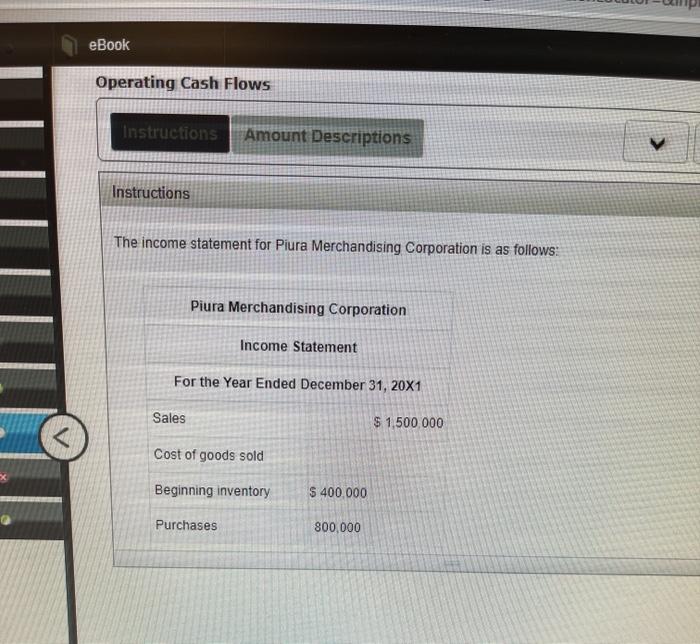

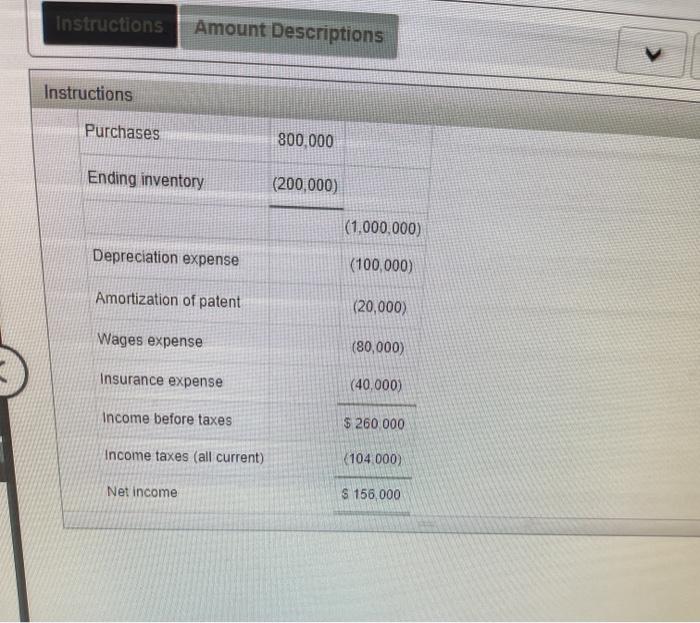

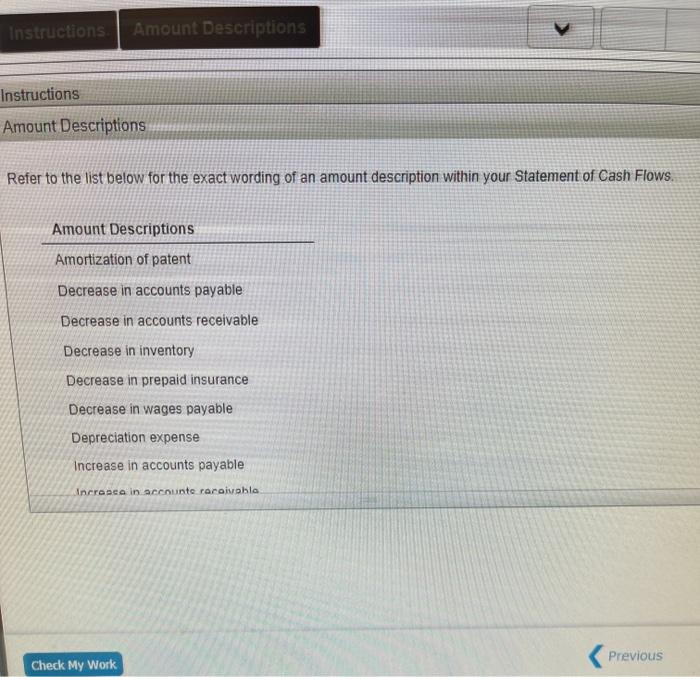

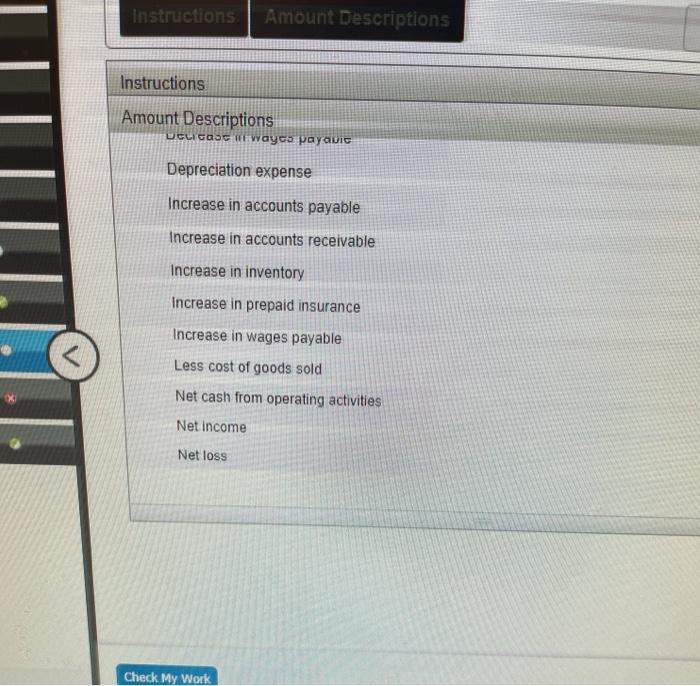

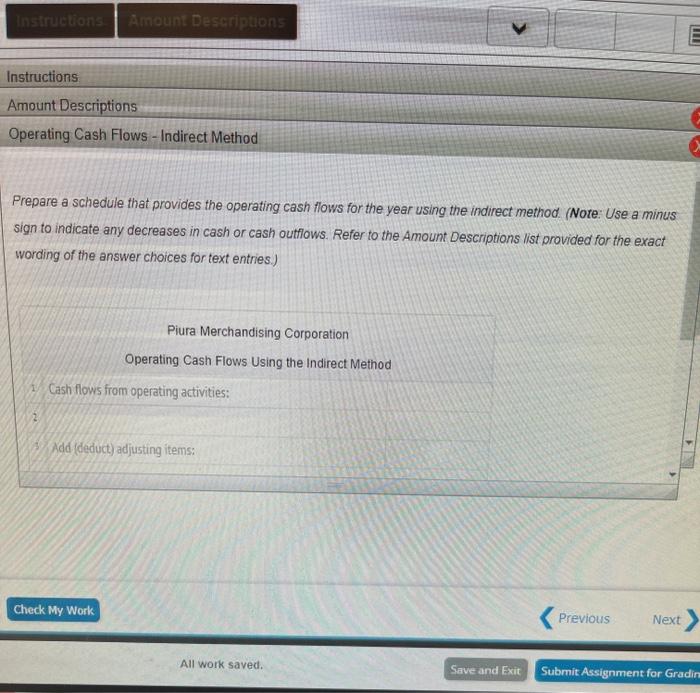

eBook Operating Cash Flows Instructions Amount Descriptions Instructions The income statement for Piura Merchandising Corporation is as follows: Piura Merchandising Corporation Income Statement For the Year Ended December 31, 20X1 Sales $ 1.500.000 Cost of goods sold Beginning inventory $ 400.000 Purchases 800,000 Instructions Amount Descriptions Instructions Purchases 800,000 Ending inventory (200,000) (1,000,000) Depreciation expense (100,000) Amortization of patent (20,000) Wages expense (80,000) Insurance expense (40,000) Income before taxes $ 260 000 Income taxes (all current) (104 000) Net Income S 156,000 Instructions Amount Descriptions Instructions Amount Descriptions Refer to the list below for the exact wording of an amount description within your Statement of Cash Flows. Amount Descriptions Amortization of patent Decrease in accounts payable Decrease in accounts receivable Decrease in inventory Decrease in prepaid insurance Decrease in wages payable Depreciation expense Increase in accounts payable Incronea in accounts rarolvabla Previous Check My Work Instructions Amount Descriptions Instructions Amount Descriptions ULICAS llways payabic Depreciation expense Increase in accounts payable Increase in accounts receivable Increase in inventory Increase in prepaid insurance Increase in wages payable Less cost of goods sold Net cash from operating activities Net income Net loss Check My Work Instructions Amount Descriptions IM Instructions Amount Descriptions Operating Cash Flows - Indirect Method Prepare a schedule that provides the operating cash flows for the year using the indirect method. (Note: Use a minus sign to indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.) Piura Merchandising Corporation Operating Cash Flows Using the Indirect Method Cash flows from operating