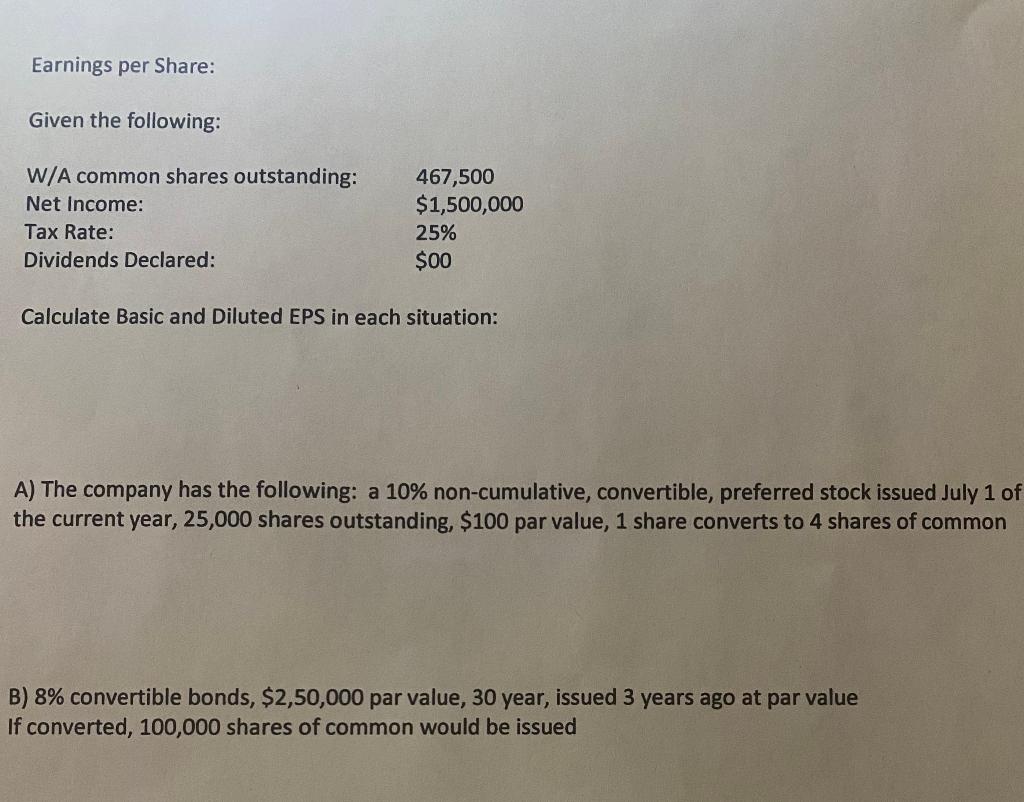

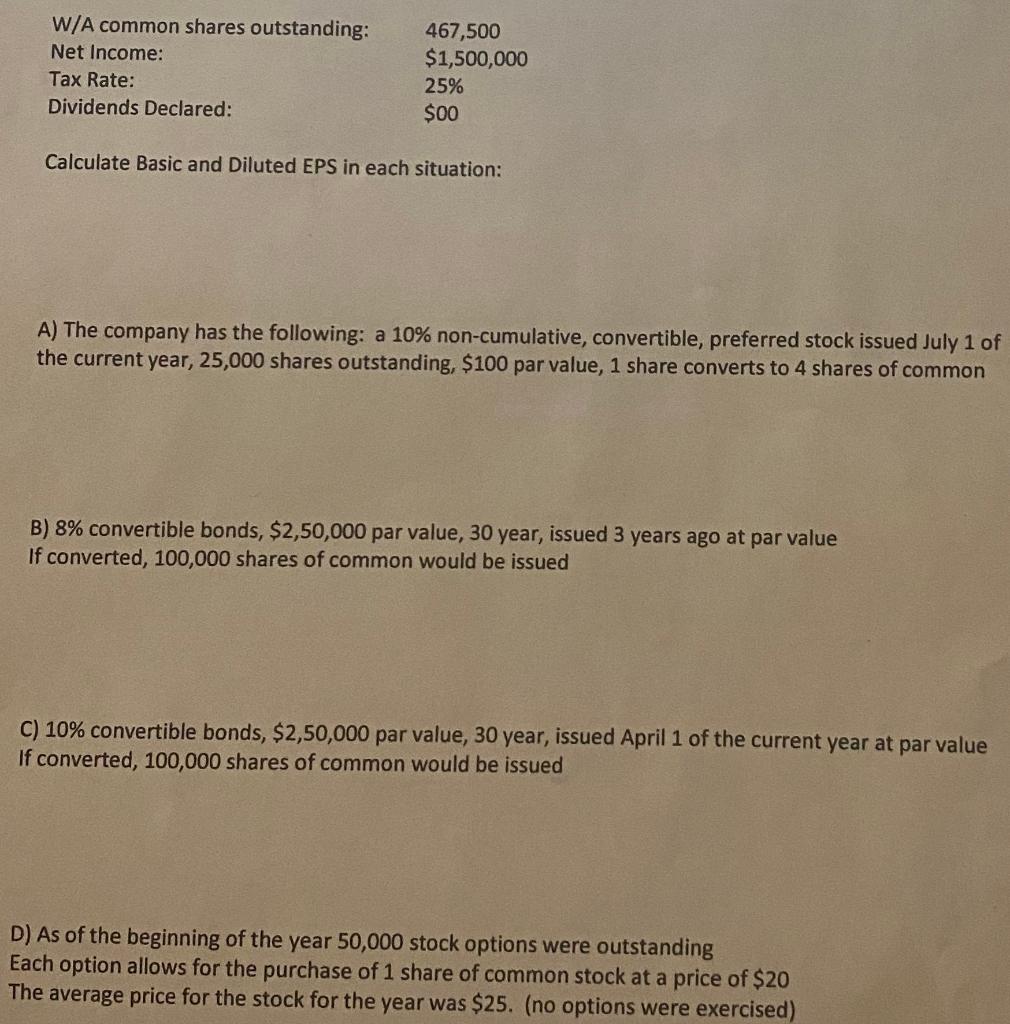

Earnings per Share: Given the following: W/A common shares outstanding: Net Income: Tax Rate: Dividends Declared: 467,500 $1,500,000 25% $00 Calculate Basic and Diluted EPS in each situation: A) The company has the following: a 10% non-cumulative, convertible, preferred stock issued July 1 of the current year, 25,000 shares outstanding, $100 par value, 1 share converts to 4 shares of common B) 8% convertible bonds, $2,50,000 par value, 30 year, issued 3 years ago at par value If converted, 100,000 shares of common would be issued W/A common shares outstanding: Net Income: Tax Rate: Dividends Declared: 467,500 $1,500,000 25% $00 Calculate Basic and Diluted EPS in each situation: A) The company has the following: a 10% non-cumulative, convertible, preferred stock issued July 1 of the current year, 25,000 shares outstanding, $100 par value, 1 share converts to 4 shares of common B) 8% convertible bonds, $2,50,000 par value, 30 year, issued 3 years ago at par value If converted, 100,000 shares of common would be issued C) 10% convertible bonds, $2,50,000 par value, 30 year, issued April 1 of the current year at par value If converted, 100,000 shares of common would be issued D) As of the beginning of the year 50,000 stock options were outstanding Each option allows for the purchase of 1 share of common stock at a price of $20 The average price for the stock for the