Answered step by step

Verified Expert Solution

Question

1 Approved Answer

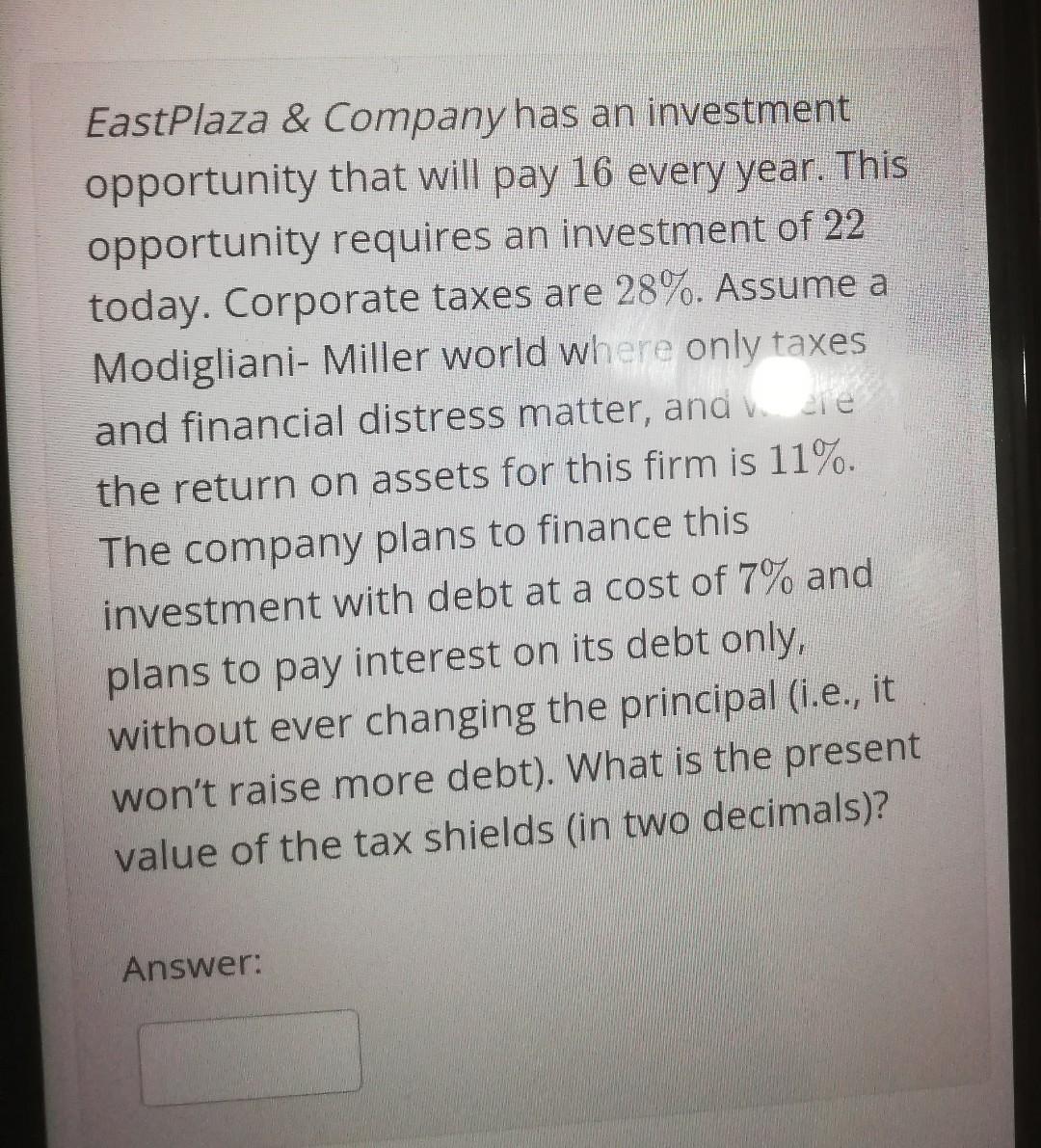

EastPlaza & Company has an investment opportunity that will pay 16 every year. This opportunity requires an investment of 22 today. Corporate taxes are 28%.

