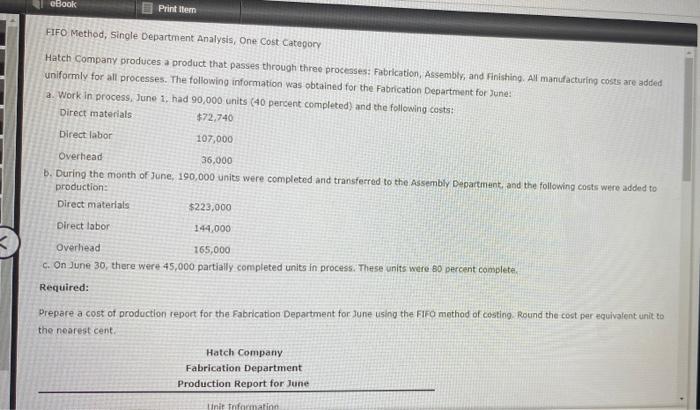

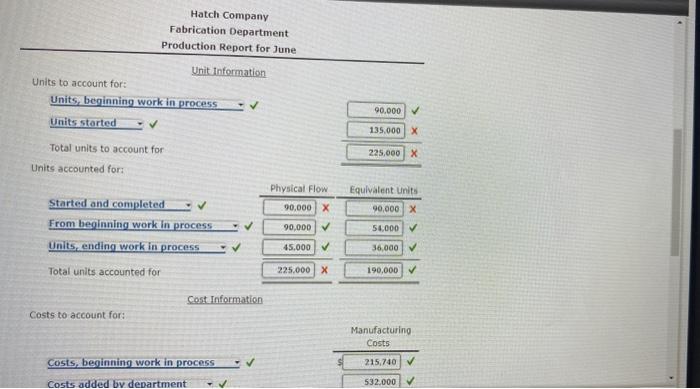

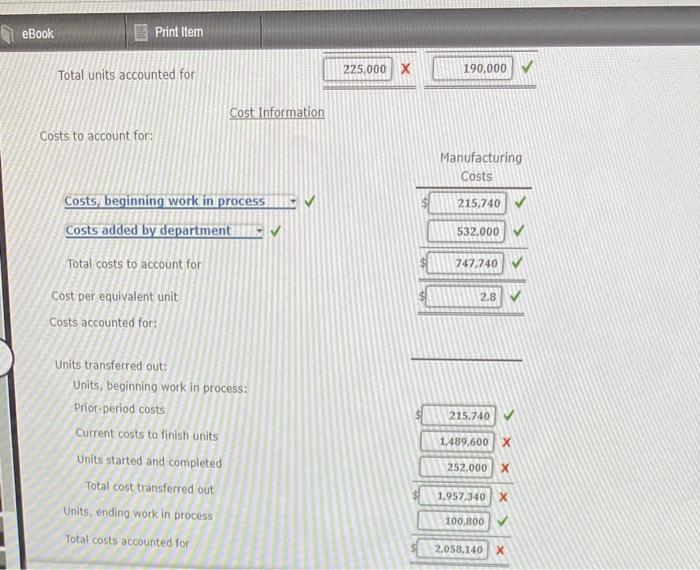

eBook Print item FIFO Method, Single Department Analysis, One Cost Category Hatch Company produces a product that passes through three processes: Fabrication, Assembly, and Finishing. All manufacturing costs are added uniformly for all processes. The following information was obtained for the Fabrication Department for June a. Work in process, June 1, had 90,000 units (40 percent completed) and the following costs: Direct materials $72.740 Direct labor 107,000 Overhead 36.000 b. During the month of June, 190,000 units were completed and transferred to the Assembly Department, and the following costs were added to production: Direct materials $223,000 Direct labor 144,000 Overhead 165,000 c. On June 30, there were 45,000 partially completed units in process. These units were 80 percent complete, Required: Prepare a cost of production report for the Fabrication Department for June using the FIFO method of costing. Round the cost per equivalent unit to the nearest cent Hatch Company Fabrication Department Production Report for June Tinit Information Hatch Company Fabrication Department Production Report for June Unit Information Units to account for: Units, beginning work in process Units started 90,000 135.000X 225,000 X Total units to account for Units accounted for: Physical Flow Equivalent units 90,000 X 90,000 X Started and completed From beginning work in process Units ending work in process 90,000 54.000 45.000 36,000 Total units accounted for 225.000 x 190,000 Cost Information Costs to account for: Manufacturing Costs 215,740 costs, beginning work in process Costs added by department 532.000 eBook Print Item Total units accounted for 225,000 X 190,000 Cost Information Costs to account for: Manufacturing Costs Costs, beginning work in process 215,740 Costs added by department 532,000 Total costs to account for 747,740 2.8 Cost per equivalent unit Costs accounted for: 215,740 Units transferred out: Units, beginning work in process: Prior period costs Current costs to finish units Units started and completed Total cost transferred out Units, ending work in process 1,489.600 X 252,000 X 1,957,340 X 100.800 Total costs accounted for 2,058,140X