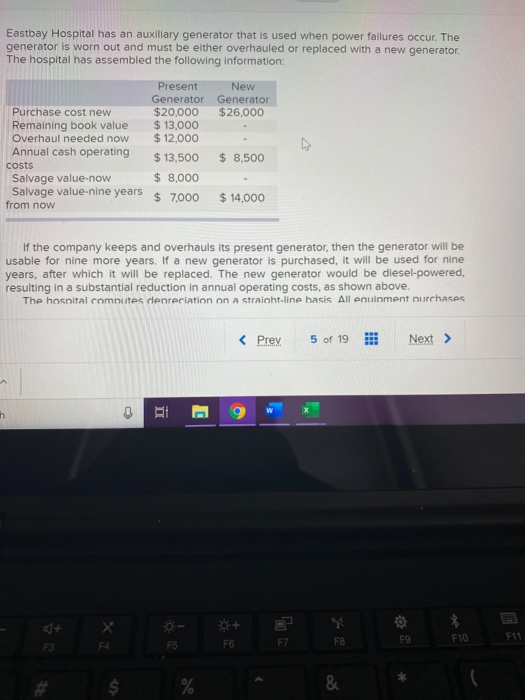

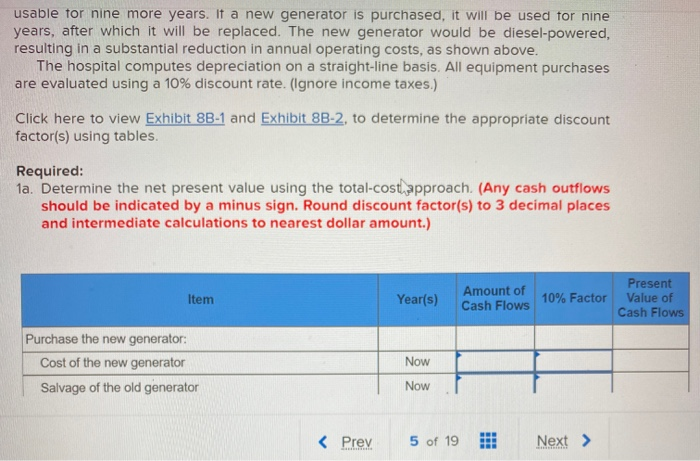

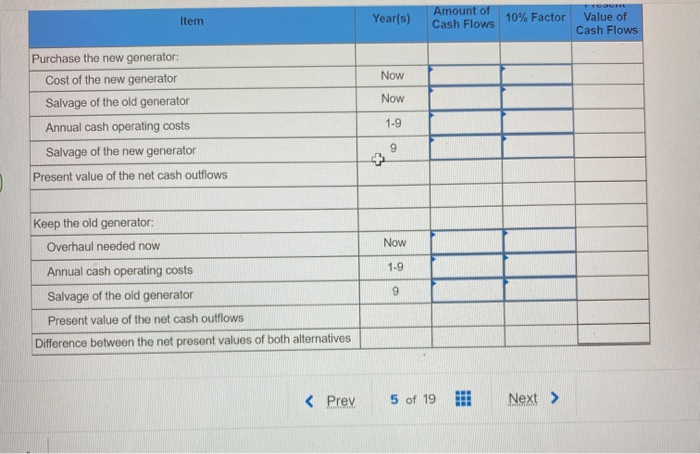

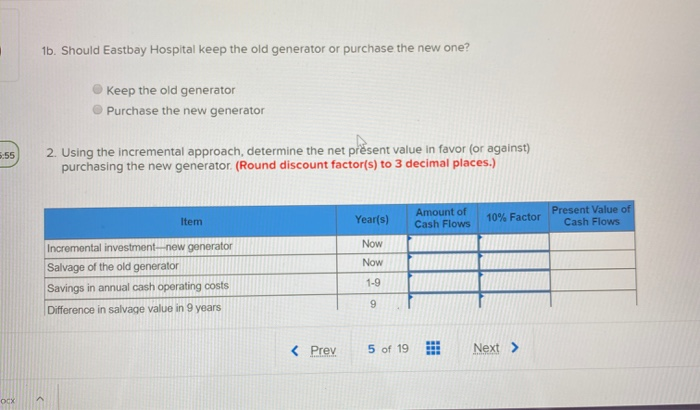

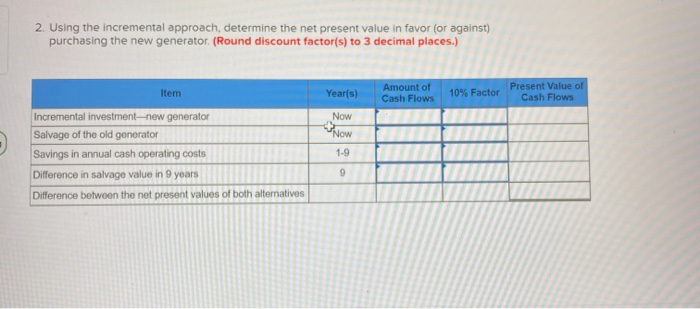

Eastbay Hospital has an auxiliary generator that is used when power failures occur. The generator is worn out and must be either overhauled or replaced with a new generator The hospital has assembled the following information: Present New Generator Generator Purchase cost new $20,000 $26.000 Remaining book value $ 13,000 Overhaul needed now $ 12,000 Annual cash operating $ 13,500 $ 8,500 costs Salvage value-now $ 8,000 Salvage value-nine years $ 7,000 $14,000 from now If the company keeps and overhauls its present generator, then the generator will be usable for nine more years. If a new generator is purchased, it will be used for nine years, after which it will be replaced. The new generator would be diesel-powered, resulting in a substantial reduction in annual operating costs, as shown above. The hospital computes depreciation on a straight-line basis All Pouinment purchases F4 F 5F6 F7 F8 F9 F10 F11 usable for nine more years. It a new generator is purchased, it will be used for nine years, after which it will be replaced. The new generator would be diesel-powered, resulting in a substantial reduction in annual operating costs, as shown above. The hospital computes depreciation on a straight-line basis. All equipment purchases are evaluated using a 10% discount rate. (Ignore income taxes.) Click here to view Exhibit 8B-1 and Exhibit 8B-2, to determine the appropriate discount factor(s) using tables. Required: 1a. Determine the net present value using the total-cost approach. (Any cash outflows should be indicated