EASY ACCOUNTING QUESTION!!!

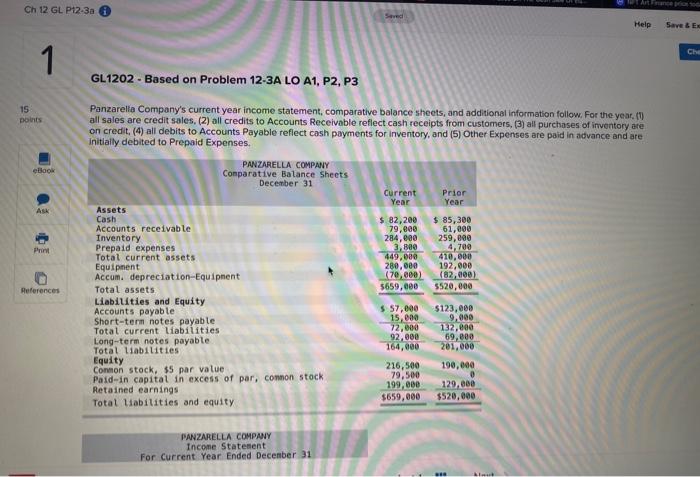

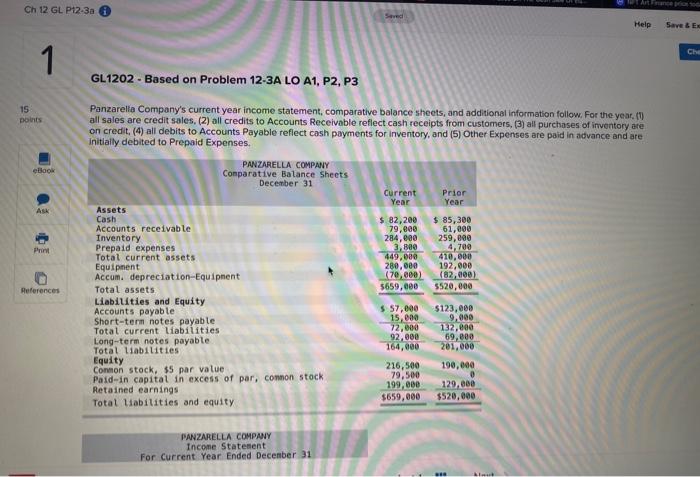

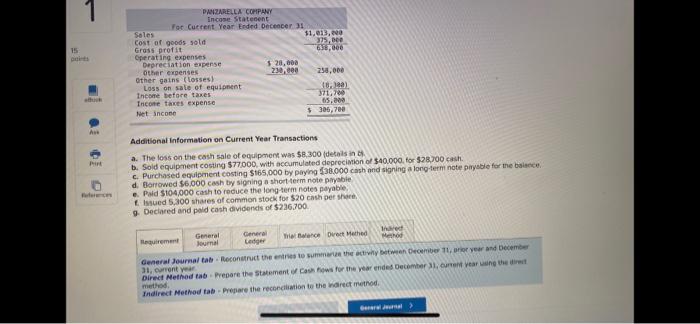

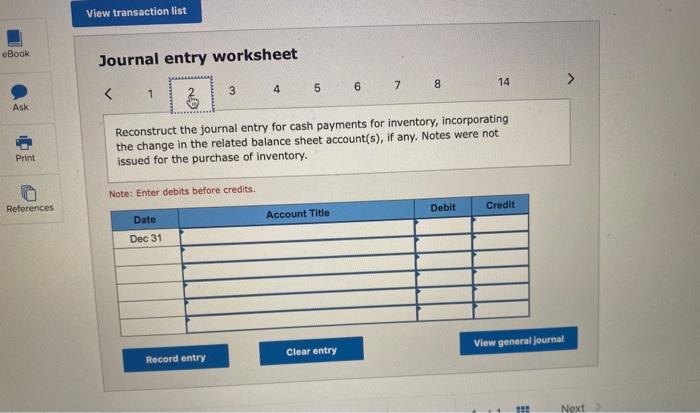

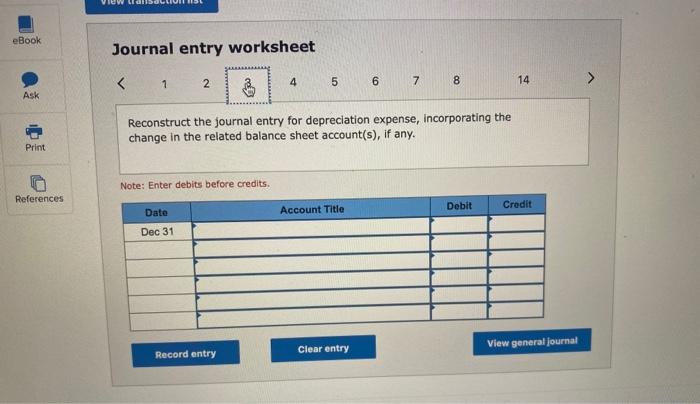

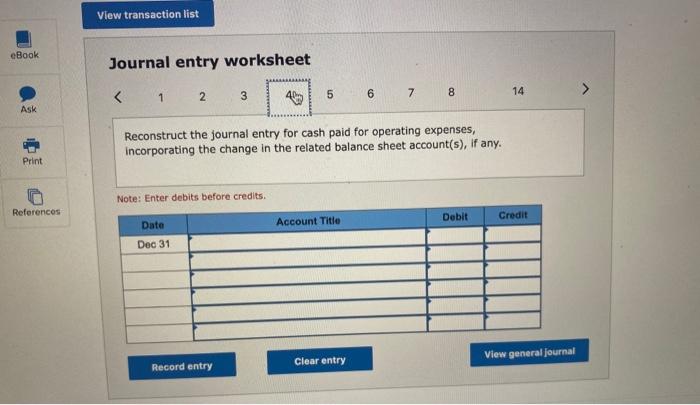

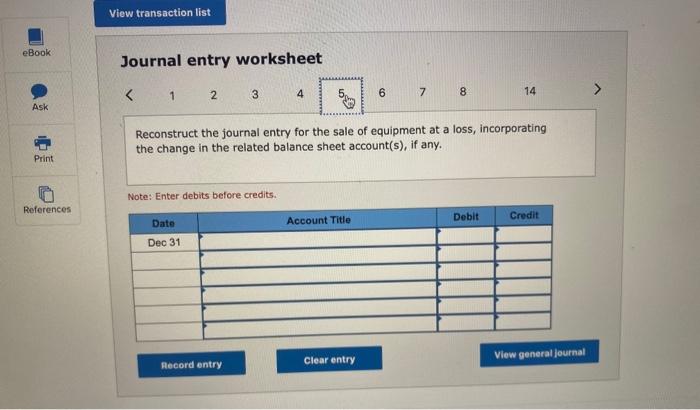

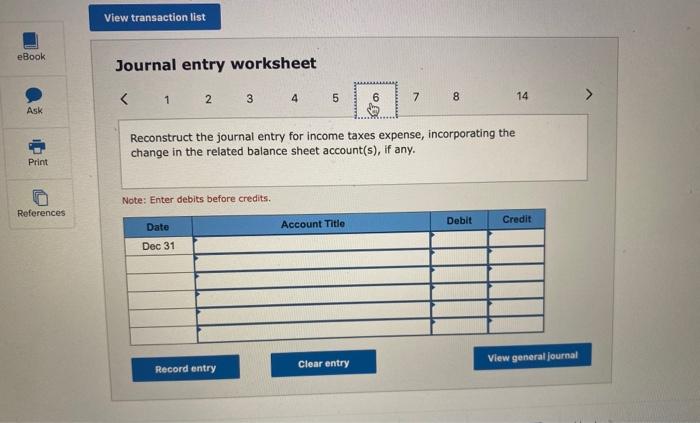

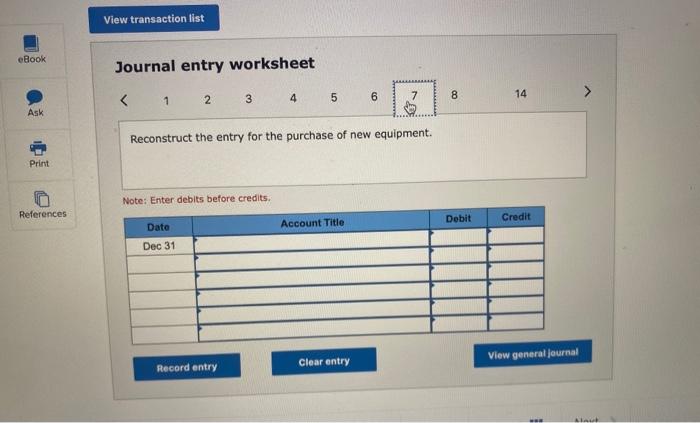

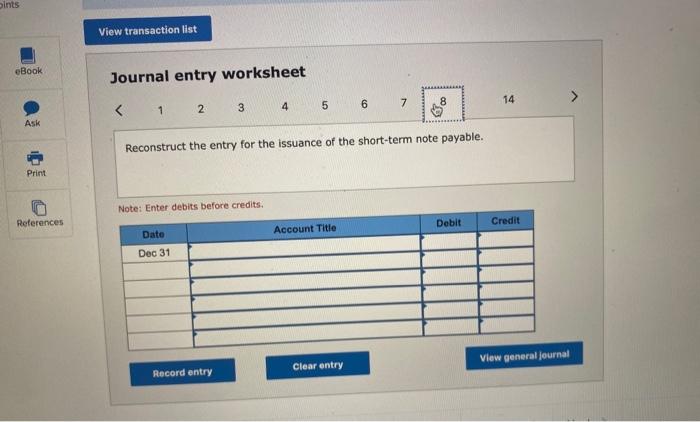

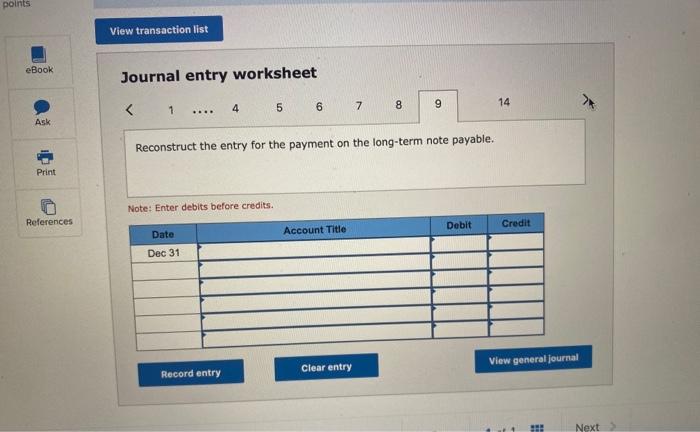

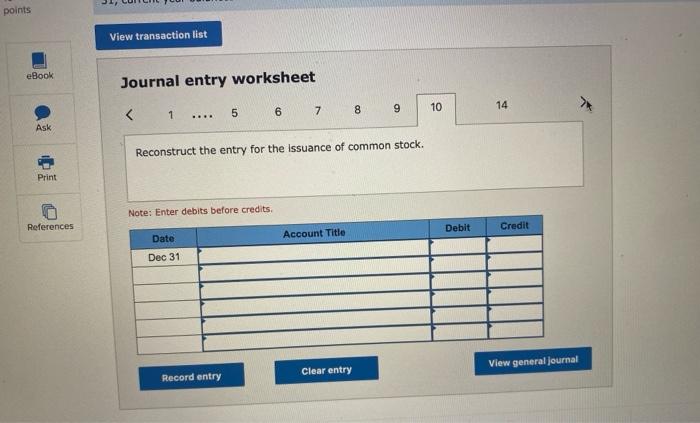

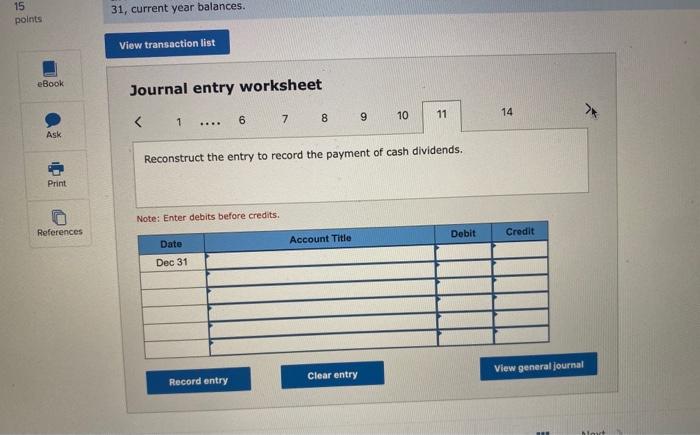

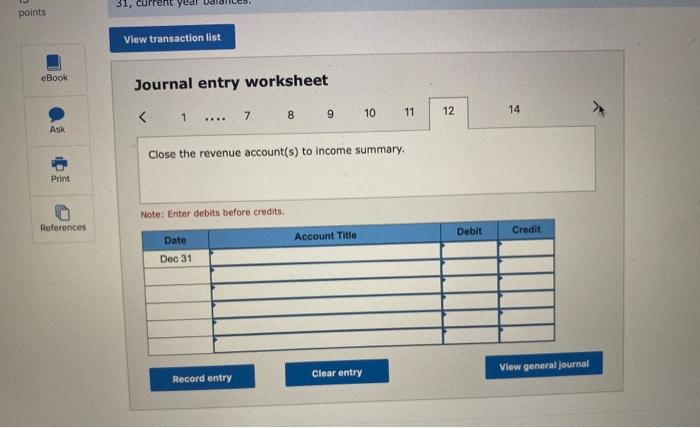

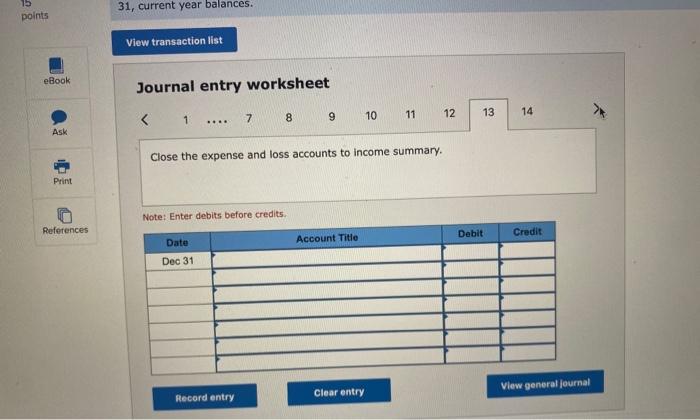

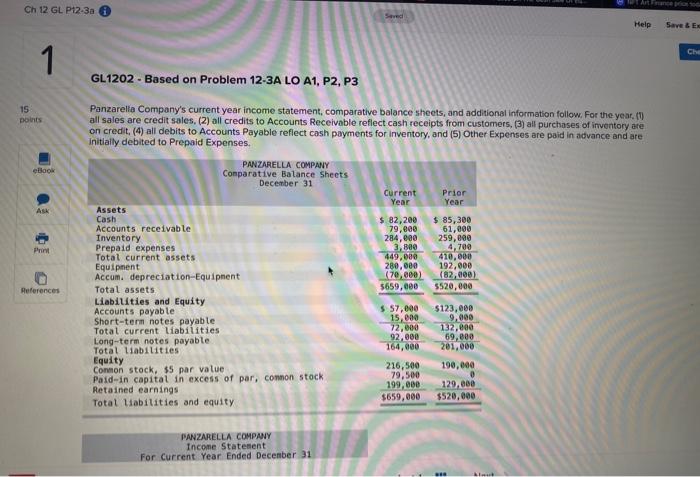

