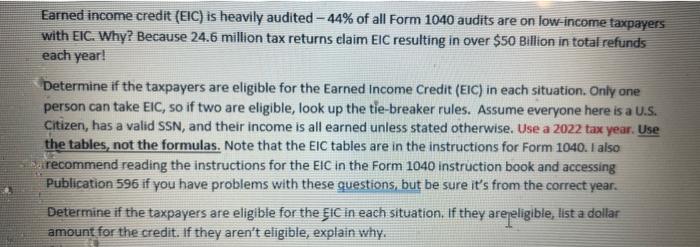

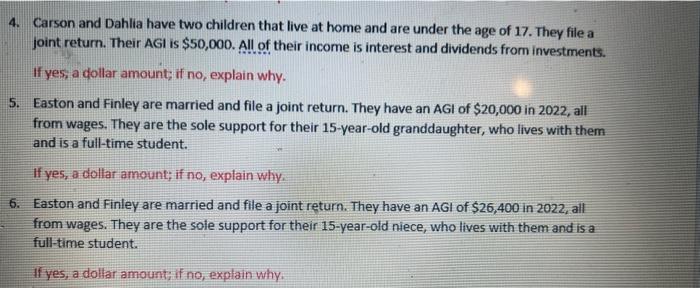

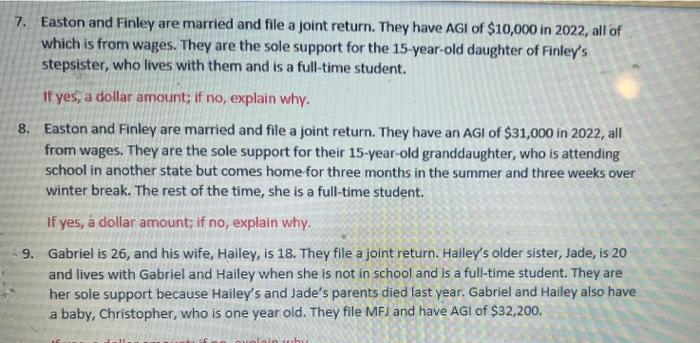

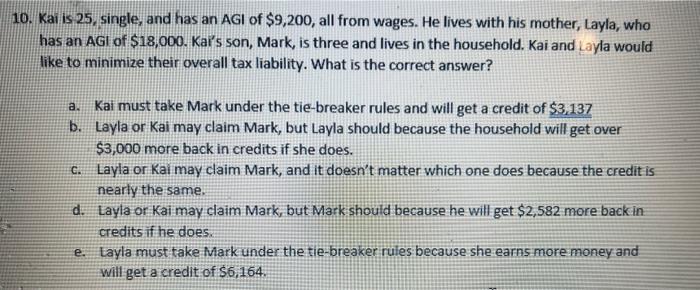

Earned income credit (EIC) is heavily audited-44\% of all Form 1040 audits are on low-income taxpayers with EIC. Why? Because 24.6 million tax returns claim EIC resulting in over $50 Billion in total refunds each year! Determine if the taxpayers are eligible for the Earned Income Credit (EIC) in each situation. Only one person can take EIC, so if two are eligible, look up the tie-breaker rules. Assume everyone here is a U.S. Citizen, has a valid SSN, and their income is all earned unless stated otherwise. Use a 2022 tax year. Use the tables, not the formulas. Note that the ElC tables are in the instructions for Form 1040 . I also recommend reading the instructions for the EIC in the Form 1040 instruction book and accessing Publication 596 if you have problems with these questions, but be sure it's from the correct year. Determine if the taxpayers are eligible for the EIC in each situation. If they aregeligible, list a dollar amount for the credit. If they aren't eligible, explain why. 4. Carson and Dahlia have two children that live at home and are under the age of 17 . They file a joint return. Their AGI is $50,000. All of their income is interest and dividends from investments. If yes, a dollar amount; if no, explain why. 5. Easton and Finley are married and file a joint return. They have an AGl of $20,000 in 2022 , all from wages. They are the sole support for their 15 -year-old granddaughter, who lives with them and is a full-time student. If yes, a dollar amount; if no, explain why. 6. Easton and Finley are married and file a joint return. They have an AGl of $26,400 in 2022 , all from wages. They are the sole support for their 15 -year-old niece, who lives with them and is a full-time student. If yes, a dollar amount; if no, explain why. 7. Easton and Finley are married and file a joint return. They have AGI of $10,000 in 2022 , all of which is from wages. They are the sole support for the 15-year-old daughter of Finley's stepsister, who lives with them and is a full-time student. If yes, a dollar amount; if no, explain why. 8. Easton and Finley are married and file a joint return. They have an AGI of $31,000 in 2022 , all from wages. They are the sole support for their 15-year-old granddaughter, who is attending school in another state but comes home for three months in the summer and three weeks over winter break. The rest of the time, she is a full-time student. If yes, a dollar amount; if no, explain why. 9. Gabriel is 26 , and his wife, Hailey, is 18 . They file a joint return. Hailey's older sister, Jade, is 20 and lives with Gabriel and Hailey when she is not in school and is a full-time student. They are her sole support because Hailey's and Jade's parents died last year. Gabriel and Hailey also have a baby, Christopher, who is one year old. They file MFJ and have AGI of $32,200. 10. Kai is 25, single, and has an AGI of $9,200, all from wages. He lives with his mother, Layla, who has an AGI of $18,000. Kai's son, Mark, is three and lives in the household. Kai and Layla would like to minimize their overall tax liability. What is the correct answer? a. Kai must take Mark under the tie-breaker rules and will get a credit of $3,137 b. Layla or Kai may claim Mark, but Layla should because the household will get over $3,000 more back in credits if she does. c. Layla or Kai may claim Mark, and it doesn't matter which one does because the credit is nearty the same. d. Layla or Kai may claim Mark, but Mark should because he will get $2,582 more back in credits if he does. e. Layla must take Mark under the tie-breaker rules because she earns more money and Will get a credit of $6,164