Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Easton Realty Company Sam Easton started out as a real estate agent in Atlanta ten years ago. After working two years for a national real

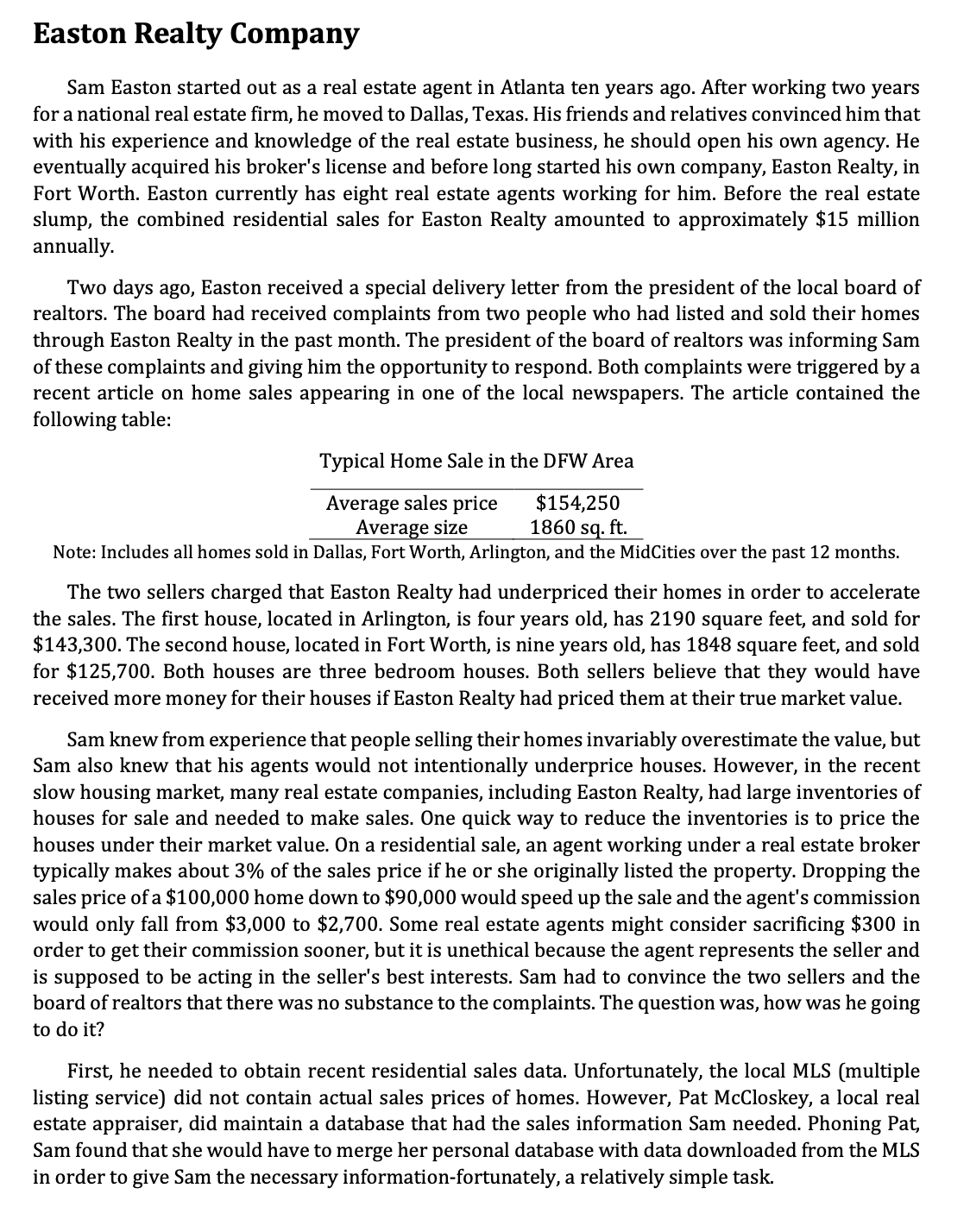

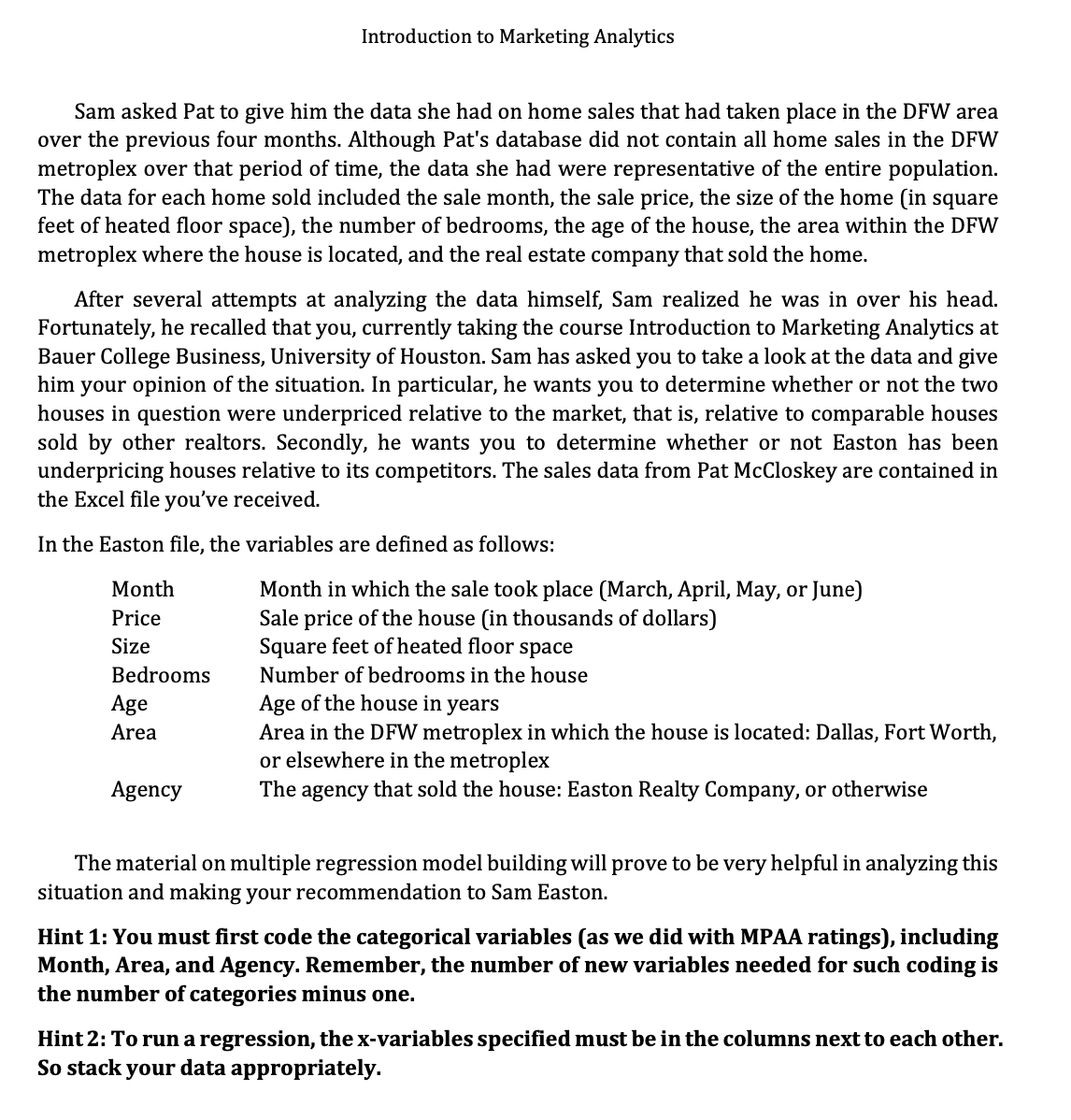

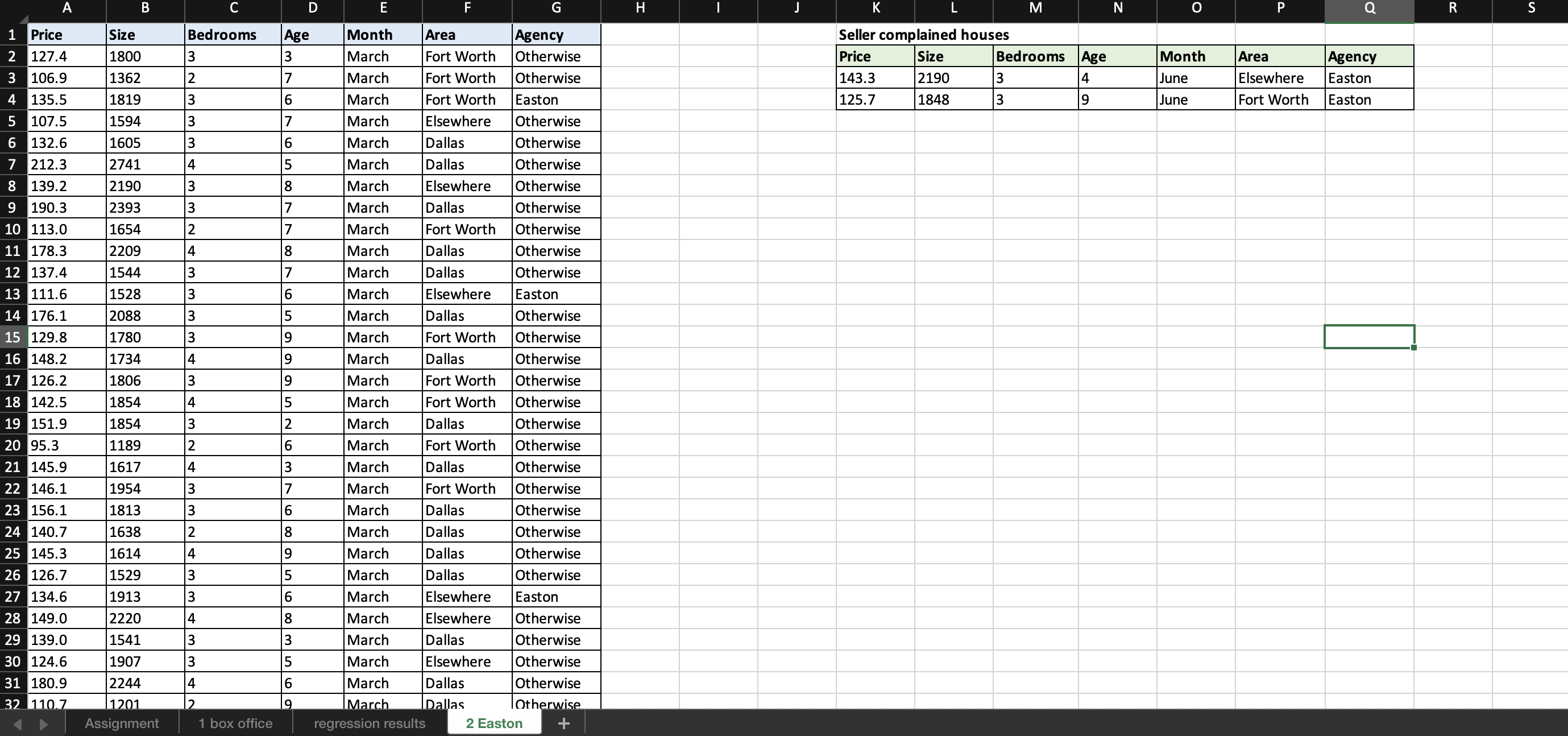

Easton Realty Company Sam Easton started out as a real estate agent in Atlanta ten years ago. After working two years for a national real estate firm, he moved to Dallas, Texas. His friends and relatives convinced him that with his experience and knowledge of the real estate business, he should open his own agency. He eventually acquired his broker's license and before long started his own company, Easton Realty, in Fort Worth. Easton currently has eight real estate agents working for him. Before the real estate slump, the combined residential sales for Easton Realty amounted to approximately $15 million annually. Two days ago, Easton received a special delivery letter from the president of the local board of realtors. The board had received complaints from two people who had listed and sold their homes through Easton Realty in the past month. The president of the board of realtors was informing Sam of these complaints and giving him the opportunity to respond. Both complaints were triggered by a recent article on home sales appearing in one of the local newspapers. The article contained the following table: Note: Includes all homes sold in Dallas, Fort Worth, Arlington, and the MidCities over the past 12 months. The two sellers charged that Easton Realty had underpriced their homes in order to accelerate the sales. The first house, located in Arlington, is four years old, has 2190 square feet, and sold for $143,300. The second house, located in Fort Worth, is nine years old, has 1848 square feet, and sold for $125,700. Both houses are three bedroom houses. Both sellers believe that they would have received more money for their houses if Easton Realty had priced them at their true market value. Sam knew from experience that people selling their homes invariably overestimate the value, but Sam also knew that his agents would not intentionally underprice houses. However, in the recent slow housing