Ch 12 GL P12-3a Help Save & EL Che 1 GL1202 - Based on Problem 12-3A LO A1, P2, P3 15 points eBook ASK 3,800 Panzarella Company's current year income statement, comparative balance sheets, and additional information follow. For the year. (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are Initially debited to Prepaid Expenses. PANZARELLA COMPANY Comparative Balance Sheets December 31 Current Prior Year Year Assets Cash $ 82,200 $ 85,300 Accounts receivable 79,800 61,000 Inventory 284,000 259,000 Prepaid expenses 4,700 Total current assets 449.000 410.000 Equipment 280,000 192,000 Accum. depreciation Equipment (70,000) (82, 000) Total assets 5659,000 5520,000 Liabilities and Equity Accounts payable $ 57,000 $123,680 Short-term notes payable 15,000 9,000 Total current liabilities 72,000 132,000 Long-term notes payable 92,000 69,000 Total liabilities 164,000 201,000 Equity Common stock, $5 par value 216,500 190,000 Paid-in capital in excess of par, common stock 79,500 199,000 129,000 Retained earnings Total liabilities and equity $659,000 $520,000 References PANZARELLA COMPANY Income Statement For Current Year Ended December 31 1 15 Die DANZARELLA COMPANY incose Statenent For Current Year Ended Decocer 31 Sales $1,033,00 Cost of goods sold 32.ee Gross profit 630,000 Operating expenses Depreciation expense 5,20,000 Other expenses 230,00 250,000 Other gains (Losses) Loss on sale of equipment 18.10) Income before taxes 371,700 Income taxes expense 05.200 Net Incon $ 306,700 Art PIRE Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $8.300 details in b. Sold equipment costing $77000, with