Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Early next year, Kate and Sam Smith will inherit $200,000. Kate and Sam are trying to decide how to invest this money and have asked

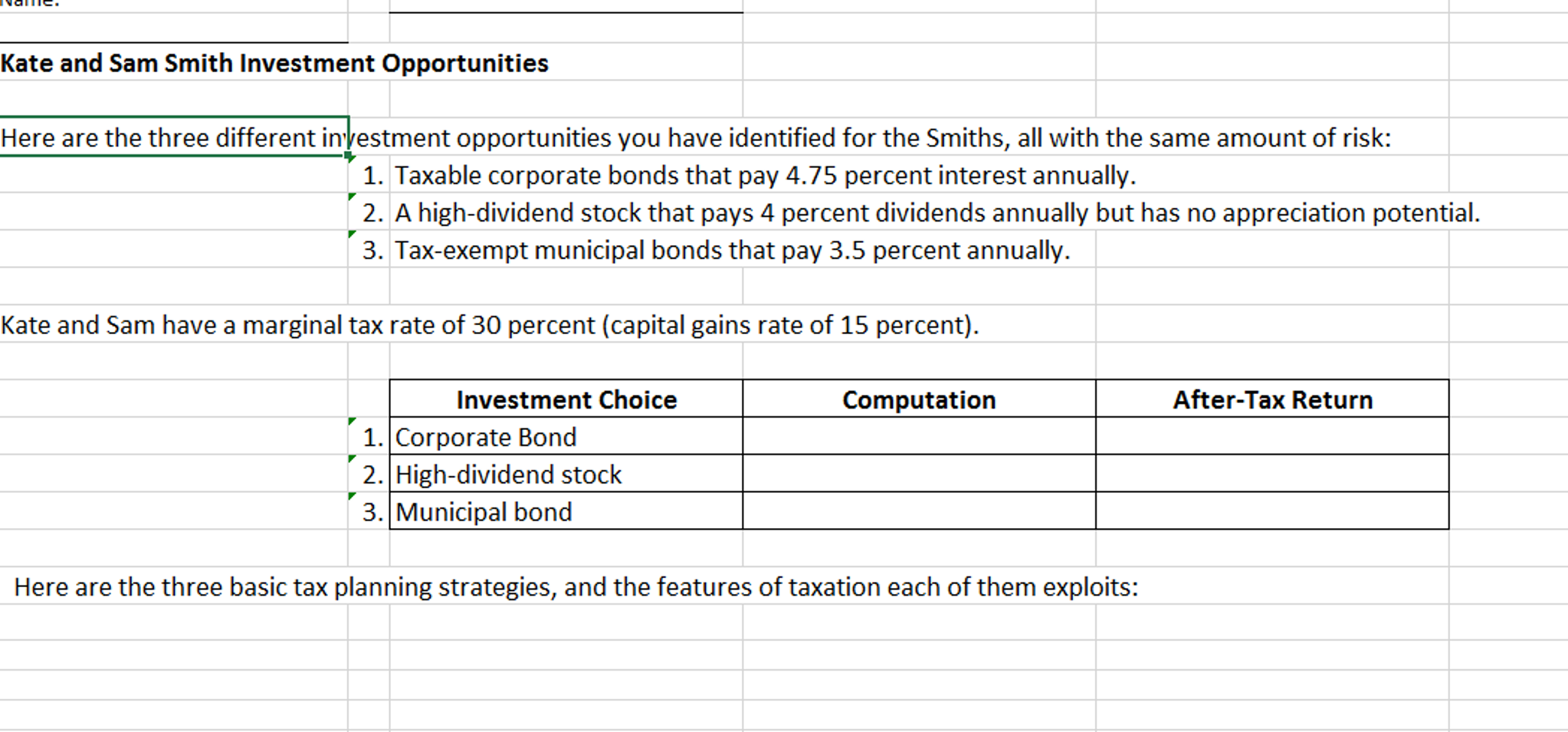

Early next year, Kate and Sam Smith will inherit $200,000. Kate and Sam are trying to decide how to invest this money and have asked you, their tax accountant, to look into some potential investment opportunities. Please see the attached excel spreadsheet, where you will complete the annual after-tax rates of return column for each investment opportunity you have identified.

Include a paragraph on the spreadsheet where you list the three basic tax planning strategies, and the features of taxation each of them exploits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started