Ebgineering Economy

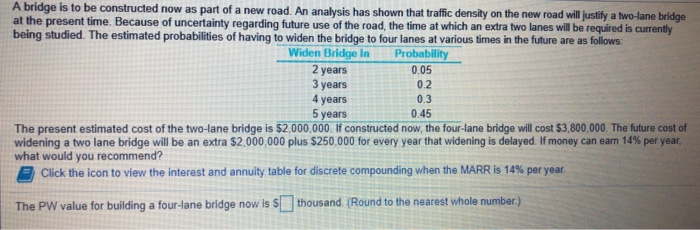

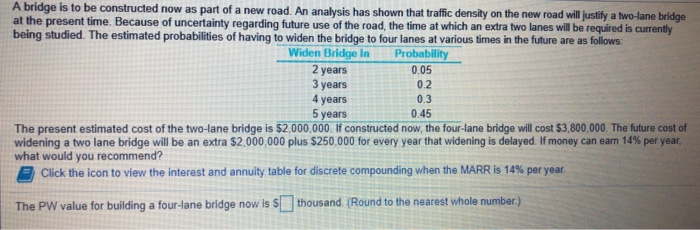

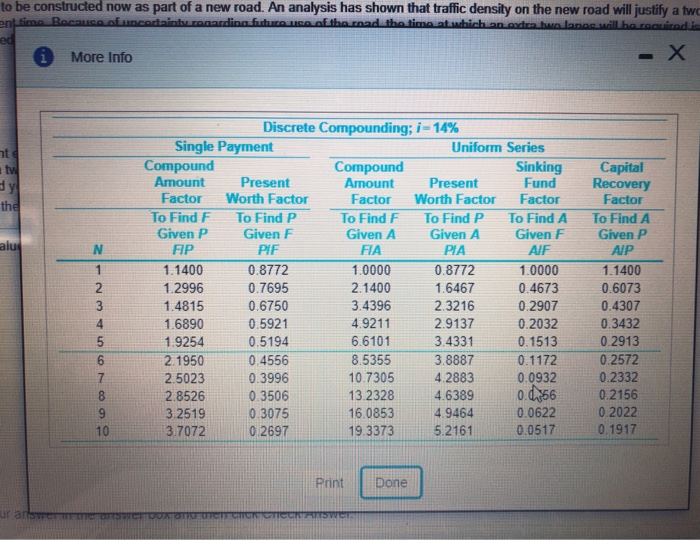

A bridge is to be constructed now as part of a new road. An analysis has shown that traffic density on the new road will justify a two-lane bridge at the present time. Because of uncertainty regarding future use of the road, the time at which an extra two lanes will be required is currently being studied. The estimated probabilities of having to widen the bridge to four lanes at various times in the future are as follows Widen Bridge in Probability 2 years 3 years 4 years 0.05 0.2 0.3 5 years 0.45 The present estimated cost of the two-lane bridge is $2,000,000. If constructed now, the four-lane bridge will cost $3,800,000. The future cost of widening a two lane bridge will be an extra $2,000 000 plus $250,000 for every year that widening is delayed. If money can earn 14% per year what would you recommend? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14 % per year The PW value for building a four-lane bridge now is Sthousand (Round to the nearest whole number.) to be constructed now as part of a new road. An analysis has shown that traffic density on the new road will justify a twc ont time Bocause.ofuncertainty ranardina.fuhura.use of the road tha timA at which an axtra bwO lanes wilLha required is ed X More Info Discrete Compounding; i-14% Single Payment Compound Amount Uniform Series t e Compound Sinking Fund Capital Recovery Factor tw d y the Present Amount Present Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P Given A To Find A To Find A Given P FIP Given F Given A Given F Given P alu N PIF FIA PIA AIF AIP 1.0000 0.8772 1.0000 1 1.1400 0.8772 1.1400 2 0.7695 2.1400 1.6467 1.2996 0.4673 0.6073 3 0.6750 3.4396 2.3216 1.4815 0.2907 0.4307 0.5921 4.9211 2.9137 0.2032 0.3432 4 1.6890 6.6101 3.4331 5 1.9254 0.5194 0.1513 0.2913 8.5355 0.2572 6 2.1950 0.4556 3.8887 0.1172 10.7305 4.2883 0.0932 0.2332 7 2.5023 0.3996 0.d-66 0.3506 0.2156 13.2328 4.6389 2.8526 0.2022 0.0622 3.2519 0.3075 16.0853 4.9464 19.3373 0.0517 0.1917 3.7072 0.2697 5.2161 10 Done Print ur ansa IsWebox CCiCCeHARSWET N t un CONCO A bridge is to be constructed now as part of a new road. An analysis has shown that traffic density on the new road will justify a two-lane bridge at the present time. Because of uncertainty regarding future use of the road, the time at which an extra two lanes will be required is currently being studied. The estimated probabilities of having to widen the bridge to four lanes at various times in the future are as follows Widen Bridge in Probability 2 years 3 years 4 years 0.05 0.2 0.3 5 years 0.45 The present estimated cost of the two-lane bridge is $2,000,000. If constructed now, the four-lane bridge will cost $3,800,000. The future cost of widening a two lane bridge will be an extra $2,000 000 plus $250,000 for every year that widening is delayed. If money can earn 14% per year what would you recommend? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14 % per year The PW value for building a four-lane bridge now is Sthousand (Round to the nearest whole number.) to be constructed now as part of a new road. An analysis has shown that traffic density on the new road will justify a twc ont time Bocause.ofuncertainty ranardina.fuhura.use of the road tha timA at which an axtra bwO lanes wilLha required is ed X More Info Discrete Compounding; i-14% Single Payment Compound Amount Uniform Series t e Compound Sinking Fund Capital Recovery Factor tw d y the Present Amount Present Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P Given A To Find A To Find A Given P FIP Given F Given A Given F Given P alu N PIF FIA PIA AIF AIP 1.0000 0.8772 1.0000 1 1.1400 0.8772 1.1400 2 0.7695 2.1400 1.6467 1.2996 0.4673 0.6073 3 0.6750 3.4396 2.3216 1.4815 0.2907 0.4307 0.5921 4.9211 2.9137 0.2032 0.3432 4 1.6890 6.6101 3.4331 5 1.9254 0.5194 0.1513 0.2913 8.5355 0.2572 6 2.1950 0.4556 3.8887 0.1172 10.7305 4.2883 0.0932 0.2332 7 2.5023 0.3996 0.d-66 0.3506 0.2156 13.2328 4.6389 2.8526 0.2022 0.0622 3.2519 0.3075 16.0853 4.9464 19.3373 0.0517 0.1917 3.7072 0.2697 5.2161 10 Done Print ur ansa IsWebox CCiCCeHARSWET N t un CONCO