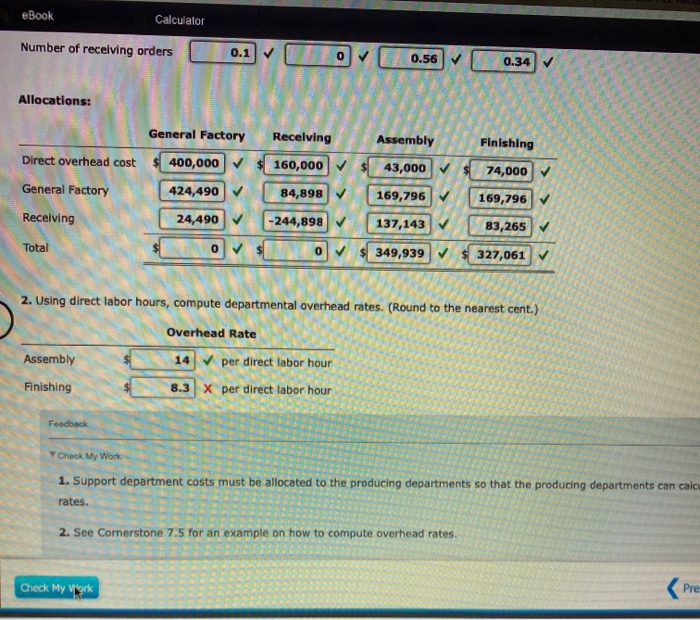

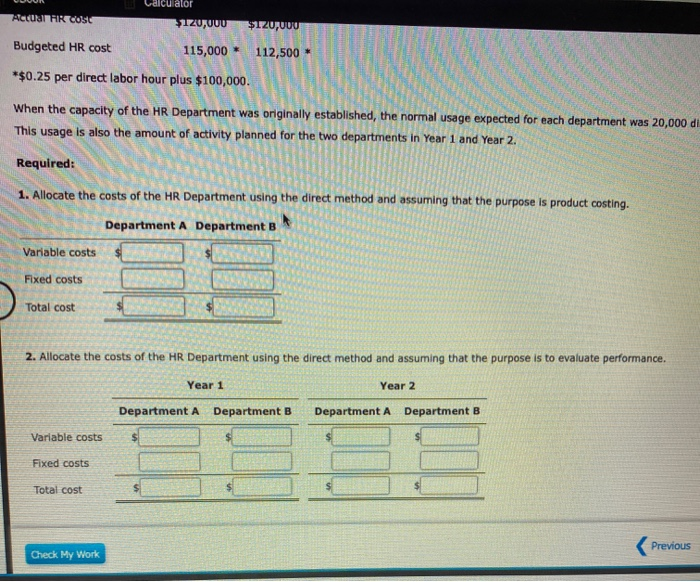

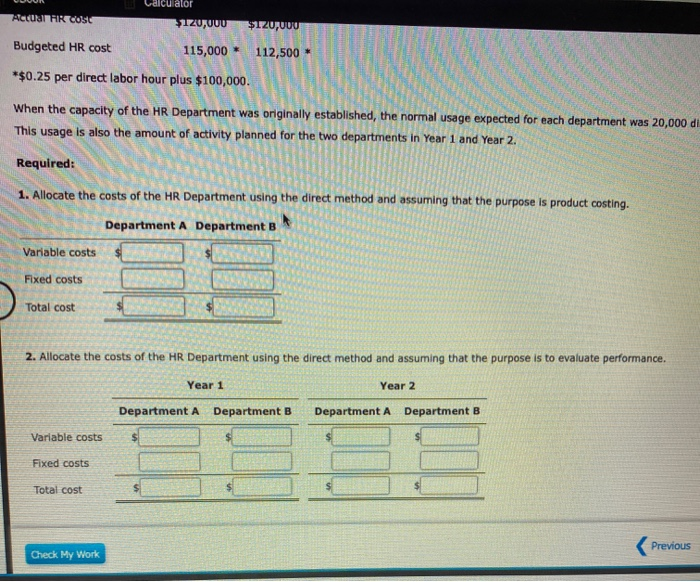

eBook Number of receiving orders 10.5 1 0. 0 0.56 0.34 Allocations: Ishing General Factory Receiving Assembly Direct overhead cost $400,000 $160,000 $ 43,000 $ 74,000 General Factory 424,490 84,898 169,796 169,796 Receiving 24,490 -244,898 137,143 83,265 Total $ 349,939 $ 327,061 RUNNINNOTECA 2. Using direct labor hours, compute departmental overhead rates. (Round to the nearest cent.) Overhead Rate Assembly 14 per direct labor hour Finishing X per direct labor hour Y Chook My Work 1. Support department costs must be allocated to the producing departments so that the producing departments can call rates. 2. See Cornerstone 7.5 for an example on how to compute overhead rates. Check My vark vaicurator ACCU HRCOS , Budgeted HR cost 115,000 112,500 *$0.25 per direct labor hour plus $100,000. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 di This usage is also the amount of activity planned for the two departments in Year 1 and Year 2 Required: 1. Allocate the costs of the HR Department using the direct method and assuming that the purpose is product costing. Department A Department B Variable costs $ $ Fixed costs | RE SER Total cost 2. Allocate the costs of the HR Department using the direct method and assuming that the purpose is to evaluate performance. Year 1 Year 2 Department A Department B Department A Department B $ Variable costs Fixed costs Total cost Previous Check My Work eBook Number of receiving orders 10.5 1 0. 0 0.56 0.34 Allocations: Ishing General Factory Receiving Assembly Direct overhead cost $400,000 $160,000 $ 43,000 $ 74,000 General Factory 424,490 84,898 169,796 169,796 Receiving 24,490 -244,898 137,143 83,265 Total $ 349,939 $ 327,061 RUNNINNOTECA 2. Using direct labor hours, compute departmental overhead rates. (Round to the nearest cent.) Overhead Rate Assembly 14 per direct labor hour Finishing X per direct labor hour Y Chook My Work 1. Support department costs must be allocated to the producing departments so that the producing departments can call rates. 2. See Cornerstone 7.5 for an example on how to compute overhead rates. Check My vark vaicurator ACCU HRCOS , Budgeted HR cost 115,000 112,500 *$0.25 per direct labor hour plus $100,000. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 di This usage is also the amount of activity planned for the two departments in Year 1 and Year 2 Required: 1. Allocate the costs of the HR Department using the direct method and assuming that the purpose is product costing. Department A Department B Variable costs $ $ Fixed costs | RE SER Total cost 2. Allocate the costs of the HR Department using the direct method and assuming that the purpose is to evaluate performance. Year 1 Year 2 Department A Department B Department A Department B $ Variable costs Fixed costs Total cost Previous Check My Work