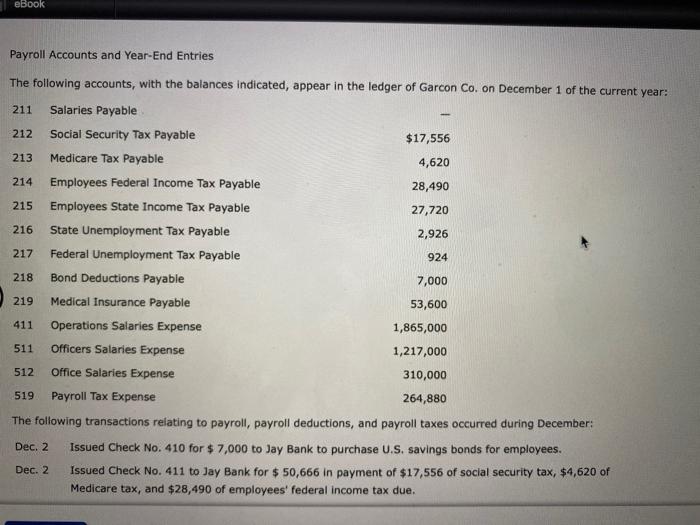

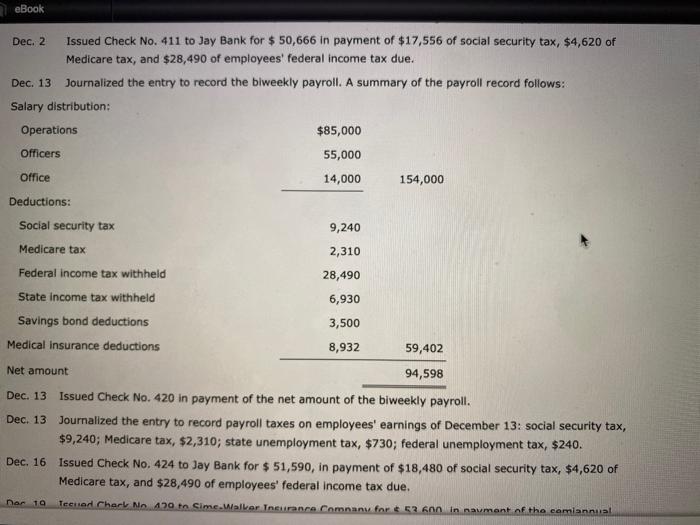

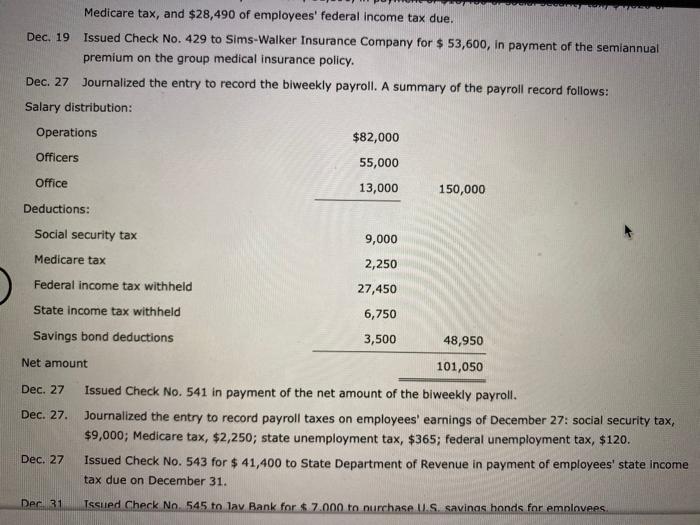

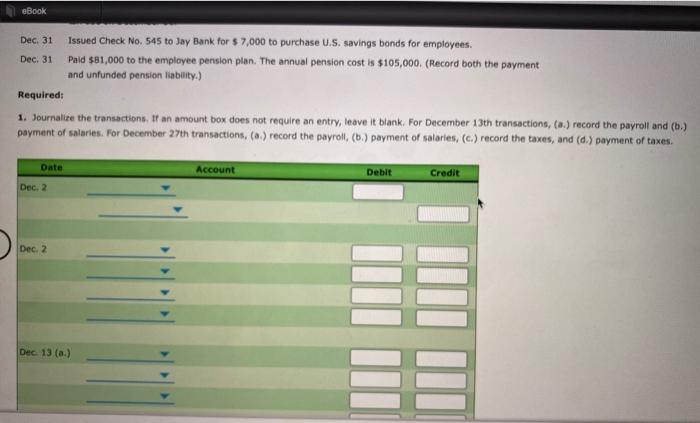

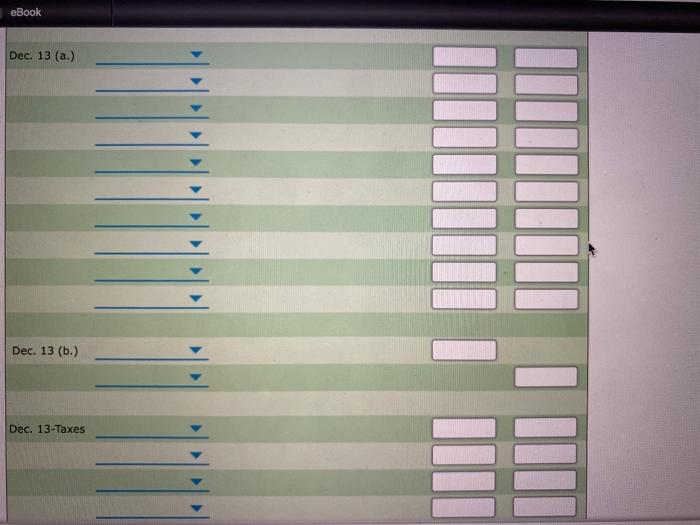

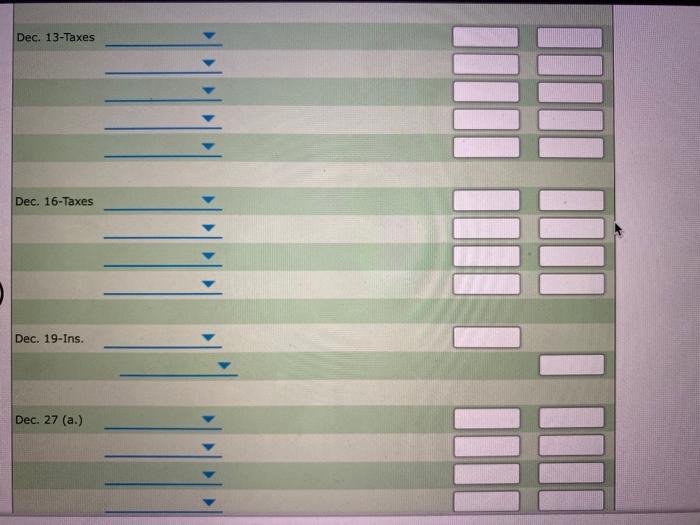

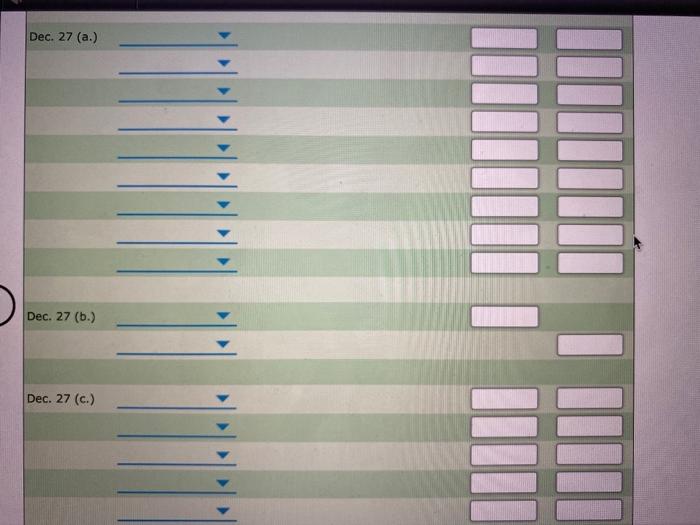

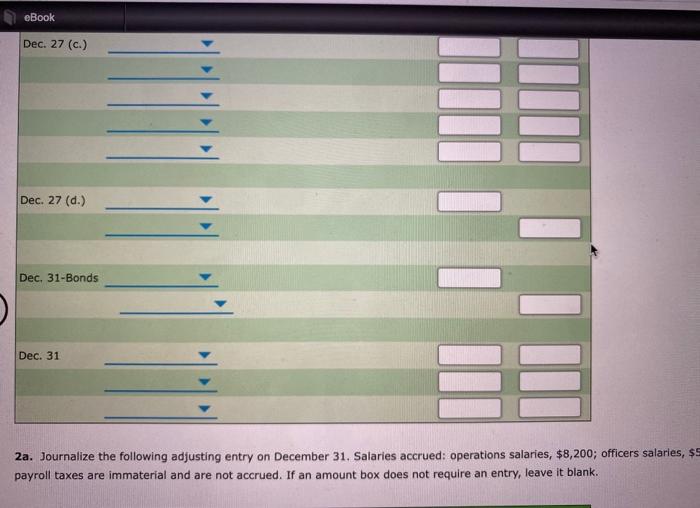

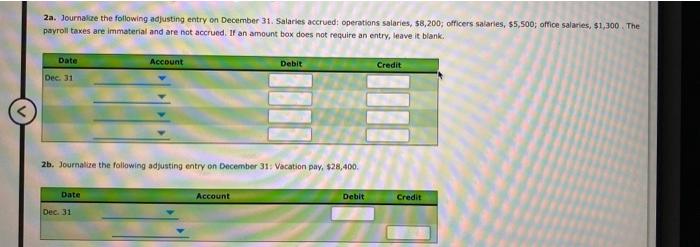

eBook Payroll Accounts and Year-End Entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable 212 Social Security Tax Payable $17,556 213 Medicare Tax Payable 4,620 214 Employees Federal Income Tax Payable 28,490 215 Employees State Income Tax Payable 27,720 216 State Unemployment Tax Payable 2,926 217 Federal Unemployment Tax Payable 924 218 Bond Deductions Payable 7,000 219 Medical Insurance Payable 53,600 411 Operations Salaries Expense 1,865,000 511 Officers Salaries Expense 1,217,000 512 Office Salaries Expense 310,000 519 Payroll Tax Expense 264,880 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2 Issued Check No. 410 for $7,000 to Jay Bank to purchase U.S. savings bonds for employees. Dec. 2 Issued Check No. 411 to Jay Bank for $ 50,666 in payment of $17,556 of social security tax, $4,620 of Medicare tax, and $28,490 of employees' federal income tax due. eBook Dec. 2 Issued Check No. 411 to Jay Bank for $ 50,666 in payment of $17,556 of social security tax, $4,620 of Medicare tax, and $28,490 of employees' federal income tax due. Dec. 13 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Operations $85,000 Officers 55,000 Office 14,000 154,000 Deductions: Social security tax 9,240 Medicare tax 2,310 