Answered step by step

Verified Expert Solution

Question

1 Approved Answer

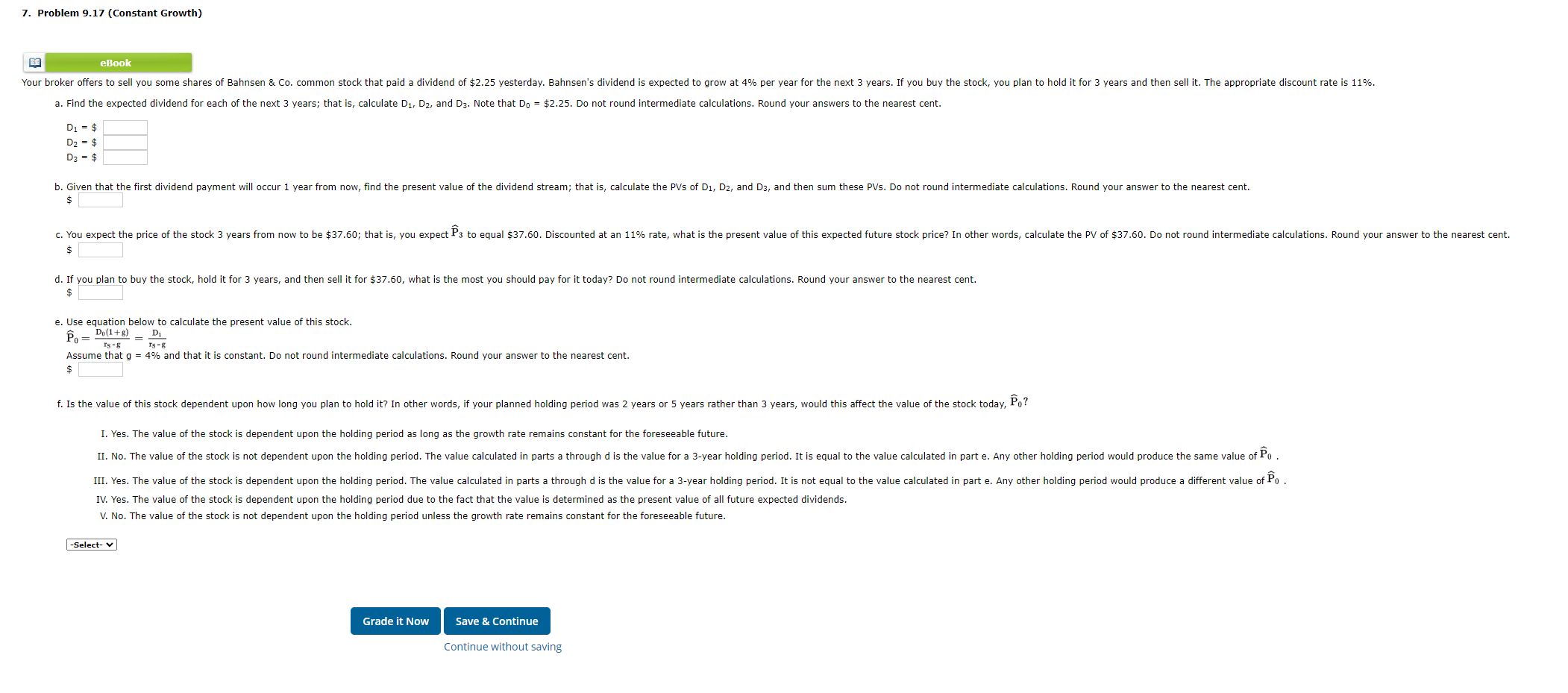

eBook a. Find the expected dividend for each of the next 3 years; that is, calculate D1,D2, and D3. Note that D0=$2.25. Do not round

eBook a. Find the expected dividend for each of the next 3 years; that is, calculate D1,D2, and D3. Note that D0=$2.25. Do not round intermediate calculations. Round your answers to the nearest cent. D1=$D2=$D3=$ $ d. If you plan to buy the stock, hold it for 3 years, and then sell it for $37.60, what is the most you should pay for it today? Do not round intermediate calculations. Round your answer to the nearest cent. e. Use equation below to calculate the present value of this stock. P0=rsgD0(1+g)=rsgD1Assumethatg=4%andthatitisconstant.Donotroundintermediatecalculations.Roundyouranswertothenearestcent.s f. Is the value of this stock dependent upon how long you plan to hold it? In other words, if your planned holding period was 2 years or 5 years rather than 3 years, would this affect the value of the stock today, P0 ? I. Yes. The value of the stock is dependent upon the holding period as long as the growth rate remains constant for the foreseeable future. IV. Yes. The value of the stock is dependent upon the holding period due to the fact that the value is determined as the present value of all future expected dividends. V. No. The value of the stock is not dependent upon the holding period unless the growth rate remains constant for the foreseeable future

eBook a. Find the expected dividend for each of the next 3 years; that is, calculate D1,D2, and D3. Note that D0=$2.25. Do not round intermediate calculations. Round your answers to the nearest cent. D1=$D2=$D3=$ $ d. If you plan to buy the stock, hold it for 3 years, and then sell it for $37.60, what is the most you should pay for it today? Do not round intermediate calculations. Round your answer to the nearest cent. e. Use equation below to calculate the present value of this stock. P0=rsgD0(1+g)=rsgD1Assumethatg=4%andthatitisconstant.Donotroundintermediatecalculations.Roundyouranswertothenearestcent.s f. Is the value of this stock dependent upon how long you plan to hold it? In other words, if your planned holding period was 2 years or 5 years rather than 3 years, would this affect the value of the stock today, P0 ? I. Yes. The value of the stock is dependent upon the holding period as long as the growth rate remains constant for the foreseeable future. IV. Yes. The value of the stock is dependent upon the holding period due to the fact that the value is determined as the present value of all future expected dividends. V. No. The value of the stock is not dependent upon the holding period unless the growth rate remains constant for the foreseeable future Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started