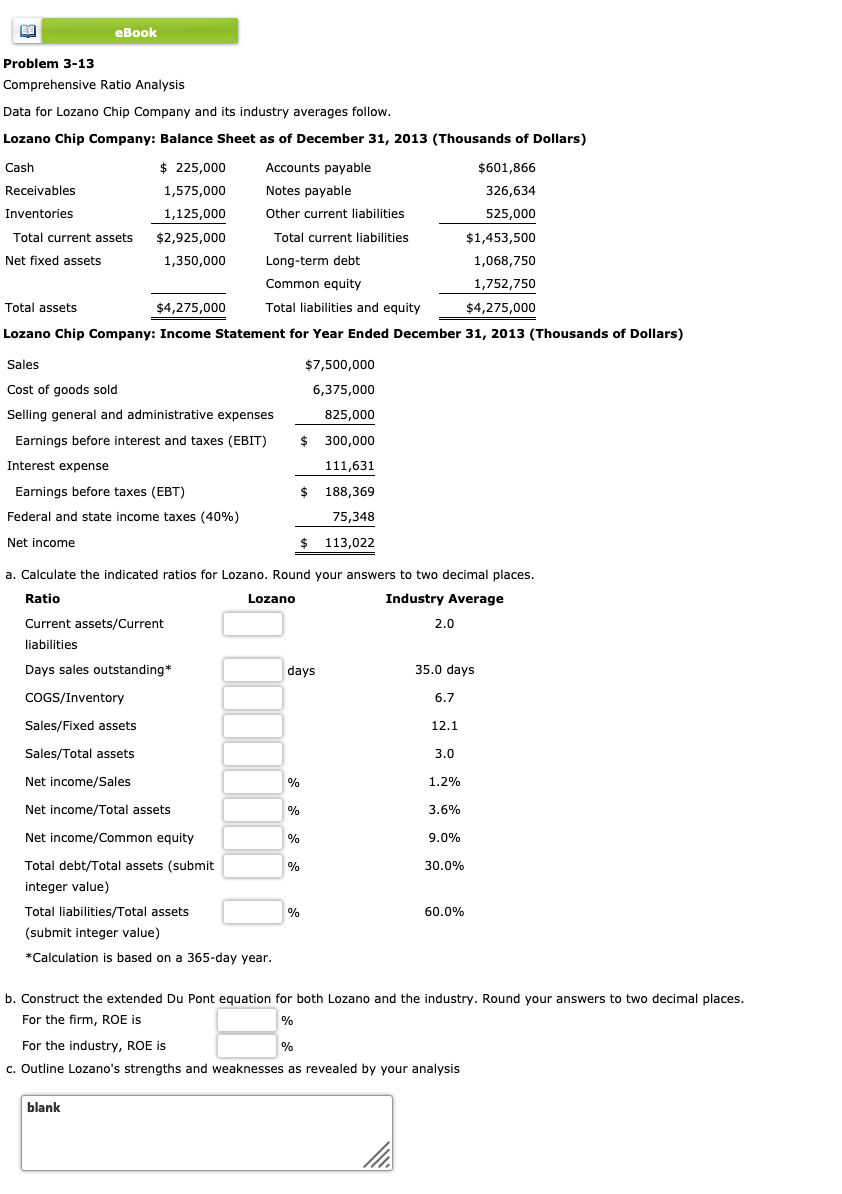

