Question

eBook Chapter 5 Financial Planning Exercise 3 Rent versus buy home Use Worksheet 5.2 and Exhibit 5.6. Emma Sanchez is currently renting an apartment for

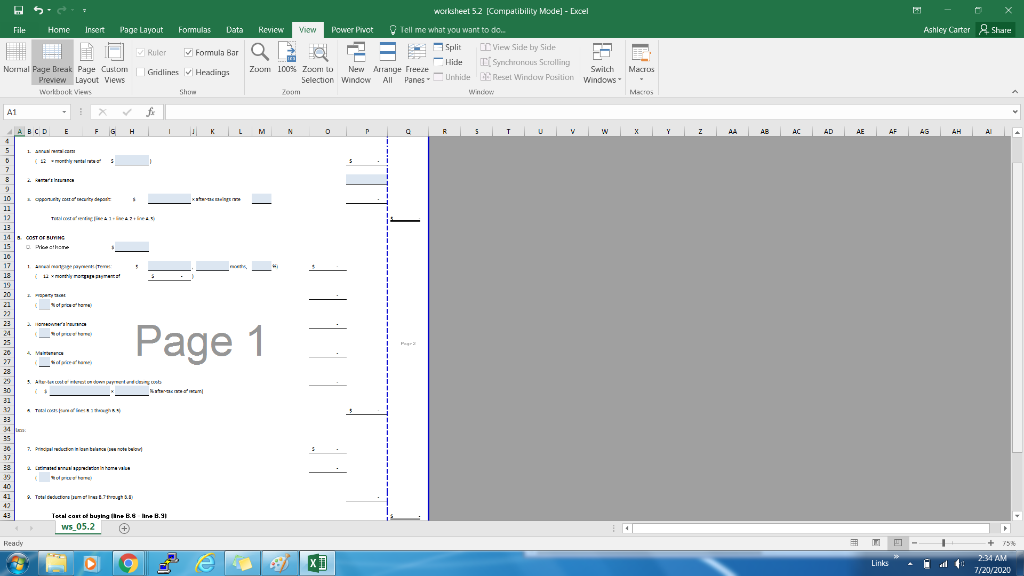

| eBook Chapter 5 Financial Planning Exercise 3 Rent versus buy home Use Worksheet 5.2 and Exhibit 5.6. Emma Sanchez is currently renting an apartment for $700 per month and paying $225 annually for renter's insurance. She just found a small townhouse she can buy for $175,000. She has enough cash for a $10,000 down payment and $4,000 in closing costs. Emma estimated the following costs as a percentage of the home's price: property taxes, 2.5 percent; homeowner's insurance, 0.5 percent; and maintenance, 0.7 percent. She is in the 25 percent tax bracket and does not plan to itemize deductions on her taxes. Using Worksheet 5.2, calculate the cost of each alternative and recommend the least costly option - rent or buy - for Emma. Assume Emma's security deposit is equal to one month's rent of $700. Also assume a 4% after tax rate return on her savings, a 3% annual appreciation in home price, and a 6% mortgage interest rate for 30 years.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started