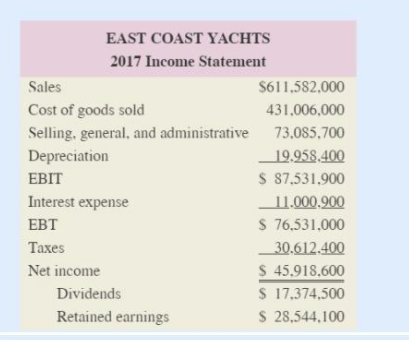

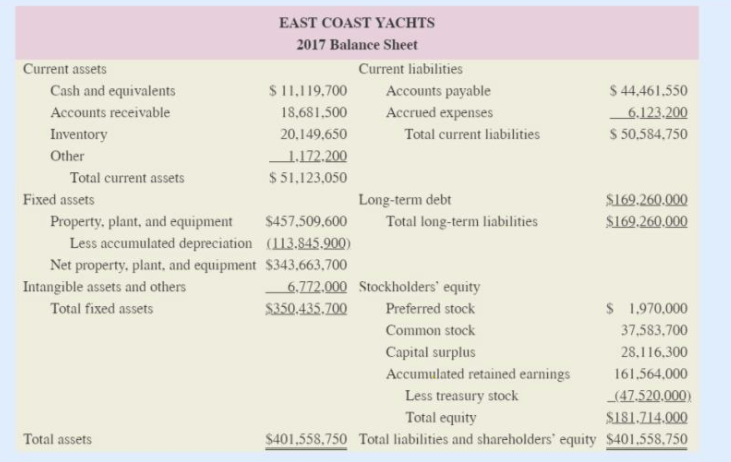

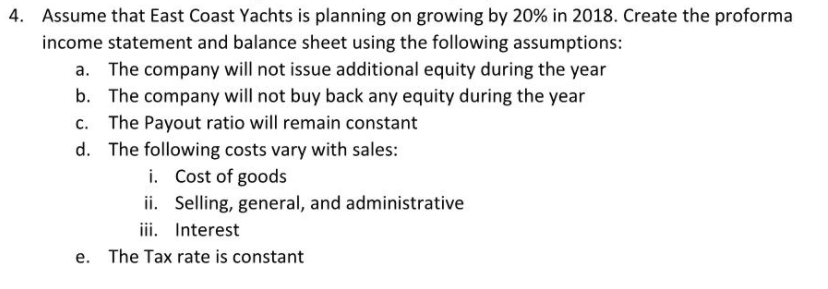

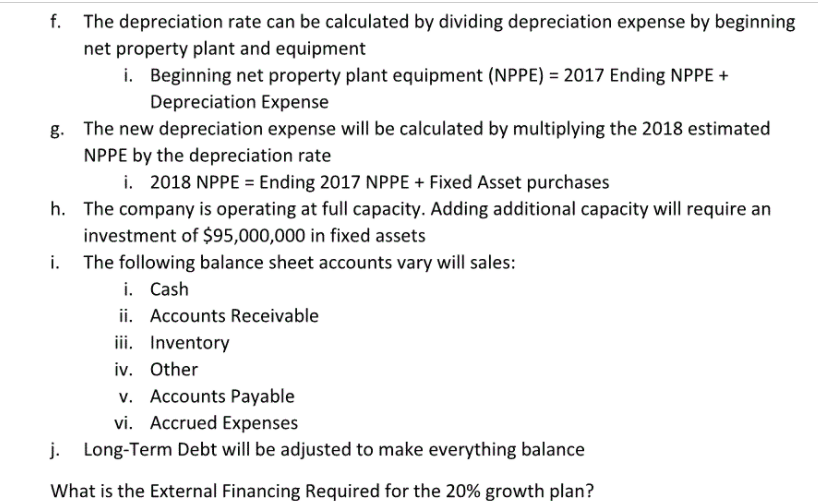

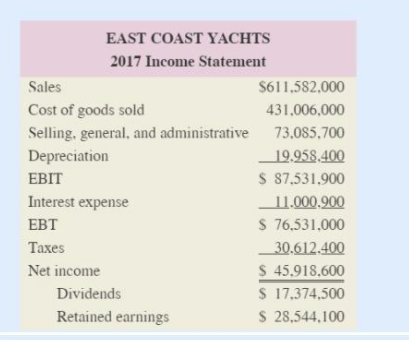

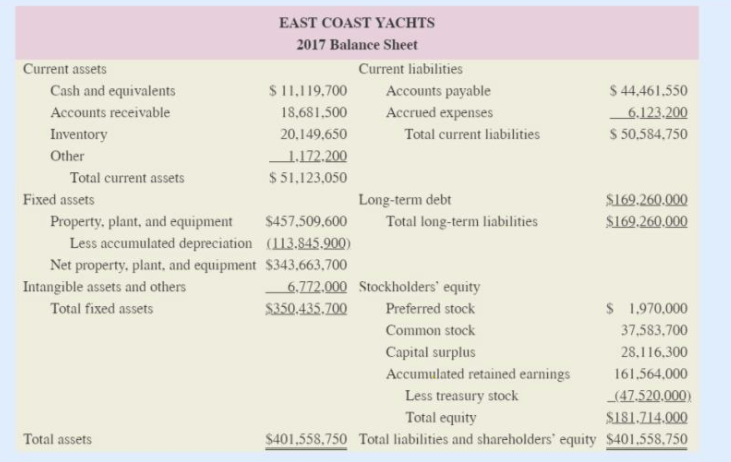

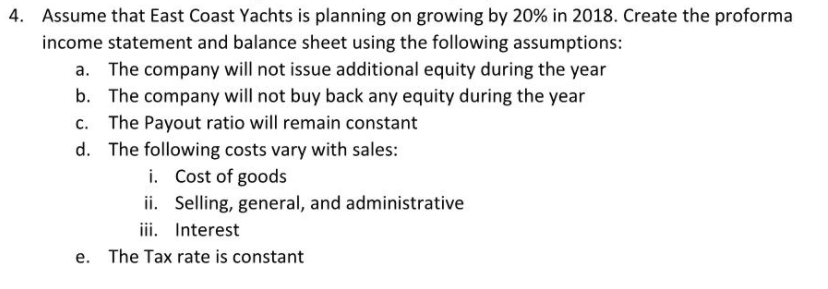

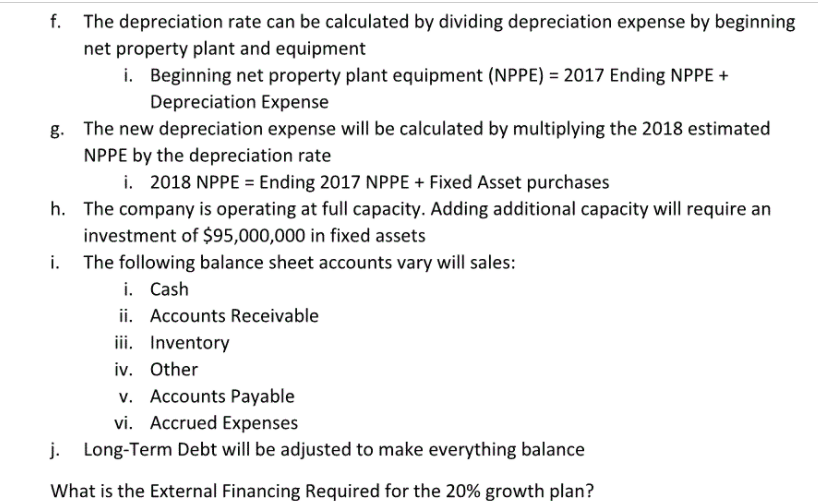

EAST COAST YACHTS 2017 Income Statement Sales $611.582.000 Cost of goods sold 431,006,000 Selling, general, and administrative 73.085.700 Depreciation 19.958.400 EBIT $ 87,531.900 Interest expense _11.000,900 EBT $ 76,531,000 Taxes 30.612.400 Net income $ 45.918.600 Dividends $ 17.374.500 Retained earnings $ 28,544.100 EAST COAST YACHTS 2017 Balance Sheet Current assets Current liabilities Cash and equivalents $ 11,119.700 Accounts payable $ 44.461.550 Accounts receivable 18.681,500 Accrued expenses 6.123.200 Inventory 20.149.650 Total current liabilities S 50.584.750 Other _1.172.200 Total current assets $ 51,123.050 Fixed assets Long-term debt $169.260.000 Property, plant, and equipment $457,509,600 Total long-term liabilities $169.260.000 Less accumulated depreciation (113.845.900) Net property, plant, and equipment $343,663,700 Intangible assets and others 6.772.000 Stockholders' equity Total fixed assets $350.435.700 Preferred stock $ 1.970,000 Common stock 37,583.700 Capital surplus 28.116.300 Accumulated retained earnings 161.564.000 Less treasury stock _(47.520.000 Total equity $181.714.000 Total assets $401,558.750 Total liabilities and shareholders' equity $401.558.750 4. Assume that East Coast Yachts is planning on growing by 20% in 2018. Create the proforma income statement and balance sheet using the following assumptions: a. The company will not issue additional equity during the year b. The company will not buy back any equity during the year C. The Payout ratio will remain constant d. The following costs vary with sales: i. Cost of goods ii. Selling, general, and administrative iii. Interest e. The Tax rate is constant f. The depreciation rate can be calculated by dividing depreciation expense by beginning net property plant and equipment i. Beginning net property plant equipment (NPPE) = 2017 Ending NPPE + Depreciation Expense g. The new depreciation expense will be calculated by multiplying the 2018 estimated NPPE by the depreciation rate i. 2018 NPPE = Ending 2017 NPPE + Fixed Asset purchases h. The company is operating at full capacity. Adding additional capacity will require an investment of $95,000,000 in fixed assets i. The following balance sheet accounts vary will sales: i. Cash ii. Accounts Receivable iii. Inventory iv. Other V. Accounts Payable vi. Accrued Expenses j. Long-Term Debt will be adjusted to make everything balance What is the External Financing Required for the 20% growth plan