market, many real estate companies, including Easton Realty, had large inventories of houses for sale and needed to make sales. One quick way to reduce the inventories is to price the houses under their market value. On a residential sale, an agent working under a real estate broker typically makes about 3% of the sales price if he or she originally listed the property. Dropping the sales price of a $100,000 home down to $90,000 would speed up the sale and the agent's commission would only fall from $3,000 to $2,700. Some real estate agents might consider sacrificing $300 in order to get their commission sooner, but it is unethical because the agent represents the seller and is supposed to be acting in the seller's best interests. Sam had to convince the two sellers and the board of realtors that there was no substance to the complaints. The question was, how was he going to do it? First, he needed to obtain recent residential sales data. Unfortunately, the local MLS (multiple listing service) did not contain actual sales prices of homes. However, Pat McCloskey, a local real estate appraiser, did maintain a database that had the sales information Sam needed. Phoning Pat, Sam found that she would have to merge her personal database with data downloaded from the MLS in order to give Sam the necessary information-fortunately, a relatively simple task. Introduction to Marketing Analytics Sam asked Pat to give him the data she had on home sales that had taken place in the DFW area over the previous four months. Although Pat's database did not contain all home sales in the DFW metroplex over that period of time, the data she had were representative of the entire population. The data for each home sold included the sale month, the sale price, the size of the home (in square feet of heated floor space), the number of bedrooms, the age of the house, the area within the DFW metroplex where the house is located, and the real estate company that sold the home. After several attempts at analyzing the data himself, Sam realized he was in over his head. Fortunately, he recalled that you, currently taking the course Introduction to Marketing Analytics at Bauer College Business, University of Houston. Sam has asked you to take a look at