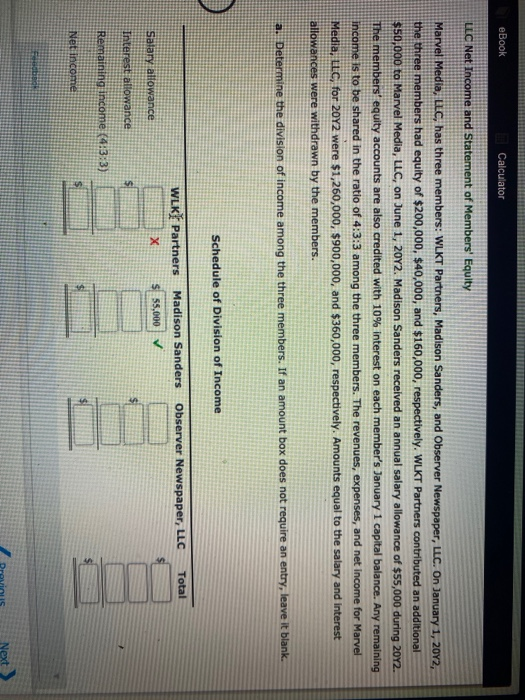

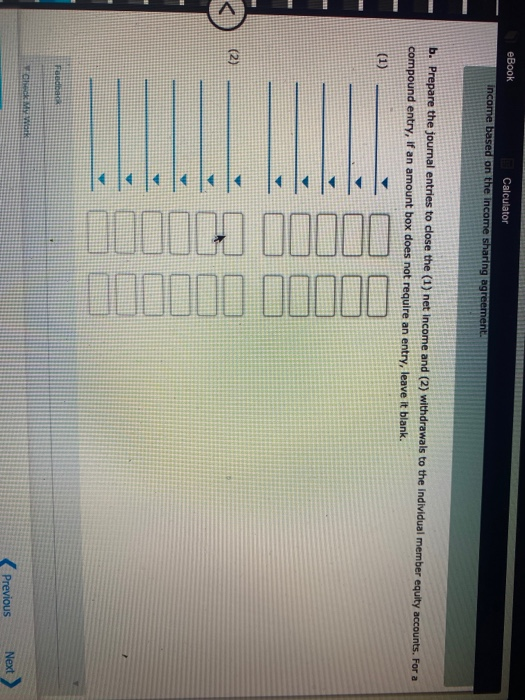

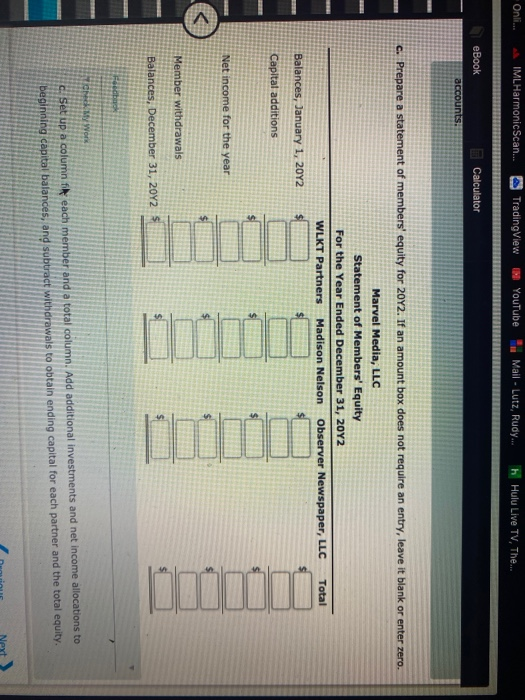

eBook Calculator LLC Net Income and Statement of Members' Equity Marvel Media, LLC, has three members: WLKT Partners, Madison Sanders, and Observer Newspaper, LLC. On January 1, 2012, the three members had equity of $200,000, $40,000, and $160,000, respectively. WLKT Partners contributed an additional $50,000 to Marvel Media, LLC, on June 1, 2012. Madison Sanders received an annual salary allowance of $55,000 during 2072. The members' equity accounts are also credited with 10% interest on each member's January 1 capital balance. Any remaining income is to be shared in the ratio of 4:3:3 among the three members. The revenues, expenses, and net income for Marvel Media, LLC, for 20Y2 were $1,260,000, $900,000, and $360,000, respectively. Amounts equal to the salary and interest allowances were withdrawn by the members. a. Determine the division of income among the three members. If an amount box does not require an entry, leave it blank. Schedule of Division of Income Madison Sanders Observer Newspaper, LLC Total WLK Partners Salary allowance 55,000 Interest allowance Remaining income (4:33) Net income Next eBook Calculator income based on the income sharing agreement. b. Prepare the journal entries to close the (1) net income and (2) withdrawals to the individual member equity accounts. For a compound entry, If an amount box does not require an entry, leave it blank. (1) (2) AD11110 11010 000ll >> Foodba My Miak Previous Next Onli... IML Harmonic Scan... Trading View YouTube Mall - Lutz, Rudy... h Hulu Live TV, The... eBook Calculator accounts. c. Prepare a statement of members' equity for 20Y2. If an amount box does not require an entry, leave it blank or enter zero. Marvel Media, LLC Statement of Members' Equity For the Year Ended December 31, 2012 WLKT Partners Madison Nelson Observer Newspaper, LLC Total Balances, January 1, 2012 Capital additions Net income for the year Member withdrawals Balances, December 31, 2012 $ Feedback TIN MY Wor c. Set up a column fin each member and a total column. Add additional investments and net income allocations to beginning capital balances, and subtract withdrawals to obtain ending capital for each partner and the total equity. Feedback Check My Work c. Set up a column for each member and a total column. Add additional Investments and net income allocations to beginning capital balances, and subtract withdrawals to obtain ending capital for each partner and the total equity. d What are the advantages of an income-sharing agreement for the members of this LLC? Without an income-sharing agreement, each member be credited with an equal proportion of the total earnings, or one-third each. Separate contributions be acknowledged in the income-sharing formula. Feedback Check My Work Incorrect Feedback Check My Wok Partially correct Previous Next > Check My Work Save and Exit Submit Assignment for Grading All work saved