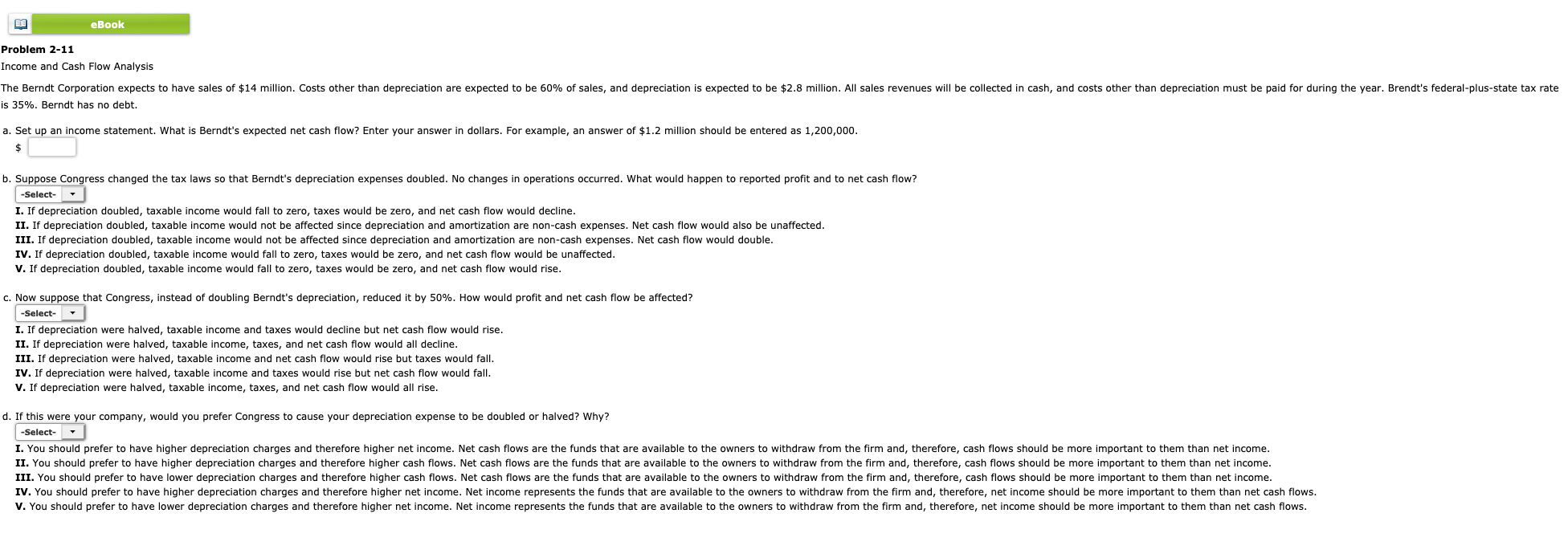

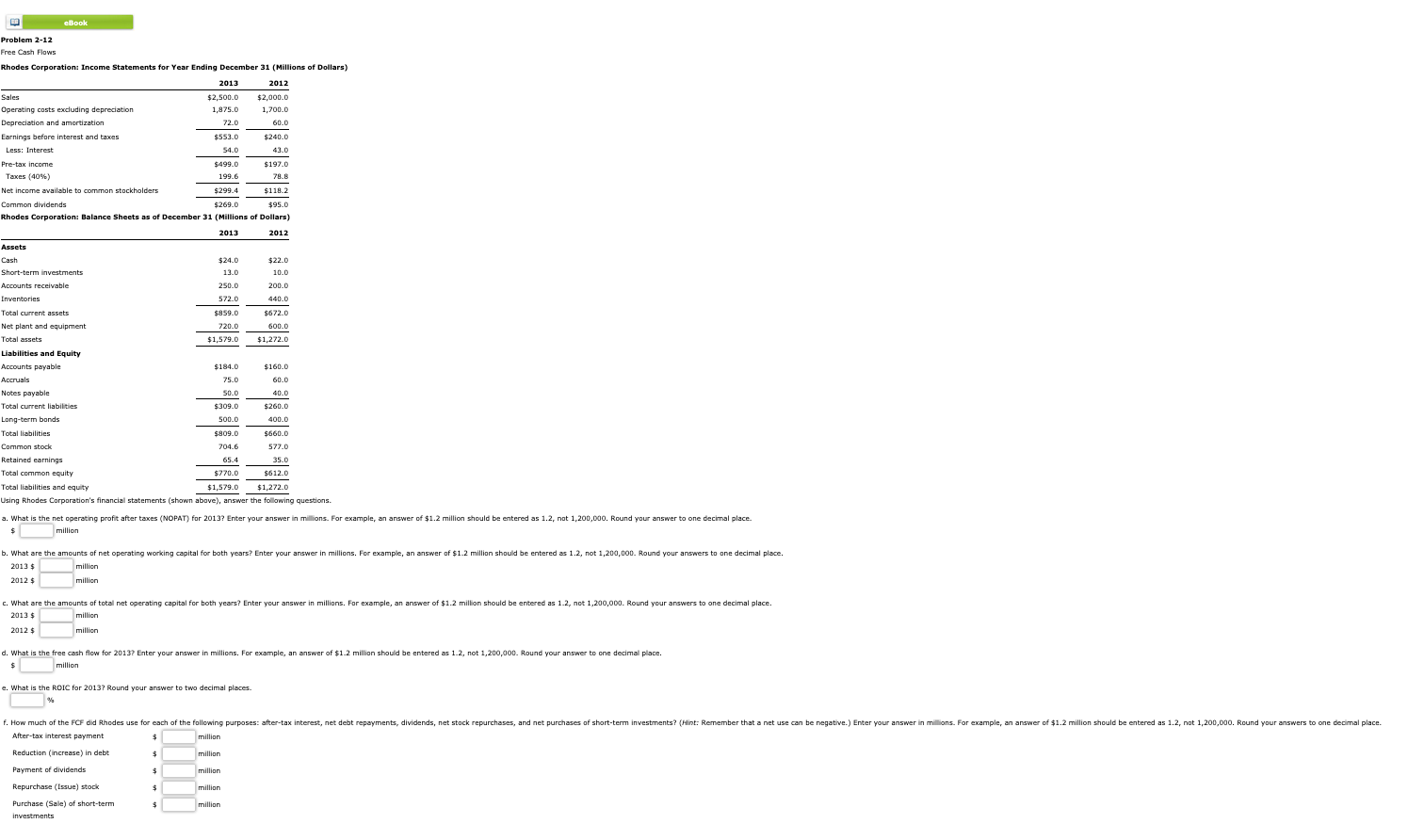