the data and give him your opinion of the situation. In particular, he wants you to determine whether or not the two houses in question were underpriced relative to the market, that is, relative to comparable houses sold by other realtors. Secondly, he wants you to determine whether or not Easton has been underpricing houses relative to its competitors. The sales data from Pat McCloskey are contained in the Excel file you've received. In the Easton file, the variables are defined as follows: The material on multiple regression model building will prove to be very helpful in analyzing this situation and making your recommendation to Sam Easton. Hint 1: You must first code the categorical variables (as we did with MPAA ratings), including Month, Area, and Agency. Remember, the number of new variables needed for such coding is the number of categories minus one. Hint 2: To run a regression, the x-variables specified must be in the columns next to each other. So stack your data appropriately. Seller complained houses \begin{tabular}{|l|l|l|l|l|l|l|} \hline Price & Size & Bedrooms & Age & Month & Area & Agency \\ \hline 143.3 & 2190 & 3 & 4 & June & Elsewhere & Easton \\ \hline 125.7 & 1848 & 3 & 9 & June & Fort Worth & Easton \\ \hline \end{tabular} Easton Realty Company Sam Easton started out as a real estate agent in Atlanta ten years ago. After working two years for a national real estate firm, he moved to Dallas, Texas. His friends and relatives convinced him that with his experience and knowledge of the real estate business, he should open his own agency. He eventually acquired his broker's license and before long started his own company, Easton Realty, in Fort Worth. Easton currently has eight real estate agents working for him. Before the real estate slump, the combined residential sales for Easton Realty amounted to approximately $15 million annually. Two days ago, Easton received a special delivery letter from the president of the local board of realtors. The board had received complaints from two people who had listed and sold their homes through Easton Realty in the past month. The president of the board of realtors was informing Sam of these complaints and giving him the opportunity to respond. Both