Question

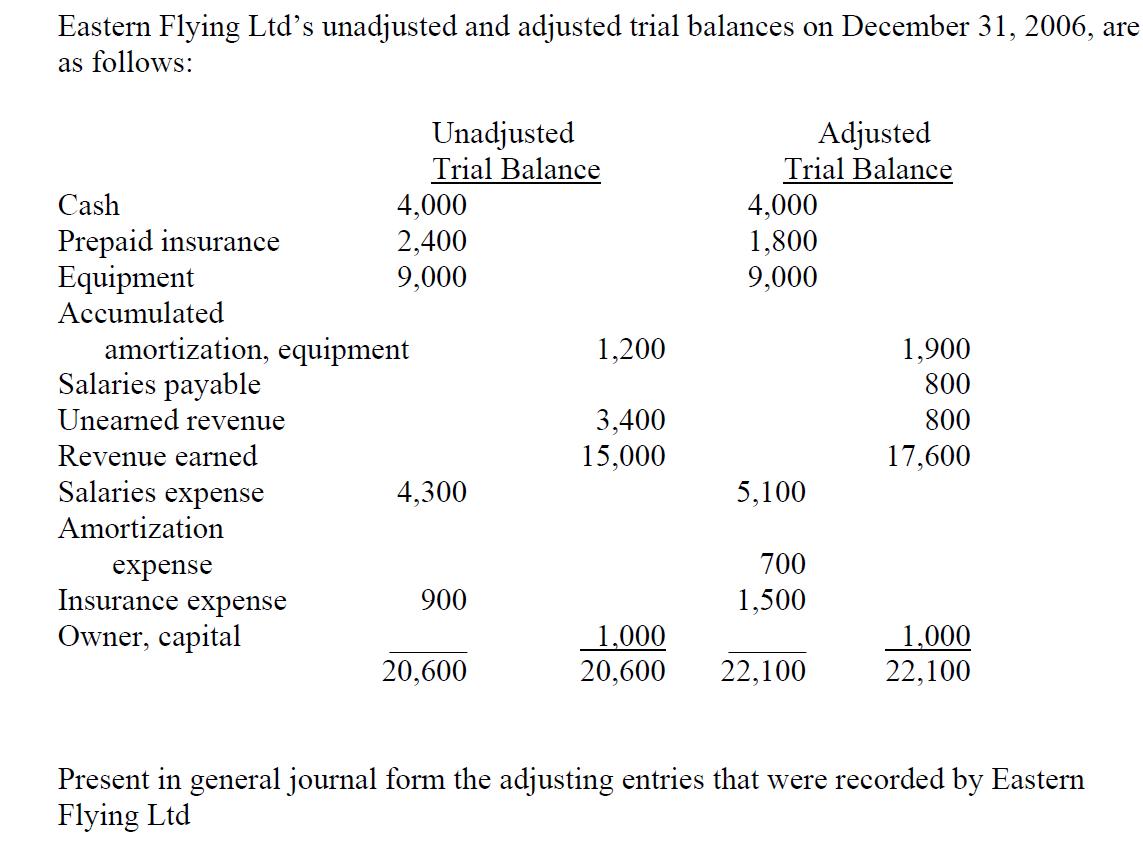

Eastern Flying Ltd's unadjusted and adjusted trial balances on December 31, 2006, are as follows: Cash Prepaid insurance Equipment Accumulated amortization, equipment Salaries payable

Eastern Flying Ltd's unadjusted and adjusted trial balances on December 31, 2006, are as follows: Cash Prepaid insurance Equipment Accumulated amortization, equipment Salaries payable Unearned revenue Revenue earned Salaries expense Amortization expense Insurance expense Owner, capital Unadjusted Trial Balance 4,000 2,400 9,000 4,300 900 20,600 1,200 3,400 15,000 Adjusted Trial Balance 4,000 1,800 9,000 5,100 700 1,500 1,000 20,600 22,100 1,900 800 800 17,600 1,000 22,100 Present in general journal form the adjusting entries that were recorded by Eastern Flying Ltd

Step by Step Solution

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

General Journal Account Name Debit Credit Insurance Expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume I

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

16th Canadian edition

978-1260305821

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App