accumulated depreciation of $40,000 for $28.700 cash c. Purchased equipment costing $165,000 by paying $38.000 cash and signing a long-term note payable for the balance d. Borrowed $6.000 cash by signing a short term note payable e. Pald $104,000 cash to reduce the long-term notes payable Issued 5.300 shares of common stock for $20 cash per she 9. Declared and pold cash dividends of $236.700 General Journal General Ledger Balance Dret Mathed Ine Method General Journal tab. Reconstruct the entre to summer the activity between December 11 year and December 31, current year Direct Method tab. Prepare the statement Cashows for the year ended December 31, earn the dirt Indirect Method tab. Prepare the reconciliation to the wirect method Journal entry worksheet 1 2 3 4 5 6 7 8 14 > Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Date Account Title Debit Credit Dec 31 Record entry Clear entry View general journal 3 Ask Close the expense and loss accounts to income summary Print Note: Enter debits before credits References Debit Credit Date Account Title Dec 31 Clear entry View general journal Record entry 15 points 31, current year balances. View transaction list eBook Journal entry worksheet Trial Balance Indirect Marked 1 Next 15 points Dates: Dec 31 to: Dec 31 Unadjusted PANZARELLA COMPANY Statement of Cash Flows (Indirect Method) For Current Year Ended December 31 Cash flows from operating activities: eBook Ask Adjustments to reconcile net income to net cash provided by operating activities Print References

