Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Easywash Ltd. is in the business of providing portable wash bags for backpackers. It has seen no growth in the past several years and

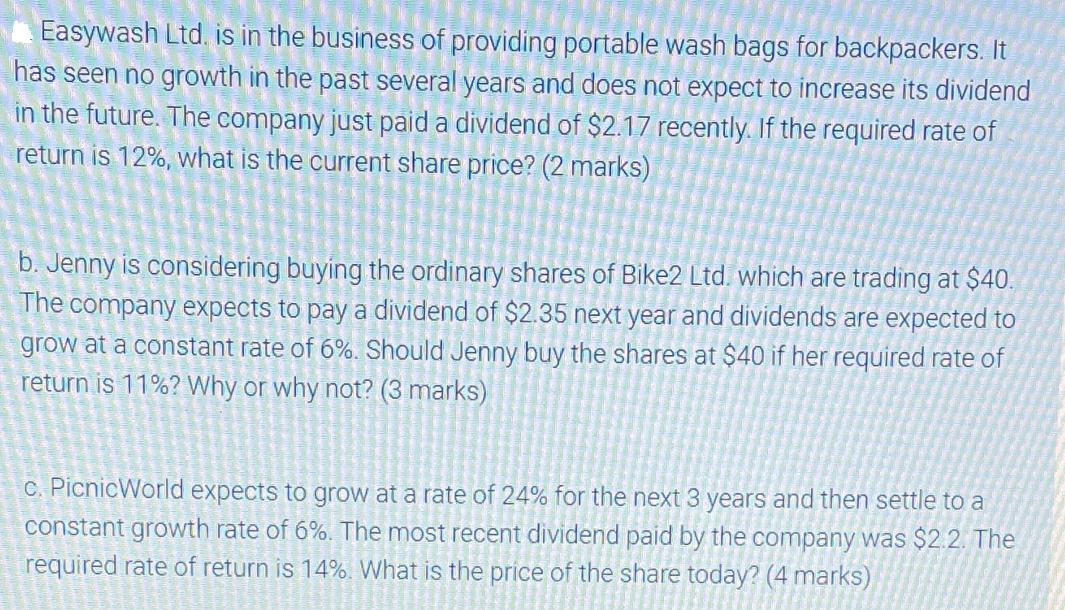

Easywash Ltd. is in the business of providing portable wash bags for backpackers. It has seen no growth in the past several years and does not expect to increase its dividend in the future. The company just paid a dividend of $2.17 recently. If the required rate of return is 12%, what is the current share price? (2 marks) b. Jenny is considering buying the ordinary shares of Bike2 Ltd. which are trading at $40. The company expects to pay a dividend of $2.35 next year and dividends are expected to grow at a constant rate of 6%. Should Jenny buy the shares at $40 if her required rate of return is 11%? Why or why not? (3 marks) c. PicnicWorld expects to grow at a rate of 24% for the next 3 years and then settle to a constant growth rate of 6%. The most recent dividend paid by the company was $2.2. The required rate of return is 14%. What is the price of the share today? (4 marks)

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the current share price of Easywash Ltd we can use the dividend discount model P D r ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started