Answered step by step

Verified Expert Solution

Question

1 Approved Answer

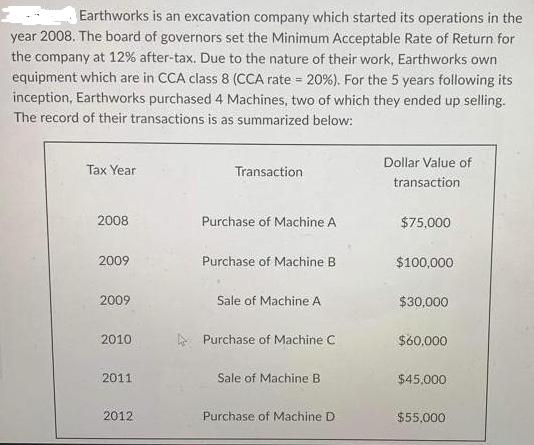

Earthworks is an excavation company which started its operations in the year 2008. The board of governors set the Minimum Acceptable Rate of Return

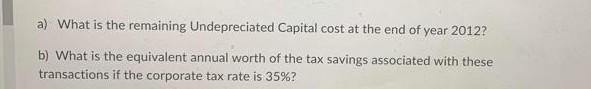

Earthworks is an excavation company which started its operations in the year 2008. The board of governors set the Minimum Acceptable Rate of Return for the company at 12% after-tax. Due to the nature of their work, Earthworks own equipment which are in CCA class 8 (CCA rate = 20%). For the 5 years following its inception, Earthworks purchased 4 Machines, two of which they ended up selling. The record of their transactions is as summarized below: Tax Year 2008 2009 2009 2010 2011 2012 Transaction Purchase of Machine A Purchase of Machine B Sale of Machine A Purchase of Machine C Sale of Machine B JE Purchase of Machine D Dollar Value of transaction $75,000 $100,000 $30,000 $60,000 $45.000 $55,000 a) What is the remaining Undepreciated Capital cost at the end of year 2012? b) What is the equivalent annual worth of the tax savings associated with these transactions if the corporate tax rate is 35%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started