Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( EBIT - EPS analysis ) Three recent graduates of the computer science program at the University of Tennessee are forming a company that will

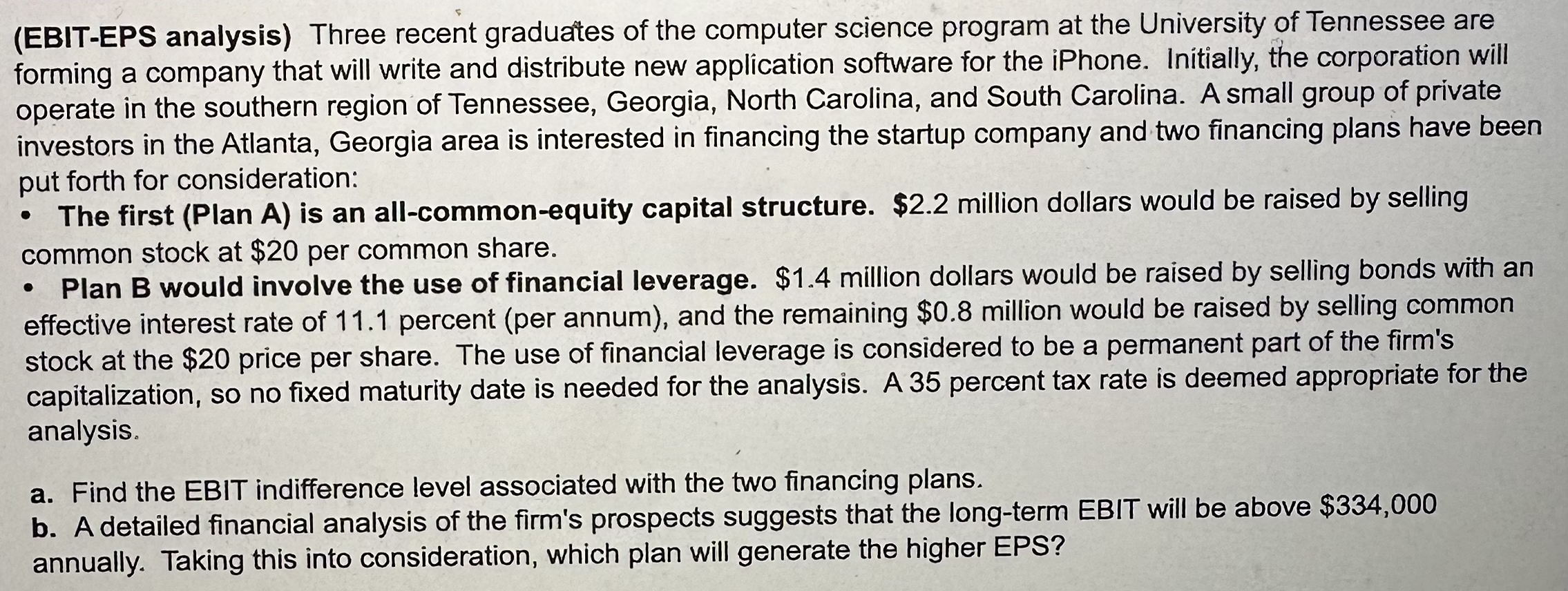

EBITEPS analysis Three recent graduates of the computer science program at the University of Tennessee are forming a company that will write and distribute new application software for the iPhone. Initially, the corporation will operate in the southern region of Tennessee, Georgia, North Carolina, and South Carolina. A small group of private investors in the Atlanta, Georgia area is interested in financing the startup company and two financing plans have been put forth for consideration:

The first Plan A is an allcommonequity capital structure. $ million dollars would be raised by selling common stock at $ per common share.

Plan B would involve the use of financial leverage. $ million dollars would be raised by selling bonds with an effective interest rate of percent per annum and the remaining $ million would be raised by selling common stock at the $ price per share. The use of financial leverage is considered to be a permanent part of the firm's capitalization, so no fixed maturity date is needed for the analysis. A percent tax rate is deemed appropriate for the analysis.

a Find the EBIT indifference level associated with the two financing plans.

b A detailed financial analysis of the firm's prospects suggests that the longterm EBIT will be above $ annually. Taking this into consideration, which plan will generate the higher EPS?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started