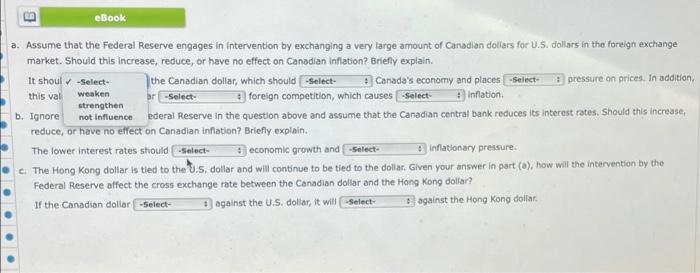

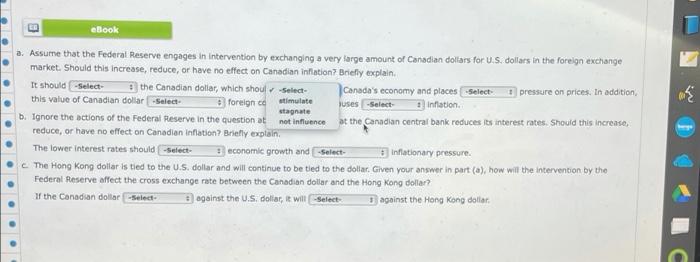

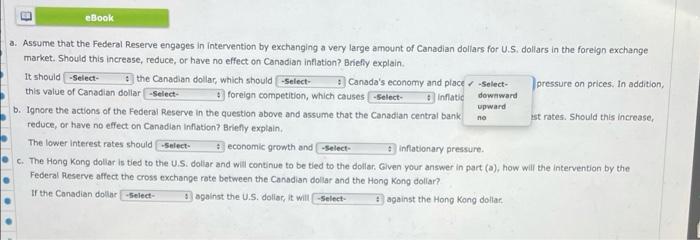

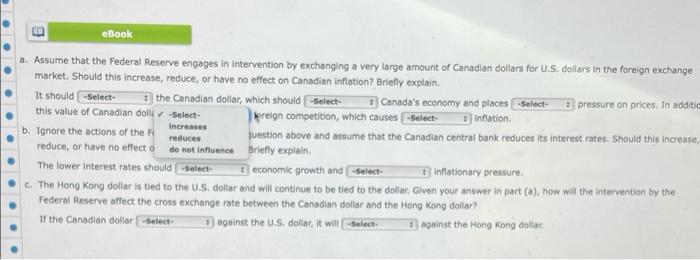

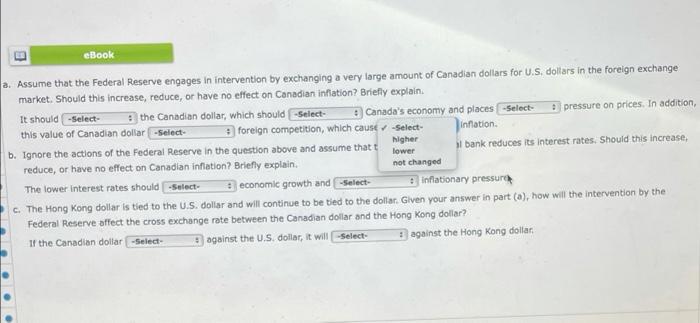

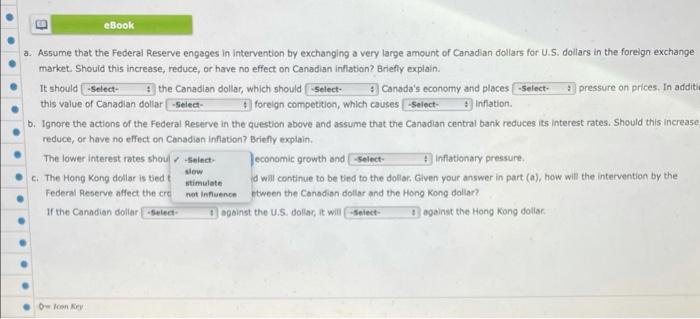

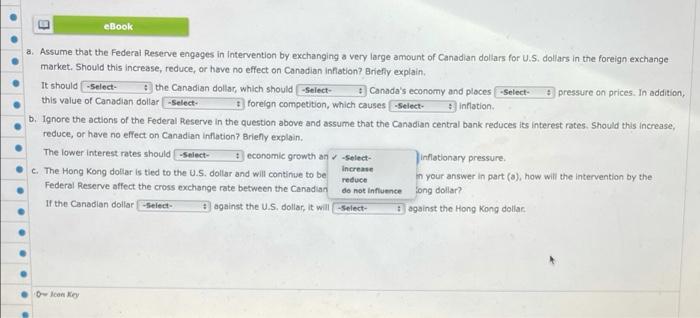

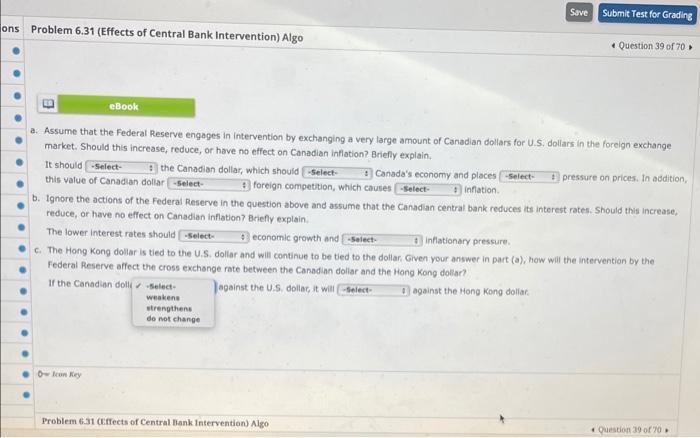

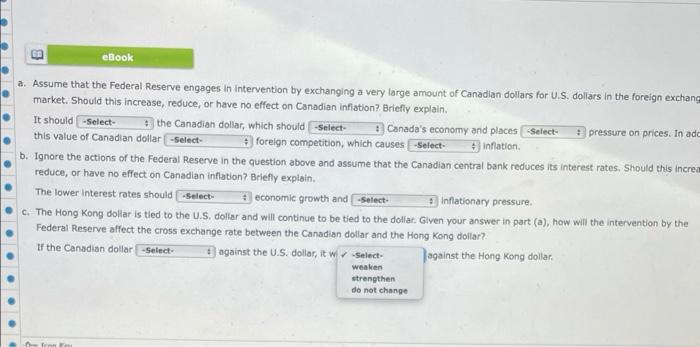

eBook a. Assume that the Federal Reserve engages in intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian Inflation? Briefly explain. It shoul -Select- the Canadian dollar, which should -Select- # Canada's economy and places Select- pressure on prices. In addition, this val weaken ar -Select- a foreign competition, which causes Select Inflation strengthen b. Ignore not influence ederal Reserve in the question above and assume that the Canadian central bank reduces its interest rates. Should this increase, reduce, or have no effect on Canadian inflation? Briefly explain The lower Interest rates should -Select- economic growth and select- Inflationary pressure C. The Hong Kong dollar is tied to the U.S. dollar and will continue to be tied to the dollar. Given your answer in part(), how will the intervention by the Federal Reserve affect the cross exchange rate between the Canadian dollar and the Hong Kong dollar? of the Canadian dollar -Select- against the U.S. dollar, it will -Select- Bagainst the Hong Kong dollar. eBook a. Assume that the Federal Reserve engages in Intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian inflation Briefly explain It should -Select the Canadian dollar, which shoul Select- Canada's economy and places Select pressure on prices. In addition, this value of Canadian dollar Select foreign toimulate suses Select Inflation stagnate b. ignore the actions of the Federal Reserve in the question at not influence at the Canadian central bank reduces its interest rates. Should this increase reduce, or have no effect on Canadian Inflation? Briefly explain The lower interest rates should -Select economic growth and Select inflationary pressure. c The Hong Kong dollar is tied to the U.S. dollar and will continue to be tied to the dollar. Given your answer in part (a), how will the Intervention by the Federal Reserve affect the cross exchange rate between the Canadian dollar and the Hong Kong dollar? If the Canadian dollar-Select- against the U.S. dollar, it will -Select- against the Hong Kong dollar. a eBook a. Assume that the Federal Reserve engages in intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian inflation? Briefly explain It should -Select- the Canadian dollar, which should -Select- Canada's economy and place -Select- pressure on prices. In addition, this value of Canadian dollar -Select- foreign competition, which causes -Select- Inflatid downward b. Ignore the actions of the Federal Reserve in the question above and assume that the Canadian central bank ist rates. Should this increase reduce, or have no effect on Canadian Inflation? Briefly explain The lower Interest rates should -Select- economic growth and select inflationary pressure c. The Hong Kong dollar is tied to the U.S. dollar and will continue to be tied to the dollar. Given your answer in part (a), how will the intervention by the Federal Reserve affect the cross exchange rate between the Canadian dollar and the Hong Kong dollar? If the Canadian dollar -Select- against the U.S. dollar, it will -Select against the Hong Kong dollar upward no eBook a. Assume that the Federal Reserve engages in intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian inflation? Brielly explain. It should -Select the Canadian dollar, which should -Select- Canada's economy and places -Select-pressure on prices. In additio this value of Canadian dolli -Select preign competition, which causes -Select- inflation Increases b. Ignore the actions of the question above and assume that the Canadian central bank reduces its interest rates should this increase, reduce, or have no effect o do not influence Briefly explain The lower interest rates should -Select economic growth and select 3 Inflationary pressure c. The Hong Kong dollar is tied to the U.S. dollar and will continue to be tied to the dollar Given your answer in part(), how will the intervention by the Federal Reserve affect the cross exchange rate between the Canadian dollar and the Hong Kong dollar? If the Canadian dollar Salat against the U.S. dollar it will "Select Bagainst the Hong Kong dollar reduces eBook a. Assume that the Federal Reserve engages in intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian inflation? Briefly explain. It should -Select- the Canadian dollar, which should -Select- Canada's economy and places -Select- pressure on prices. In addition, this value of Canadian dollar -Select- foreign competition, which caust-Select- innation. b. Ignore the actions of the Federal Reserve in the question above and assume that higher Si bank reduces its interest rates. Should this increase, lower reduce, or have no effect on Canadian inflation? Briefly explain. not changed The lower interest rates should -Select- economic growth and Select- Inflationary pressure C. The Hong Kong dollar is tied to the U.S. dollar and will continue to be tied to the dollar. Given your answer in part(s), how will the intervention by the Federal Reserve affect the cross exchange rate between the Canadian dollar and the Hong Kong dollar? If the Canadian dollar -Select- against the U.S. dollar, it will -Select- against the Hong Kong dollar eBook a. Assume that the Federal Reserve engages in Intervention by exchanging a very large amount of Canadian dollars for.U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian inflation? Briefly explain It should -Select- the Canadian dollar, which should -Select- 9 Canada's economy and places -Select-pressure on prices. In additiu this value of Canadian dollar -Select- foreign competition, which causes -Select- inflation b. Ignore the actions of the Federal Reserve in the question above and assume that the Canadian central bank reduces its interest rates. Should this increase reduce, or have no effect on Canadian inflation? Briefly explain The lower interest rates shoul-Select economic growth and select Inflationary pressure C. The Hong Kong dollar is tiedt d wal continue to be tied to the dollar. Given your answer in part (a), how will the intervention by the Federal Reserve affect the cre not influencn tween the Canadian dollar and the Hong Kong dollar? or the Canadian dollar - Select goinst the U.S. dollar, it will select Bagainst the Hong Kong dollar slow stimulate Own eBook a. Assume that the Federal Reserve engages in Intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian inflation? Briefly explain. It should -Select- the Canadian dollar, which should -Select- Canada's economy and places - Select pressure on prices. In addition, this value of Canadian dollar -Select- foreign competition, which causes -Select- inflation b. Ignore the actions of the Federal Reserve in the question above and assume that the Canadian central bank reduces tes interest rates. Should this increase, reduce, or have no effect on Canadian Inflation? Briefly explain. The lower Interest rates should -Salact economic growth an -Select- inflationary pressure C. The Hong Kong dollar is tied to the U.S. dollar and will continue to be Increase reduce in your answer in part (a), how will the intervention by the Federal Reserve affect the cross exchange rate between the Canadian Long dollar? If the Canadian dollar -Select against the U.S. dollar, it will -Select- Bagainst the Hong Kong dollar. do not influence - Icon Key Save Submit Test for Grading ons Problem 6.31 (Effects of Central Bank Intervention) Algo Question 39 of 70 ) eBook a. Assume that the Federal Reserve engages in intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchange market. Should this increase, reduce, or have no effect on Canadian inflation? Briefly explain, It should -Select- the Canadian dollar, which should -Select- Canada's economy and places Select pressure on prices. In addition, this value of Canadian dollar - Select foreign competition, which causes Select Inflation b. Ignore the actions of the Federal Reserve in the question above and assume that the Canadian central bank reduces its interest rates. Should this increase, reduce, or have no effect on Canadian Inflation Briefly explain The lower interest rates should -Select- economic growth and select- inflationary pressure c. The Hong Kong dollar is tied to the US dollar and will continue to be tied to the dollar. Given your answer in part (a), how will the intervention by the Federal Reserve affect the cross exchange rate between the Canadian dollar and the Hong Kong dollar? If the Canadian doll Select against the US dollac, it will select 1) against the Hong Kong dollar. weakene strengthens do not change 0 con Rey Problem 6.31 Effects of Central Bank Intervention) Algo + Question 39 06 70 eBook a. Assume that the Federal Reserve engages in intervention by exchanging a very large amount of Canadian dollars for U.S. dollars in the foreign exchang market. Should this increase, reduce, or have no effect on Canadian Inflation? Briefly explain It should -Select- the Canadian dollar, which should -Select- Canada's economy and places Select pressure on prices. In ade this value of Canadian dollar-Select- foreign competition, which causes -Select- inflation b. Ignore the actions of the Federal Reserve in the question above and assume that the Canadian central bank reduces its interest rates. Should this incream reduce, or have no effect on Canadian inflation? Briefly explain. The lower interest rates should -Select- economic growth and select- inflationary pressure c. The Hong Kong dollar is tied to the U.S. dollar and will continue to be tied to the dollar. Given your answer in part (a), how will the intervention by the Federal Reserve affect the cross exchange rate between the Canadian dollar and the Hong Kong dollar? If the Canadian dollar -Select- against the U.S. dollar, it w-Select- against the Hong Kong dollar weaken strengthen do not change