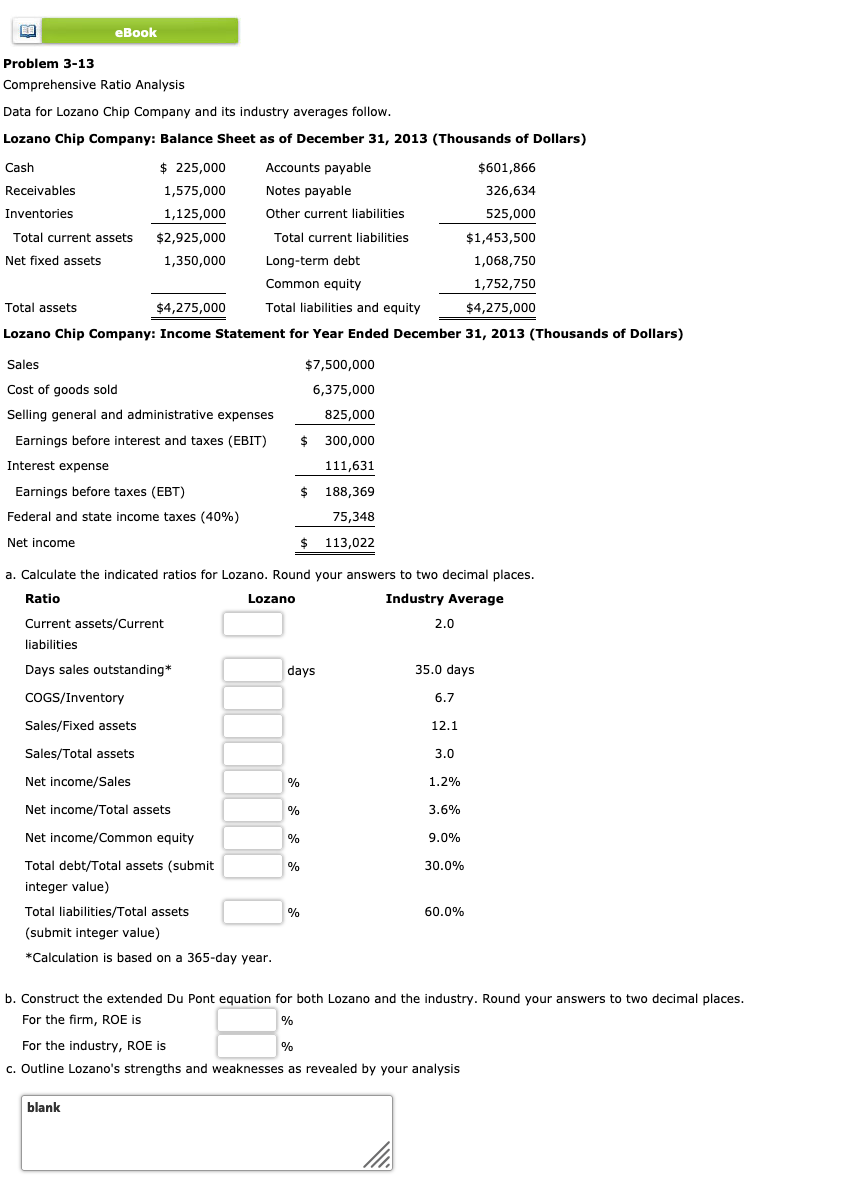