Federal income tax withheld 28,490 State income tax withheld 6,930 Savings bond deductions 3,500 Medical insurance deductions 8,932 59,402 Net amount 94,598 Dec. 13 Issued Check No. 420 in payment of the net amount of the biweekly payroll. Dec. 13 Journalized the entry to record payroll taxes on employees' earnings of December 13: social security tax, $9,240; Medicare tax, $2,310; state unemployment tax, $730; federal unemployment tax, $240. Dec. 16 Issued Check No. 424 to Jay Bank for $ 51,590, in payment of $18,480 of social security tax, $4,620 of Medicare tax, and $28,490 of employees' federal income tax due. Teeted Chery No 120 t Sime.Waller Tncurance Comnany for & 53.600 in namont of the comiannual Der 19 Medicare tax, and $28,490 of employees' federal income tax due. Dec. 19 Issued Check No. 429 to Sims-Walker Insurance Company for $ 53,600, in payment of the semiannual premium on the group medical insurance policy. Dec. 27 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Operations $82,000 Officers 55,000 Office 13,000 150,000 Deductions: Social security tax 9,000 Medicare tax 2,250 Federal income tax withheld 27,450 State income tax withheld 6,750 Savings bond deductions 3,500 48,950 Net amount 101,050 Dec. 27 Issued Check No. 541 in payment of the net amount of the biweekly payroll. Dec. 27. Journalized the entry to record payroll taxes on employees' earnings of December 27: social security tax, $9,000; Medicare tax, $2,250; state unemployment tax, $365; federal unemployment tax, $120. Dec. 27 Issued Check No. 543 for $ 41,400 to State Department of Revenue in payment of employees' state