Answered step by step

Verified Expert Solution

Question

1 Approved Answer

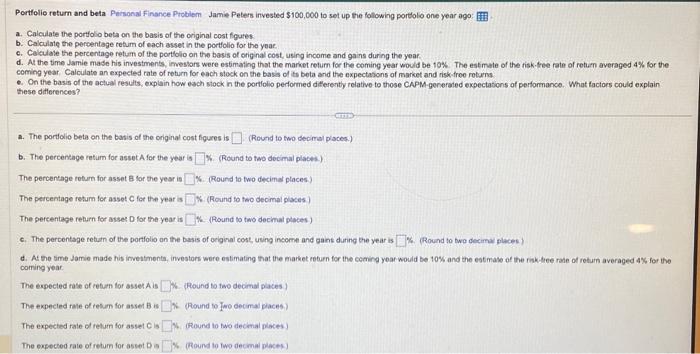

easier when using excel Portfolio return and beta Parsonal Finance Problem Jame Peters invested $100,000 to set up the following portolo one year ago: a.

easier when using excel

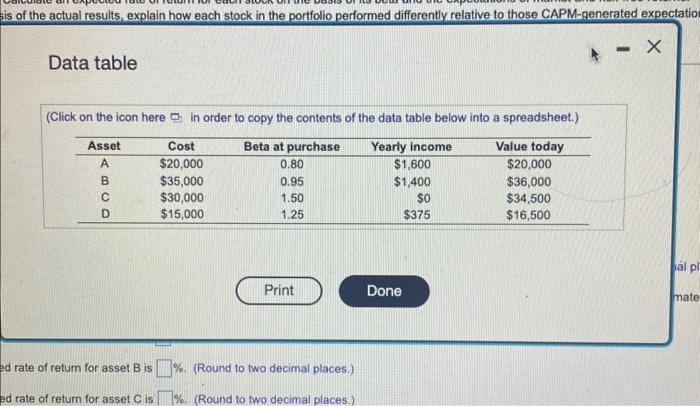

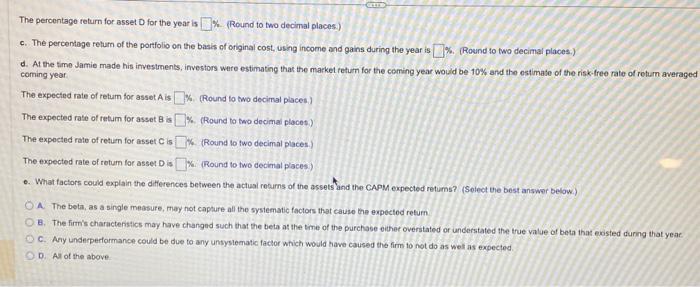

Portfolio return and beta Parsonal Finance Problem Jame Peters invested $100,000 to set up the following portolo one year ago: a. Calculate the portfolio beta on the basis of the original cost foures b. Calculate the peroentage tetum of each asset in the porttolio for the yoar. c. Calculale the percentage retum of the portlolo on the basis of original cost, using income and gains during the year. d. At the time Jamie made his investments, investars were estimating that the market retum for the coming year would be 10%. The estmate of the fisk.tree rate of rotum averaged 4% for the coming year, Calculate an expected rate of return for each stock on the bass of its beta and the expectatons of market and riskitroe roturs. e. On the basis of the actual resuts, explain how esch stock in the portfolio peflormed difterenty relative to those CAPM-generated expectations of performance. What factors could explain these diflerences? Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet. d rate of retum for asset B is \%. (Round to two decimal places.) od rate of retum for asset C is %. (Round to two decimal places) The percentage return for asset D for the year is \%. (Round to two decimal places) c. The percentage relum of the portfolio on the basis of otiginal cost, using income and gains during the year is \%. (Round to two decimal places.) d. At the time Jamie made his irvestments, investors were estimating that the market retum for the coming year would be 10% and the ostimate of the risk-free rate of roturn averaged coming year The expected rate of retum for asset A is %. (Round to two decimal places.) The expected rate of retum for asset B is \%\%. (Round to two decimai plocet) ) The expected rate of retuen for asset C is W. (Round lo two decimal places.) The expected rate of rotum for asset D is K. (Round to two decimal places) ) 0. What factors could explain the differences between the actual reourns of the assets and the CAPM expected retums? (Splect bhe best answer below.) A. The beth, as a single measure, may not capture all the sysiematic factors that cause the expectod retum. B. The firm's charactenstics may have changed such that the beta at the time of the purchase eicher overstated or understated the true value of beta that exsted durng that year. C. Any underpertormance could be due to any unsyslematic factor which would have caused the firm to not do as wel as expected. D. Al of the above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started