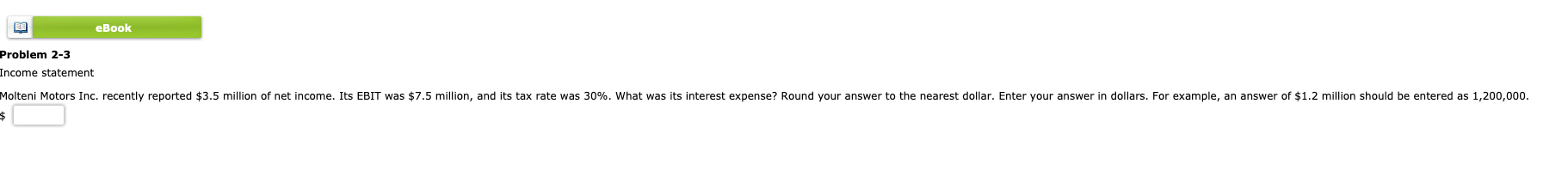

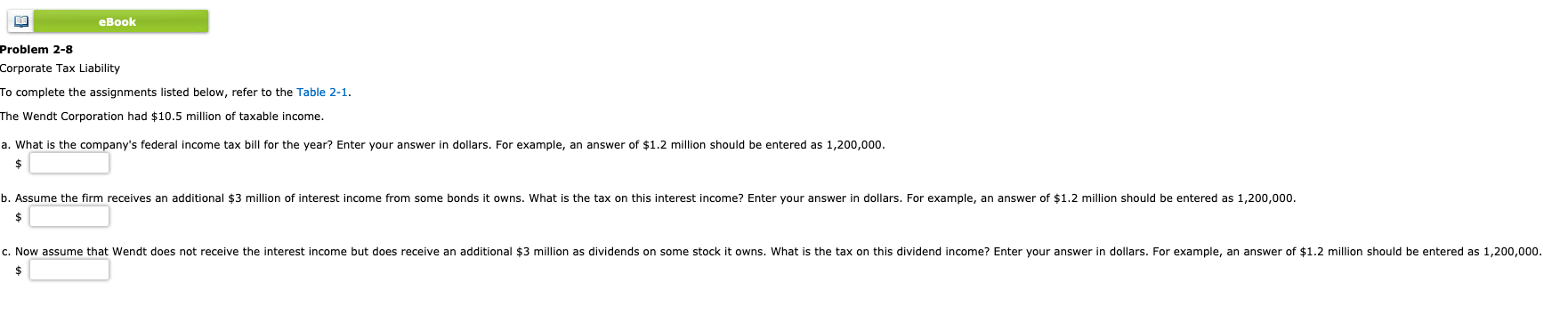