by a minus sign. Round discount factor(s) to 3 decimal places and intermediate calculations to nearest dollar amount.) Item Year(s) Amount of Cash Flows 10% Factor Present Value of Cash Flows Purchase the new generator: Cost of the new generator Salvage of the old generator Now Now Item Year(s) Amount of Cash Flows 10% Factor Value of Cash Flows Now Now Purchase the new generator: Cost of the new generator Salvage of the old generator Annual cash operating costs Salvage of the new generator Present value of the net cash outflows 1-9 XO Now 1-9 Keep the old generator: Overhaul needed now Annual cash operating costs Salvage of the old generator Present value of the net cash outflows Difference between the not present values of both alternatives 1b. Should Eastbay Hospital keep the old generator or purchase the new one? Keep the old generator Purchase the new generator 55 2. Using the incremental approach, determine the net prsent value in favor (or against) purchasing the new generator (Round discount factor(s) to 3 decimal places.) Present Value of Item Year(s) Amount of Cash Flows 10% Factor Cash Flows Now Now Incremental investment-new generator Salvage of the old generator Savings in annual cash operating costs Difference in salvage value in 9 years 1-9 2. Using the incremental approach, determine the net present value in favor (or against) purchasing the new generator. (Round discount factor(s) to 3 decimal places.) Amount of Yearls) Item 109. Factor Present Value of Amount of Cash Flows 10% Factor Cash Flows Now NOW Incremental investment-new generator Salvage of the old generator Savings in annual cash operating costs Difference in salvage value in 9 years Difference between the net present values of both alternatives 1-9