Question

Earth Ltd owns a pharmaceutical business with a year-end of 31 October 2021. Earth Ltd began the development stage of a new injection on

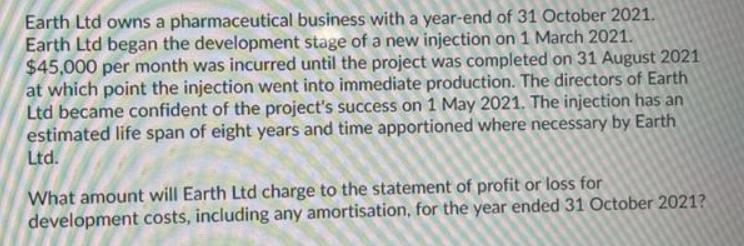

Earth Ltd owns a pharmaceutical business with a year-end of 31 October 2021. Earth Ltd began the development stage of a new injection on 1 March 2021. $45,000 per month was incurred until the project was completed on 31 August 2021 at which point the injection went into immediate production. The directors of Earth Ltd became confident of the project's success on 1 May 2021. The injection has an estimated life span of eight years and time apportioned where necessary by Earth Ltd. What amount will Earth Ltd charge to the statement of profit or loss for development costs, including any amortisation, for the year ended 31 October 2021?

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Expense incurred per month 45000 Only expense incurred during the d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

8th edition

978-1408041802, 1408041804, 978-1408048566, 1408048566, 978-1408093887

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App