year was $25. (no options were exercised) Earnings per Share: Given the following: W/A common shares outstanding: Net Income: Tax Rate: Dividends Declared: 467,500 $1,500,000 25% $00 Calculate Basic and Diluted EPS in each situation: A) The company has the following: a 10% non-cumulative, convertible, preferred stock issued July 1 of the current year, 25,000 shares outstanding, $100 par value, 1 share converts to 4 shares of common B) 8% convertible bonds, $2,50,000 par value, 30 year, issued 3 years ago at par value If converted, 100,000 shares of common would be issued W/A common shares outstanding: Net Income: Tax Rate: Dividends Declared: 467,500 $1,500,000 25% $00 Calculate Basic and Diluted EPS in each situation: A) The company has the following: a 10% non-cumulative, convertible, preferred stock issued July 1 of the current year, 25,000 shares outstanding, $100 par value, 1 share converts to 4 shares of common B) 8% convertible bonds, $2,50,000 par value, 30 year, issued 3 years ago at par value If converted, 100,000 shares of common would be issued C) 10% convertible bonds, $2,50,000 par value, 30 year, issued April 1 of the current year at par value If converted, 100,000 shares of common would be issued D) As of the beginning of the year 50,000 stock options were outstanding Each option allows for the purchase of 1 share of common stock at a price of $20 The average price for the stock for the year was $25. (no options were exercised)