Answered step by step

Verified Expert Solution

Question

1 Approved Answer

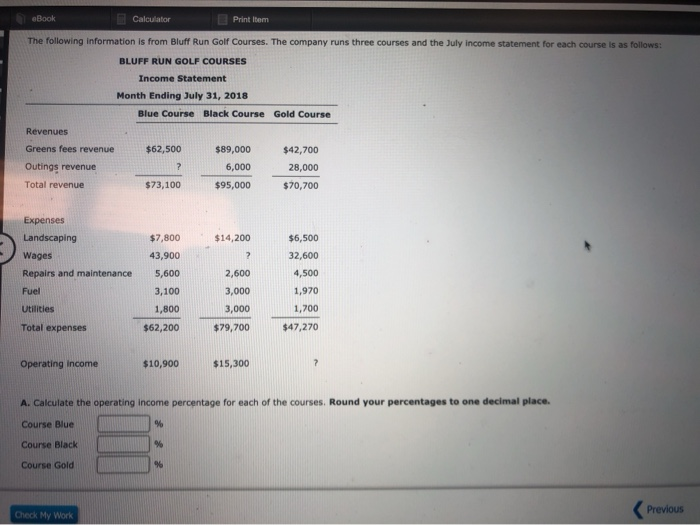

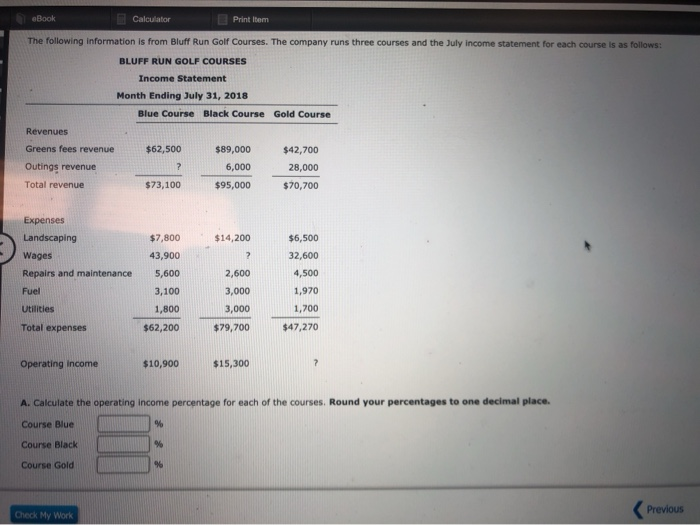

eBook Calculator Print item The following information is from Bluff Run Golf Courses. The company runs three courses and the July income statement for each

