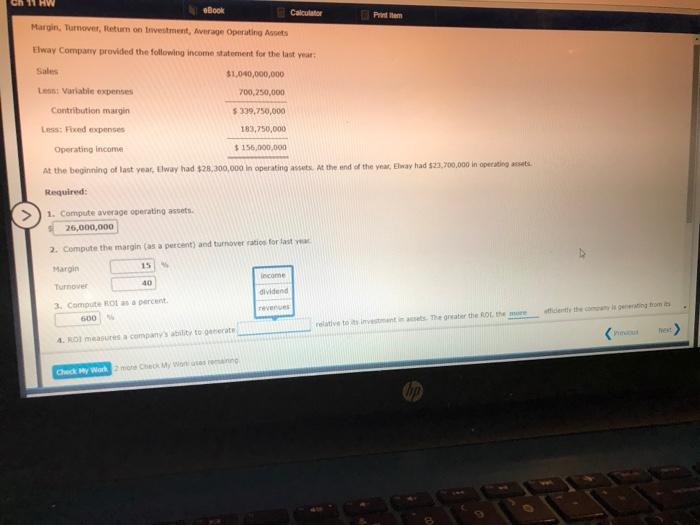

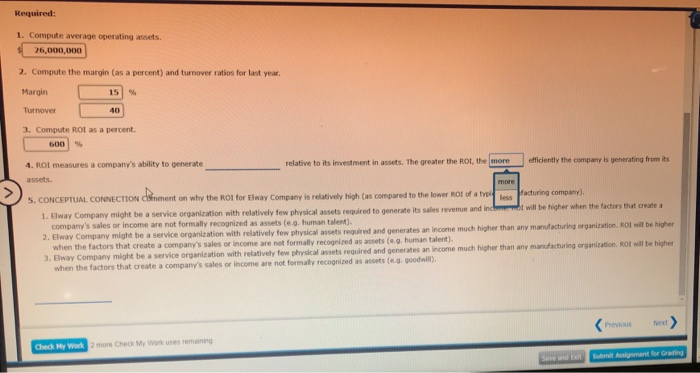

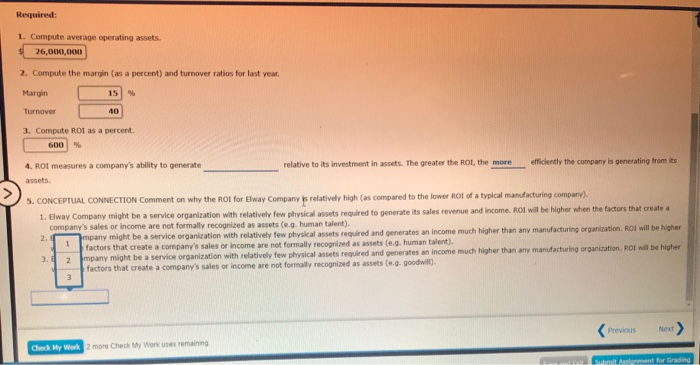

eBook Margin, Turnover, Return on investment, Average Operating Assets Elway Company provided the following income statement for the last year: Sales $1,040,000,000 700,250,000 Less: Variable expenses Contribution margin $ 339,750,000 153.750.000 Les Fixed expenses $156,000,000 Operating income us. At the end of the year, Ewa had $23,700,000 in operating At the beginning of last year, Elway had $28.300,000 in operating Required: t 1. Compute average operating a $ 26,000,000 for at 2. Compute the margin (as a percent) and turnover Margin Turnover 3ComputeROL as a percent 600 > 4. Rol measures a company's ability to generate My Work 2 ore Checko Required: 1. Compute average operating ass 26 on BDO 2. Compute the margin (as a percent) and turnover ratios for last year Margin Turnover 3. Compute ROI as a percent. 600 4. ROI measures a company's ability to generate assets relative to its investment in assets. The greater the ROI, the more office the company is generating from S. CONCEPTUAL CONNECTION Sinment on why the ROI for Elway Company is relatively high (as compared to the lower Rot of a typ facturing company). 1. Fway Company might be a service organization with relatively few physical required to generate its sales revenue and inch I will be higher when the factors that create company's sales or income are not formally recognized as w e human talent) 2. Elway Company might be a service organization with relatively few physical assets required and generates an income much higher than any manufacturing organization. Roll be higher when the factors that create a company's sales or income are not formally recognized as assets (eg, human talent). 3. Elway Company might be a service organization with relatively few physical awets required and generates an income much higher than any manufacturing organisation Rot will be higher when the factors that create a company's sales or income are not formally recognized as a goodwill). Check My Work 2 more Check My Works remaining Seed But Alment for Grading Required: 1. Compute average operating assets. $ 26,000,000 2. Compute the margin (as a percent) and turnover ratios for last year Margin Turner 1. Computerol as a percent 600 4. ROI measures a company's ability to generate relative to its investment in ts. The greater the ROI, the more efficiently the company is generating from 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company). 1. Elway Company might be a service organization with relatively few p e t s required to generates sales revenue and income ROI wil be higher when the factors that create company's sales or income are not formally recognized as assets (e. human talent) 2. m pany might be a service organization with relatively few physical assets required and generates an income much higher than any manufacturing organisation. ROE will be her factors that create a company's sales or income are not formally recognized as assets (e. human talent). 3. 2 mpany might be a service organization with relatively few physical assets required and generates an income much higher than any manufacturing organization. Rof will be higher factors that create a company's sales or income are not formally recognized as assets (eg goodwill). ( previous Next My Work 2 Ch Wong