complaints were triggered by a recent article on home sales appearing in one of the local newspapers. The article contained the following table: Note: Includes all homes sold in Dallas, Fort Worth, Arlington, and the MidCities over the past 12 months. The two sellers charged that Easton Realty had underpriced their homes in order to accelerate the sales. The first house, located in Arlington, is four years old, has 2190 square feet, and sold for $143,300. The second house, located in Fort Worth, is nine years old, has 1848 square feet, and sold for $125,700. Both houses are three bedroom houses. Both sellers believe that they would have received more money for their houses if Easton Realty had priced them at their true market value. Sam knew from experience that people selling their homes invariably overestimate the value, but Sam also knew that his agents would not intentionally underprice houses. However, in the recent slow housing market, many real estate companies, including Easton Realty, had large inventories of houses for sale and needed to make sales. One quick way to reduce the inventories is to price the houses under their market value. On a residential sale, an agent working under a real estate broker typically makes about 3% of the sales price if he or she originally listed the property. Dropping the sales price of a $100,000 home down to $90,000 would speed up the sale and the agent's commission would only fall from $3,000 to $2,700. Some real estate agents might consider sacrificing $300 in order to get their commission sooner, but it is unethical because the agent represents the seller and is supposed to be acting in the seller's best interests. Sam had to convince the two sellers and the board of realtors that there was no substance to the complaints. The question was, how was he going to do it? First, he needed to obtain recent residential sales data. Unfortunately, the local MLS (multiple listing service) did not contain actual sales prices of homes. However, Pat McCloskey, a local real estate appraiser, did maintain a database that had the sales information Sam needed. Phoning Pat, Sam found that she would have to merge her personal database with data downloaded from the MLS in order to give Sam the