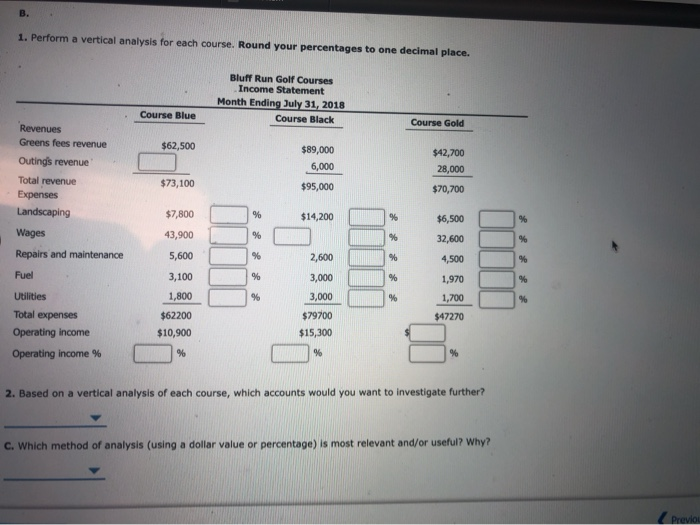

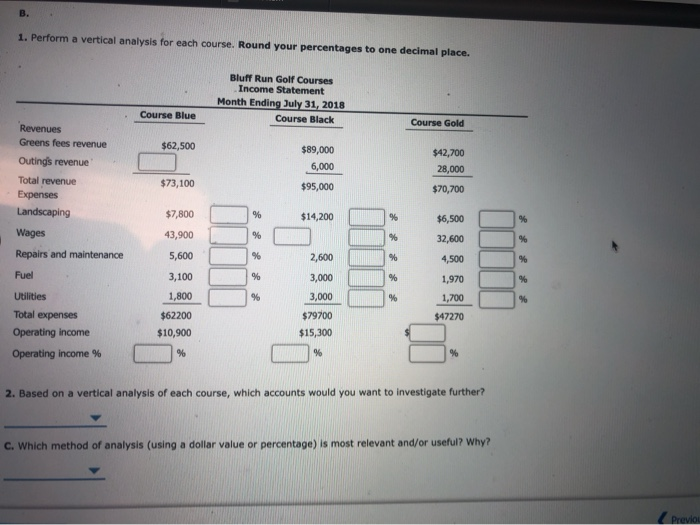

eBook Calculator Print item The following information is from Bluff Run Golf Courses. The company runs three courses and the July income statement for each course is as foros BLUFF RUN GOLF COURSES Income Statement Month Ending July 31, 2018 Blue Course Black Course Gold Course Revenues $62,500 Greens fees revenue Outings revenue Total revenue $89,000 6,000 $95,000 $42,700 28,000 $70,700 $73,100 Expenses Landscaping $14,200 Wages Repairs and maintenance Fuel $7,800 43,900 5,600 3,100 1,800 $62,200 2,600 3,000 3,000 $79,700 $6,500 32,600 4,500 1,970 1,700 $47,270 Utilities Total expenses Operating income $10,900 $15,300 A. Calculate the operating Income percentage for each of the courses. Round your percentages to one decimal place. Course Blue Course Black Course Gold Check My Work Previous 1. Perform a vertical analysis for each course. Round your percentages to one decimal place. Bluff Run Golf Courses Income Statement Month Ending July 31, 2018 Course Black Course Blue Course Gold $62,500 $89,000 6,000 $42,700 28,000 Revenues Greens fees revenue Outings revenue Total revenue Expenses Landscaping Wages $73,100 $95,000 $70,700 $7,800 $14,200 43,900 5,600 Repairs and maintenance Fuel $6,500 32,600 4,500 1,970 1,700 $47270 3,100 1,800 % 2,600 3,000 3,000 $79700 $15,300 Utilities Total expenses Operating income Operating income % $62200 $10,900 2. Based on a vertical analysis of each course, which accounts would you want to investigate further? C. Which method of analysis (using a dollar value or percentage) is most relevant and/or useful? Why? Previou

eBook Calculator Print item The following information is from Bluff Run Golf Courses. The company runs three courses and the July income statement for each course is as foros BLUFF RUN GOLF COURSES Income Statement Month Ending July 31, 2018 Blue Course Black Course Gold Course Revenues $62,500 Greens fees revenue Outings revenue Total revenue $89,000 6,000 $95,000 $42,700 28,000 $70,700 $73,100 Expenses Landscaping $14,200 Wages Repairs and maintenance Fuel $7,800 43,900 5,600 3,100 1,800 $62,200 2,600 3,000 3,000 $79,700 $6,500 32,600 4,500 1,970 1,700 $47,270 Utilities Total expenses Operating income $10,900 $15,300 A. Calculate the operating Income percentage for each of the courses. Round your percentages to one decimal place. Course Blue Course Black Course Gold Check My Work Previous 1. Perform a vertical analysis for each course. Round your percentages to one decimal place. Bluff Run Golf Courses Income Statement Month Ending July 31, 2018 Course Black Course Blue Course Gold $62,500 $89,000 6,000 $42,700 28,000 Revenues Greens fees revenue Outings revenue Total revenue Expenses Landscaping Wages $73,100 $95,000 $70,700 $7,800 $14,200 43,900 5,600 Repairs and maintenance Fuel $6,500 32,600 4,500 1,970 1,700 $47270 3,100 1,800 % 2,600 3,000 3,000 $79700 $15,300 Utilities Total expenses Operating income Operating income % $62200 $10,900 2. Based on a vertical analysis of each course, which accounts would you want to investigate further? C. Which method of analysis (using a dollar value or percentage) is most relevant and/or useful? Why? Previou

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started