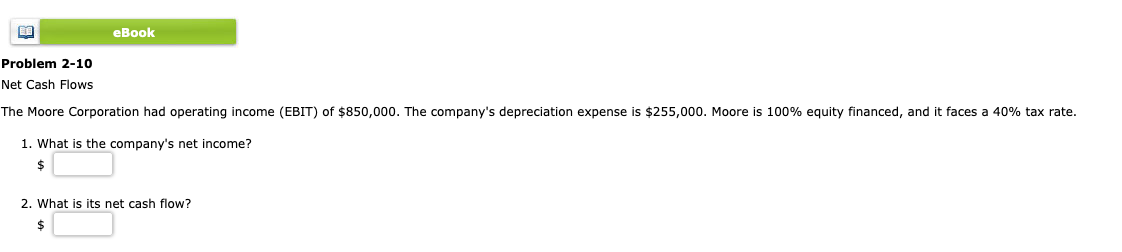

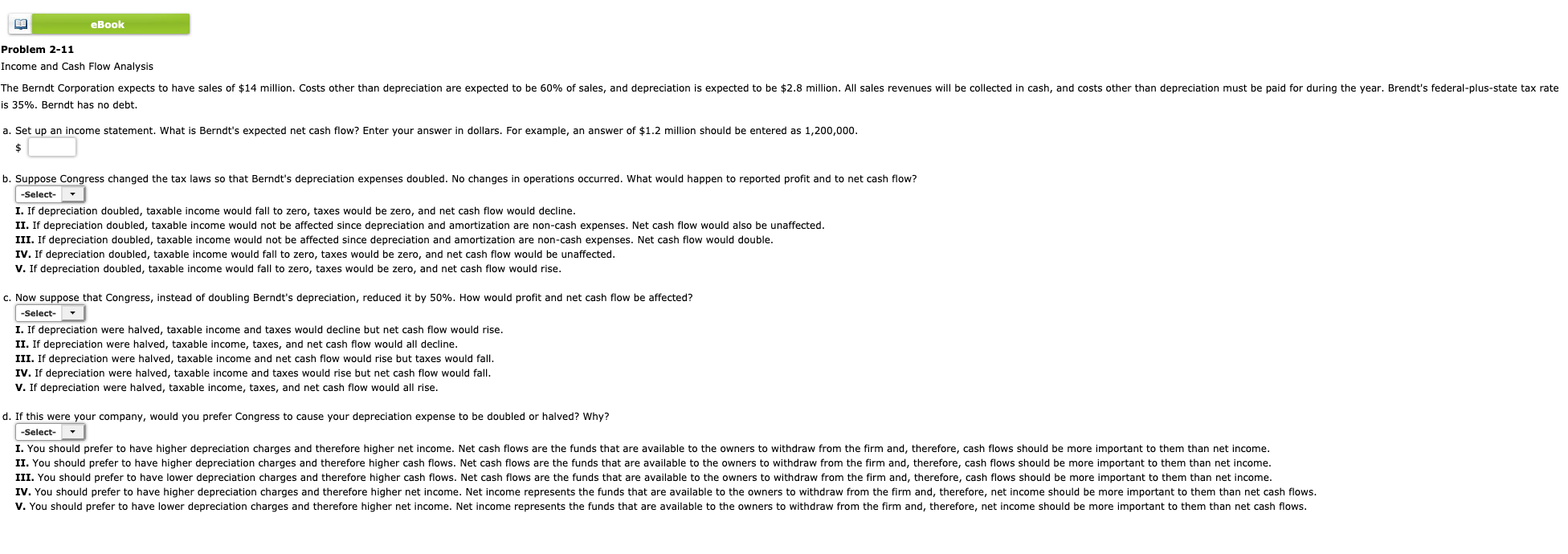

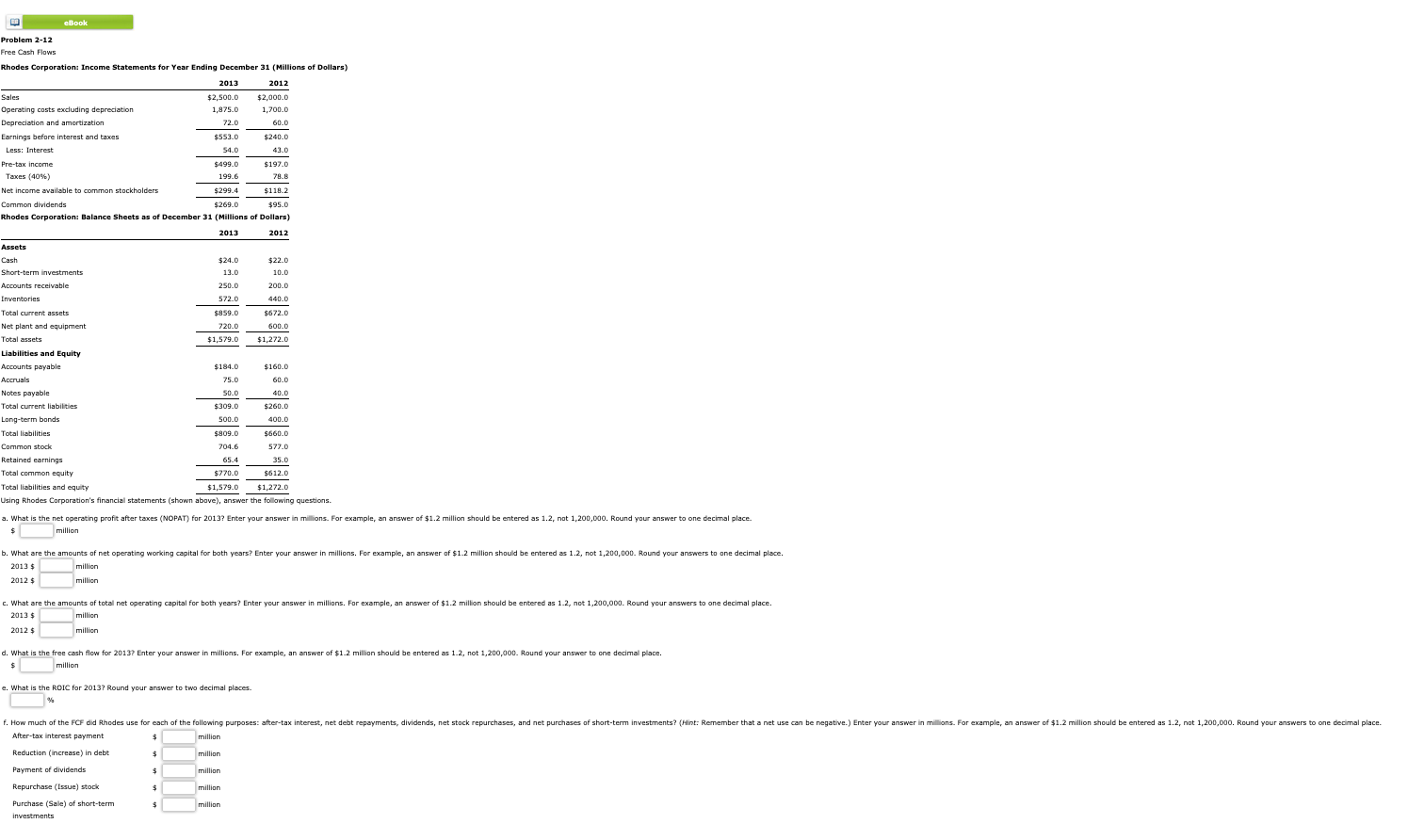