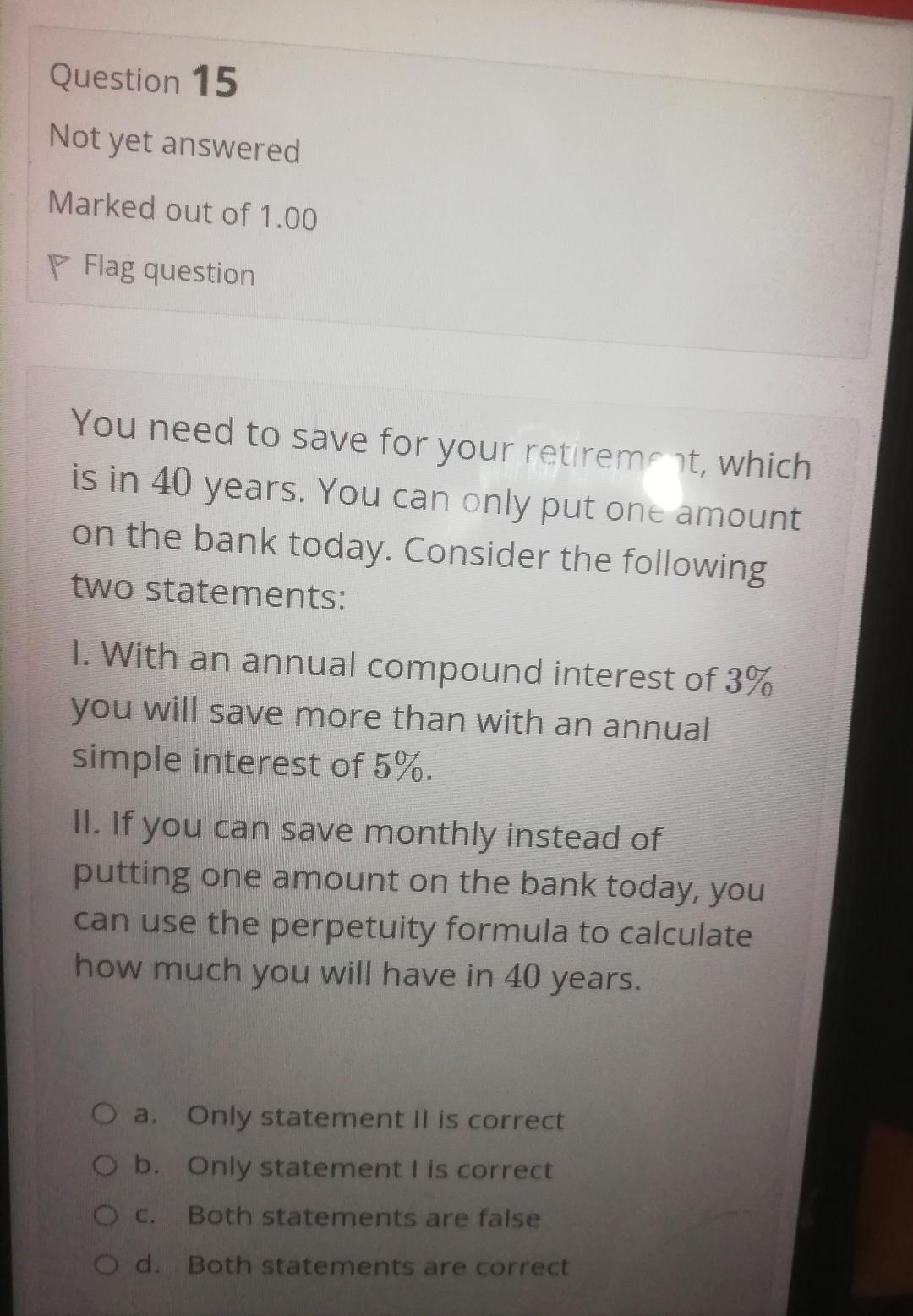

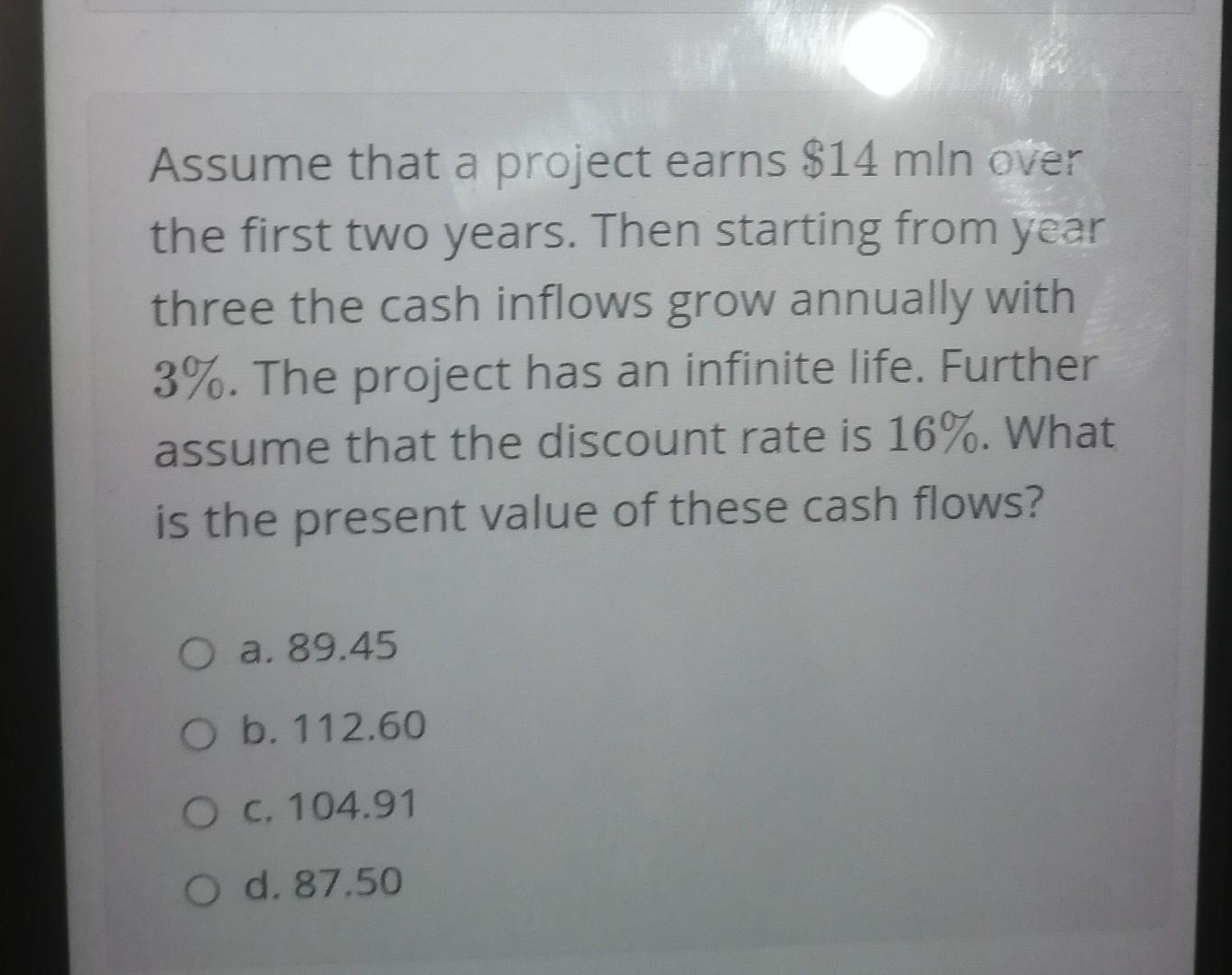

EastPlaza & Company has an investment opportunity that will pay 16 every year. This opportunity requires an investment of 22 today. Corporate taxes are 28%. Assume a Modigliani- Miller world where only taxes and financial distress matter, and v the return on assets for this firm is 11%. The company plans to finance this investment with debt at a cost of 7% and plans to pay interest on its debt only, without ever changing the principal (i.e., it won't raise more debt). What is the present value of the tax shields (in two decimals)? Answer: Question 15 Not yet answered Marked out of 1.00 P Flag question You need to save for your retiremt, which is in 40 years. You can only put one amount on the bank today. Consider the following two statements: 1. With an annual compound interest of 3% you will save more than with an annual simple interest of 5%. II. If you can save monthly instead of putting one amount on the bank today, you can use the perpetuity formula to calculate how much you will have in 40 years. O a. Only statement Il is correct O b. Only statement is correct OC. Both statements are false O d. Both statements are correct Assume that a project earns $14 mln over the first two years. Then starting from year three the cash inflows grow annually with 3%. The project has an infinite life. Further assume that the discount rate is 16%. What is the present value of these cash flows? O a. 89.45 O b. 112.60 O C. 104.91 O d. 87.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started