Answered step by step

Verified Expert Solution

Question

1 Approved Answer

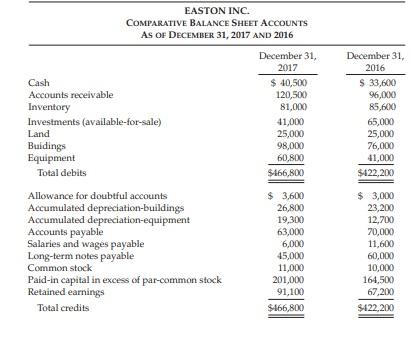

. EASTON INC. COMPARATIVE BALANCE SHEET ACCOUNTS AS OF DECEMBER 31, 2017 AND 2016 Cash Accounts receivable. Inventory Investments (available-for-sale). Land Buidings Equipment Total debits

.

EASTON INC. COMPARATIVE BALANCE SHEET ACCOUNTS AS OF DECEMBER 31, 2017 AND 2016 Cash Accounts receivable. Inventory Investments (available-for-sale). Land Buidings Equipment Total debits Allowance for doubtful accounts Accumulated depreciation-buildings Accumulated depreciation-equipment Accounts payable Salaries and wages payable Long-term notes payable Common stock Paid-in capital in excess of par-common stock Retained earnings Total credits December 31, 2017 $ 40,500 120,500 81,000 41,000 25,000 98,000 60,800 $466,800 $ 3,600 26,800 19,300 63,000 6,000 45,000 11,000 201,000 91,100 $466,800 December 31, 2016 $ 33,600 96,000 85,600 65,000 25,000 76,000 41,000 $422,200 $ 3,000 23,200 12,700 70,000 11,600 60,000 10,000 164,500 67,200 $422,200

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Cash flows from Operating Activities Cash received from customers Less Cash payments for Cash paid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started