activities: 2 Add(deduct) adjusting items: Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Gradin eBook Operating Cash Flows Instructions Amount Descriptions Instructions The income statement for Piura Merchandising Corporation is as follows: Piura Merchandising Corporation Income Statement For the Year Ended December 31, 20X1 Sales $ 1.500.000 Cost of goods sold Beginning inventory $ 400.000 Purchases 800,000 Instructions Amount Descriptions Instructions Purchases 800,000 Ending inventory (200,000) (1,000,000) Depreciation expense (100,000) Amortization of patent (20,000) Wages expense (80,000) Insurance expense (40,000) Income before taxes $ 260 000 Income taxes (all current) (104 000) Net Income S 156,000 Instructions Amount Descriptions Instructions Amount Descriptions Refer to the list below for the exact wording of an amount description within your Statement of Cash Flows. Amount Descriptions Amortization of patent Decrease in accounts payable Decrease in accounts receivable Decrease in inventory Decrease in prepaid insurance Decrease in wages payable Depreciation expense Increase in accounts payable Incronea in accounts rarolvabla Previous Check My Work Instructions Amount Descriptions Instructions Amount Descriptions ULICAS llways payabic Depreciation expense Increase in accounts payable Increase in accounts receivable Increase in inventory Increase in prepaid insurance Increase in wages payable Less cost of goods sold Net cash from operating activities Net income Net loss Check My Work Instructions Amount Descriptions IM Instructions Amount Descriptions Operating Cash Flows - Indirect Method Prepare a schedule that provides the operating cash flows for the year using the indirect method. (Note: Use a minus sign to indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.) Piura Merchandising Corporation Operating Cash Flows Using the Indirect Method Cash flows from operating activities: 2 Add(deduct) adjusting items: Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Gradin