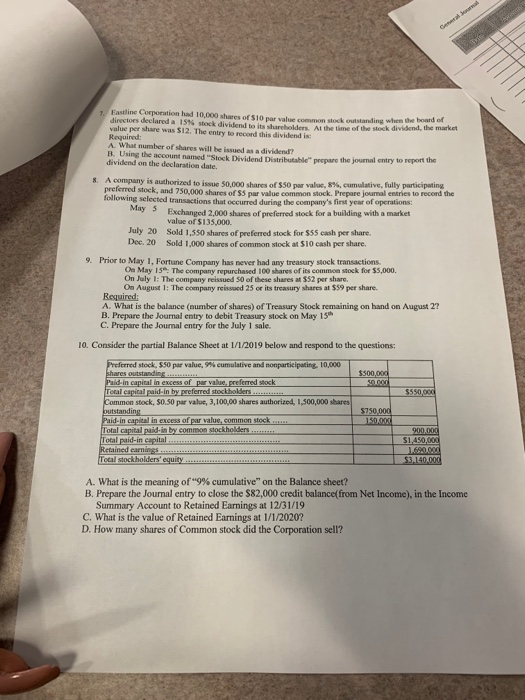

Eastline Corporation had 10.000 shares of S10 valamon scoutstanding when the board directors declared a 15% stock dividend to its shareholders. All the time of the stock dividend, the market value per share was $12. The entry to record this dividend is Required: A What number of shares will be issued as a dividend? B. Using the account named "Stock Dividend Distributable prepare the journal entry to report the dividend on the declaration date. 8. A company is authorized to issue 50.000 shares of 550 per value, 8%, cumulative, fully participating preferred stock, and 750,000 shares of $5 par value common stock. Prepare journal entries to record the following selected transactions that occurred during the company's first year of operations: May 3 Exchanged 2,000 shares of preferred stock for a building with a market value of $135.000 July 20 Sold 1.350 shares of preferred stock for $55 cash per share. Dec. 20 Sold 1,000 shares of common stock at $10 cash per share. 9. Prior to May 1, Fortune Company has never had any treasury stock transactions. On May 15". The company repurchased 100 shares of its common stock for $5,000 On July 1: The company reissued 50 of these shares at $52 per share. On August 1: The company reissued 25 or its treasury shares at 559 per share. Required: A. What is the balance (number of shares) of Treasury Stock remaining on hand on August 2? B. Prepare the Journal entry to debit Treasury stock on May 15 C. Prepare the Journal entry for the July 1 sale. 10. Consider the partial Balance Sheet at 1/1/2019 below and respond to the questions: $500,000 Preferred stock, S50 per value, 9% cumulative and nonparticipating 10.000 Shares outstanding .... Pald-in capital in excess of par value, preferred stock Total capital paid-in by preferred stockholders ..... Common stock, 50.50 par value, 3.100,00 shares authorized, 1,500,000 shares $550,000 outstandi $750.000 150.000 Paid-in capital in excess of par value, common stock ..... Total capital paid in by common stockholders ......... Total paid-in capital... .... .... Retained earnings ............................................. Total stockholders equity. 900.000 $1,450,000 53.140.000 A. What is the meaning of "9% cumulative" on the Balance sheet? B. Prepare the Journal entry to close the $82,000 credit balance(from Net Income), in the Income Summary Account to Retained Earnings at 12/31/19 C. What is the value of Retained Earnings at 1/1/2020? D. How many shares of Common stock did the Corporation sell