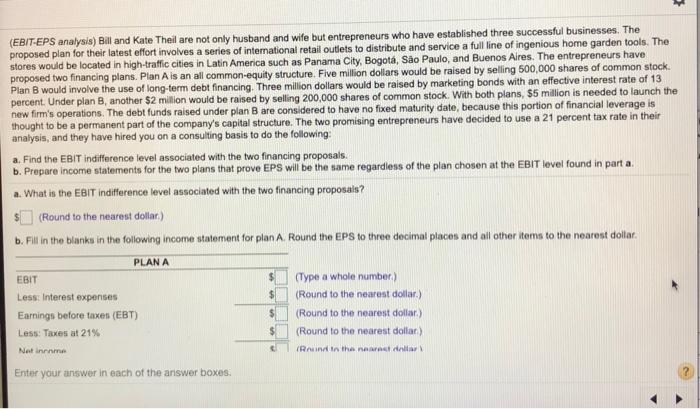

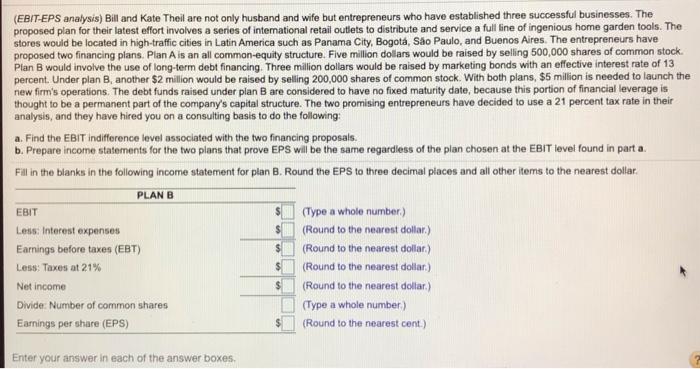

(EBIT-EPS analysis) Bill and Kate Theil are not only husband and wife but entrepreneurs who have established three successful businesses. The proposed plan for their latest effort involves a series of international retail outlets to distribute and service a full line of ingenious home garden tools. The stores would be located in high-traffic cities in Latin America such as Panama City, Bogot, So Paulo, and Buenos Aires. The entrepreneurs have proposed two financing plans. Plan A is an all common-equity structure. Five million dollars would be raised by selling 500,000 shares of common stock Plan B would involve the use of long-term debt financing. Three million dollars would be raised by marketing bonds with an effective interest rate of 13 percent. Under plan B, another $2 million would be raised by selling 200,000 shares of common stock. With both plans, $5 million is needed to launch the new firm's operations. The debt funds raised under plan B are considered to have no fixed maturity date, because this portion of financial leverage is thought to be a permanent part of the company's capital structure. The two promising entrepreneurs have decided to use a 21 percent tax rate in their analysis, and they have hired you on a consulting basis to do the following: a. Find the EBIT indifference level associated with the two financing proposals. b. Prepare income statements for the two plans that prove EPS will be the same regardless of the plan chosen at the EBIT level found in part a. a. What in the EBIT indifference level associated with the two financing proposals? (Round to the nearest dollar) b. Fill in the blanks in the following income statement for plan A. Round the EPS to three decimal places and all other items to the nearest dollar PLANA EBIT (Type a whole number) Less Interest expenses (Round to the nearest dollar) Earnings before taxes (EBT) (Round to the nearest dollar.) Less: Taxes at 21% (Round to the nearest dollar) Not in me RAinin the dar Enter your answer in each of the answer boxes. (EBIT-EPS analysis) Bill and Kate Theil are not only husband and wife but entrepreneurs who have established three successful businesses. The proposed plan for their latest effort involves a series of interational retail outlets to distribute and service a full line of ingenious home garden tools. The stores would be located in high-traffic cities in Latin America such as Panama City, Bogot, So Paulo, and Buenos Aires. The entrepreneurs have proposed two financing plans. Plan A is an all common-equity structure. Five million dollars would be raised by selling 500,000 shares of common stock. Plan B would involve the use of long-term debt financing. Three million dollars would be raised by marketing bonds with an effective interest rate of 13 percent. Under plan B, another $2 million would be raised by selling 200,000 shares of common stock. With both plans, $5 million is needed to launch the new firm's operations. The debt funds raised under plan B are considered to have no fixed maturity date, because this portion of financial leverage is thought to be a permanent part of the company's capital structure. The two promising entrepreneurs have decided to use a 21 percent tax rate in their analysis, and they have hired you on a consulting basis to do the following: a. Find the EBIT indifference level associated with the two financing proposals. b. Prepare income statements for the two plans that prove EPS will be the same regardless of the plan chosen at the EBIT level found in part a. Fill in the blanks in the following income statement for plan B. Round the EPS to three decimal places and all other items to the nearest dollar. PLAN B EBIT (Type a whole number) Less Interest expenses (Round to the nearest dollar) Earnings before taxes (EBT) $(Round to the nearest dollar) Less: Taxes at 21% (Round to the nearest dollar) Net income (Round to the nearest dollar) Divide Number of common shares (Type a whole number) Earnings per share (EPS) (Round to the nearest cont.) $ Enter your answer in each of the answer boxes