necessary information-fortunately, a relatively simple task. Introduction to Marketing Analytics Sam asked Pat to give him the data she had on home sales that had taken place in the DFW area over the previous four months. Although Pat's database did not contain all home sales in the DFW metroplex over that period of time, the data she had were representative of the entire population. The data for each home sold included the sale month, the sale price, the size of the home (in square feet of heated floor space), the number of bedrooms, the age of the house, the area within the DFW metroplex where the house is located, and the real estate company that sold the home. After several attempts at analyzing the data himself, Sam realized he was in over his head. Fortunately, he recalled that you, currently taking the course Introduction to Marketing Analytics at Bauer College Business, University of Houston. Sam has asked you to take a look at the data and give him your opinion of the situation. In particular, he wants you to determine whether or not the two houses in question were underpriced relative to the market, that is, relative to comparable houses sold by other realtors. Secondly, he wants you to determine whether or not Easton has been underpricing houses relative to its competitors. The sales data from Pat McCloskey are contained in the Excel file you've received. In the Easton file, the variables are defined as follows: The material on multiple regression model building will prove to be very helpful in analyzing this situation and making your recommendation to Sam Easton. Hint 1: You must first code the categorical variables (as we did with MPAA ratings), including Month, Area, and Agency. Remember, the number of new variables needed for such coding is the number of categories minus one. Hint 2: To run a regression, the x-variables specified must be in the columns next to each other. So stack your data appropriately. Seller complained houses \begin{tabular}{|l|l|l|l|l|l|l|} \hline Price & Size & Bedrooms & Age & Month & Area & Agency \\ \hline 143.3 & 2190 & 3 & 4 & June & Elsewhere & Easton \\ \hline 125.7 & 1848 & 3 & 9 & June & Fort Worth & Easton \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started