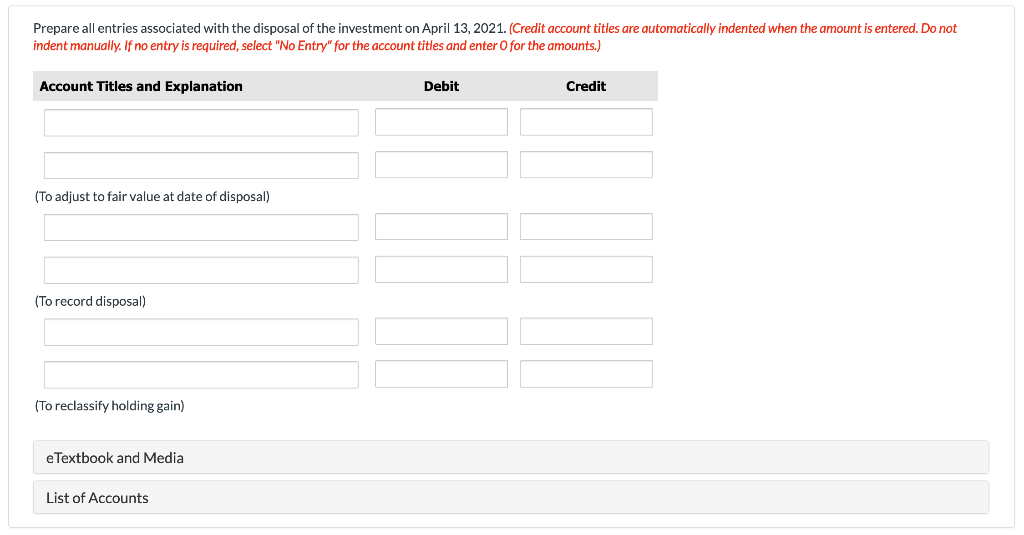

Early in its 2020 fiscal year (December 31 year end), Grouper Company purchased 9,500 shares of Kenyon Corporation common shares for $26.18 per share, plus $1,800 in brokerage commissions. These securities were accounted for at FV-OCI (with no recycling), and transaction costs were capitalized. In September, Kenyon declared and paid a dividend of $1.02 per share, and on December 31, 2020, the fair value of these shares was $257,925. On April 13, 2021, Grouper sold all the Kenyon shares at a price of $28.10 each, incurring $1,925 in brokerage commissions on the sale. Prepare the entry to record the purchase of the Kenyon shares. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts Prepare the entry to record the receipt of the dividend. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Prepare the entry to record the fair value adjustment at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts Prepare all entries associated with the disposal of the investment on April 13, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit (To adjust to fair value at date of disposal) (To record disposal) (To reclassify holding gain) e Textbook and Media List of Accounts Early in its 2020 fiscal year (December 31 year end), Grouper Company purchased 9,500 shares of Kenyon Corporation common shares for $26.18 per share, plus $1,800 in brokerage commissions. These securities were accounted for at FV-OCI (with no recycling), and transaction costs were capitalized. In September, Kenyon declared and paid a dividend of $1.02 per share, and on December 31, 2020, the fair value of these shares was $257,925. On April 13, 2021, Grouper sold all the Kenyon shares at a price of $28.10 each, incurring $1,925 in brokerage commissions on the sale. Prepare the entry to record the purchase of the Kenyon shares. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts Prepare the entry to record the receipt of the dividend. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Prepare the entry to record the fair value adjustment at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts Prepare all entries associated with the disposal of the investment on April 13, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit (To adjust to fair value at date of disposal) (To record disposal) (To reclassify holding gain) e Textbook and Media List of Accounts