Answered step by step

Verified Expert Solution

Question

1 Approved Answer

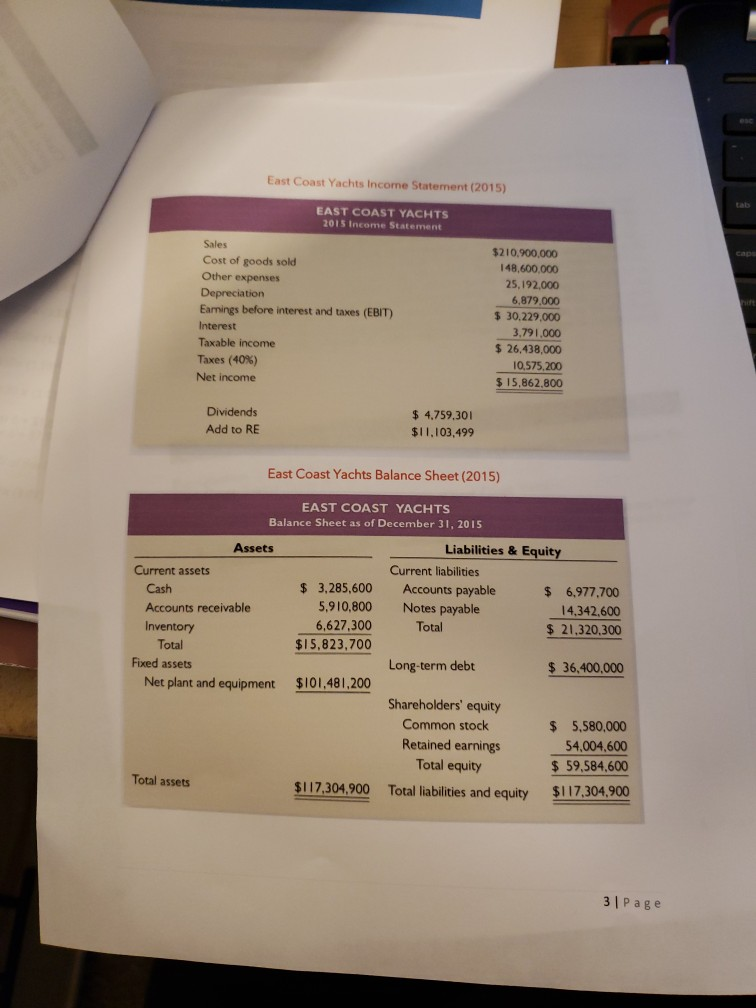

East Coast Yachts Income Statement (2015) cape EAST COAST YACHTS 2015 Income Statement Sales Cost of goods sold Other expenses Depreciation Earnings before interest and

East Coast Yachts Income Statement (2015) cape EAST COAST YACHTS 2015 Income Statement Sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest Taxable income Taxes (40%) Net income $210,900,000 148,600,000 25,192,000 6,879.000 $ 30.229.000 3.791.000 $ 26,438,000 10.575,200 $ 15,862.800 Dividends Add to RE $ 4.759,301 $11,103,499 East Coast Yachts Balance Sheet (2015) EAST COAST YACHTS Balance Sheet as of December 31, 2015 Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment $ 3.285,600 5,910,800 6,627,300 $15,823,700 Liabilities & Equity Current liabilities Accounts payable $ 6,977.700 Notes payable 14,342,600 Total $ 21,320,300 Long-term debt $ 36,400,000 $101,481,200 Shareholders' equity Common stock Retained earnings Total equity Total liabilities and equity $ 5,580,000 54,004,600 $ 59,584,600 Total assets $117,304.900 $117,304,900 3 Page East Coast Yachts is planning a growth rate of 20%. What is the External Financing Needed when sales grow At A rate of 20%? Derive the Pro-Forma Income Statement and Balance Sheet. To find the External Financing Needed, assume that costs and other expenses vary directly with sales, but depreciation and interest expense are not affected by any change in the sales' level. It takes time for the initial investment to depreciate, so, to simplify the analysis, we are going to assume that depreciation is unaffected by changes in sales Similarly, the payment to bondholders is fixed in any period. Further, Assume that all assets (i.e., current and fixed) vary directly with sales. Regarding the current liabilities, since we are considering a regular growth rate of assets, only accounts payable respond to a change in sales. Finally, use the same assumptions used in class for long-term debt and equity. More in detail, assume that long-term liabilities do not change with a change in sales as they strongly depend upon managerial decisions that take time to be approved and thus be effective. The change in equity will be driven by the change in accumulated retained earnings. QUESTION 3 - SUSTAINABLE GROWTIL RATE 20 POINTS For Question 3, consider the 2015 Income Statement and Balance Sheet information for East Coast Yachts (page 3). 1. Calculate the sustainable growth rate of East Coast Yachts. 2. Calculate the External Financing Needed (EFN) and prepare the Pro Forma Income Statement and Balance Sheet assuming sales grow at the sustainable growth rate. 4 Page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started