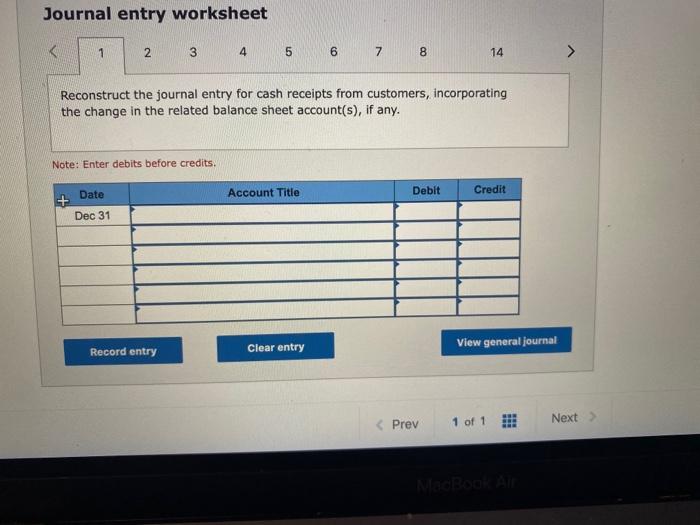

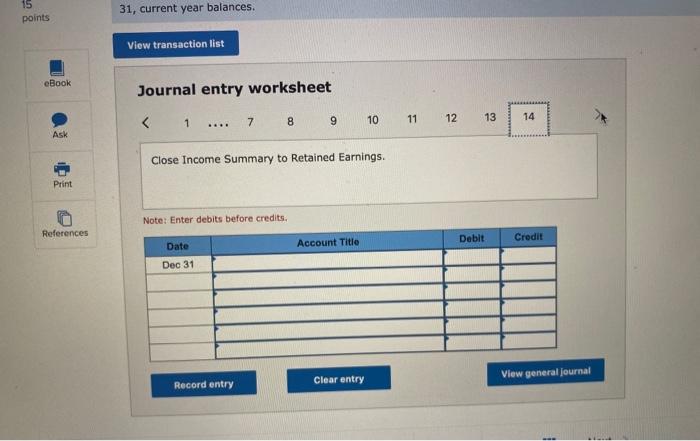

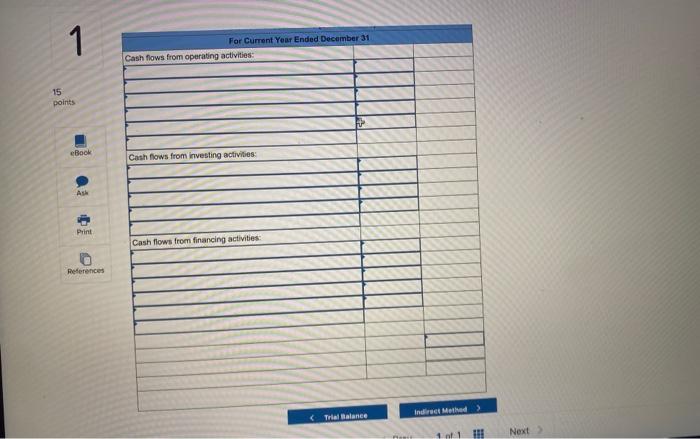

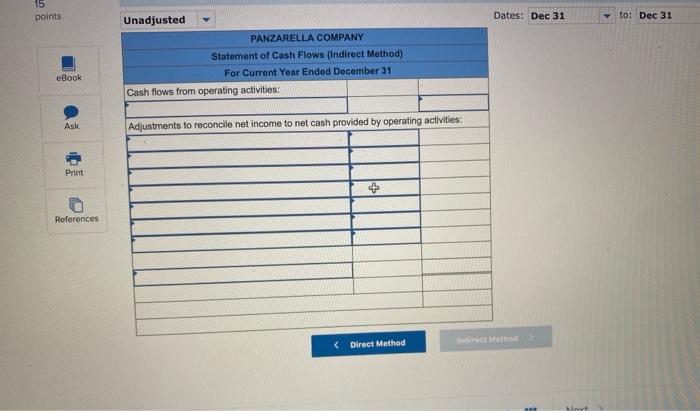

Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Date Account Title Debit Credit Dec 31 Record entry Clear entry View general journal 3 Ask Close the expense and loss accounts to income summary Print Note: Enter debits before credits References Debit Credit Date Account Title Dec 31 Clear entry View general journal Record entry 15 points 31, current year balances. View transaction list eBook Journal entry worksheet Trial Balance Indirect Marked 1 Next 15 points Dates: Dec 31 to: Dec 31 Unadjusted PANZARELLA COMPANY Statement of Cash Flows (Indirect Method) For Current Year Ended December 31 Cash flows from operating activities: eBook Ask Adjustments to reconcile net income to net cash provided by operating activities Print References