income tax due on December 31. Dec 31 Issued Check No 545 to lav Bank for $ 7.000 to purchase U.S. savinas bonds for emplovees. eBook Dec. 31 Dec 31 Issued Check No. 545 to Jay Bank for $7,000 to purchase U.S. savings bonds for employees. Paid $81,000 to the employee pension plan. The annual pension cost is $105,000. (Record both the payment and unfunded pension liability.) Required: 1. Journalire the transactions. It an amount box does not require an entry, leave it blank. For December 13th transactions, (a) record the payroll and (b.) payment of salaries. For December 27th transactions, (a) record the payroll. (6.) payment of salaries, (c.) record the taxes, and (d.) payment of taxes. Date Account Debit Credit Dec, 2 Dec. 2 Dec 13 () eBook Dec. 13 (a.) Dec. 13 (b.) Dec. 13-Taxes III Dec. 13-Taxes Dec. 16-Taxes Dec. 19-Ins. Dec. 27 (a.) Dec. 27 (a.) Dec. 27 (b.) mi Dec. 27 (c.) eBook Dec. 27 (c.) Dec. 27 (d.) Dec. 31-Bonds Dec. 31 F 2a. Journalize the following adjusting entry on December 31. Salaries accrued: operations salaries, $8,200; officers salaries, $S payroll taxes are immaterial and are not accrued. If an amount box does not require an entry, leave it blank. 2a. Journalce the following adjusting entry on December 31. Salaries accrued: operations salaries, $8,200; officers salaries, $5,500, office salaries, $1,300. The payroll taxes are immaterial and are not accrued. If an amount box does not require an entry, leave it blank. Date Account Debit Credit Dec. 31 2b. Journalize the following adjusting entry on December 31: Vacation pay $28,400 Date Account Debit Credit Dec. 31