Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eat Well plc is a restaurant with operating lease commitments of 50 million per year for the next 5 years. It has a weighted average

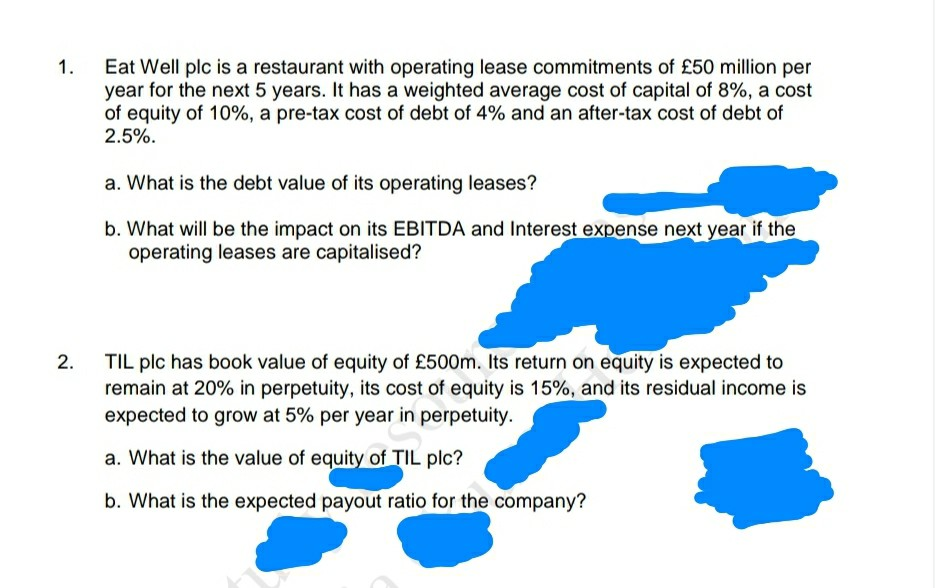

Eat Well plc is a restaurant with operating lease commitments of 50 million per year for the next 5 years. It has a weighted average cost of capital of 8%, a cost of equity of 10%, a pre-tax cost of debt of 4% and an after-tax cost of debt of 2.5%. a. What is the debt value of its operating leases? b. What will be the impact on its EBITDA and Interest expense next year if the operating leases are capitalised? 2. TIL plc has book value of equity of 500m. Its return on equity is expected to remain at 20% in perpetuity, its cost of equity is 15%, and its residual income is expected to grow at 5% per year in perpetuity. a. What is the value of equity of TIL plc? b. What is the expected payout ratio for the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started