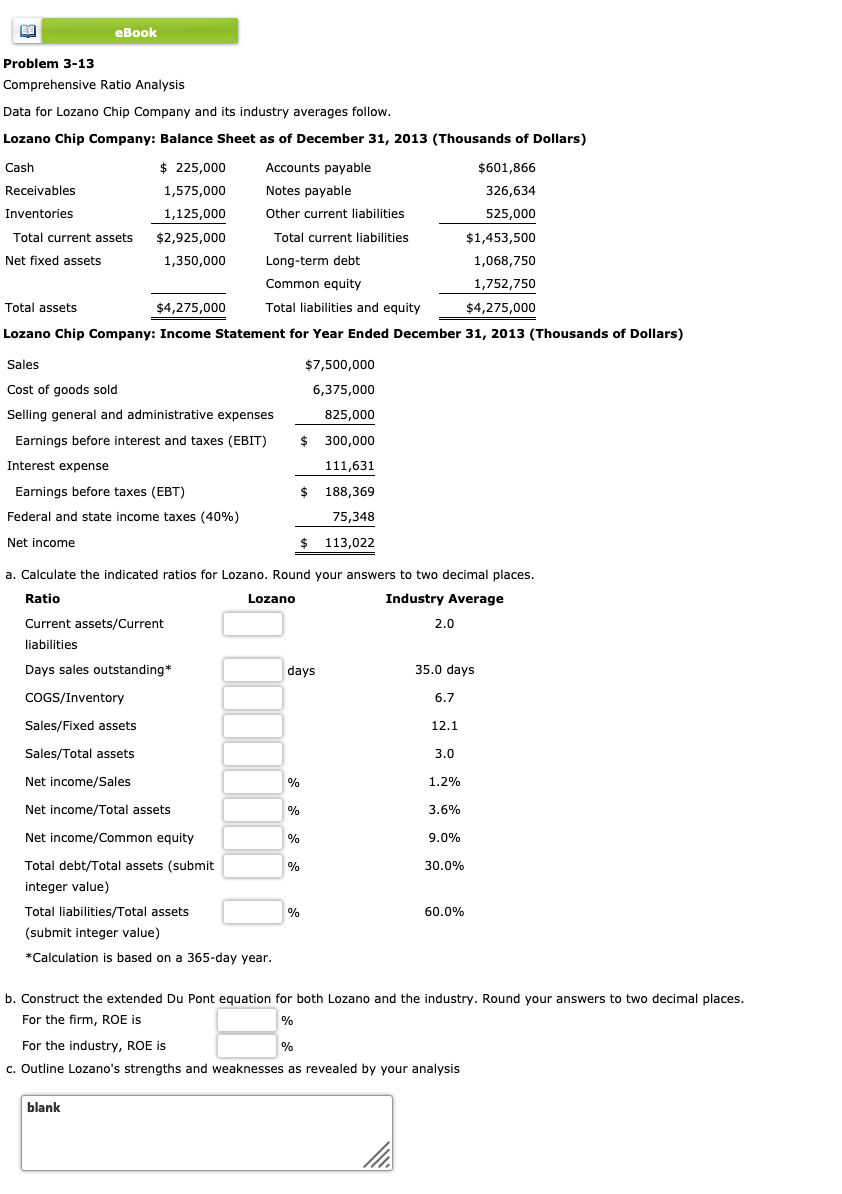

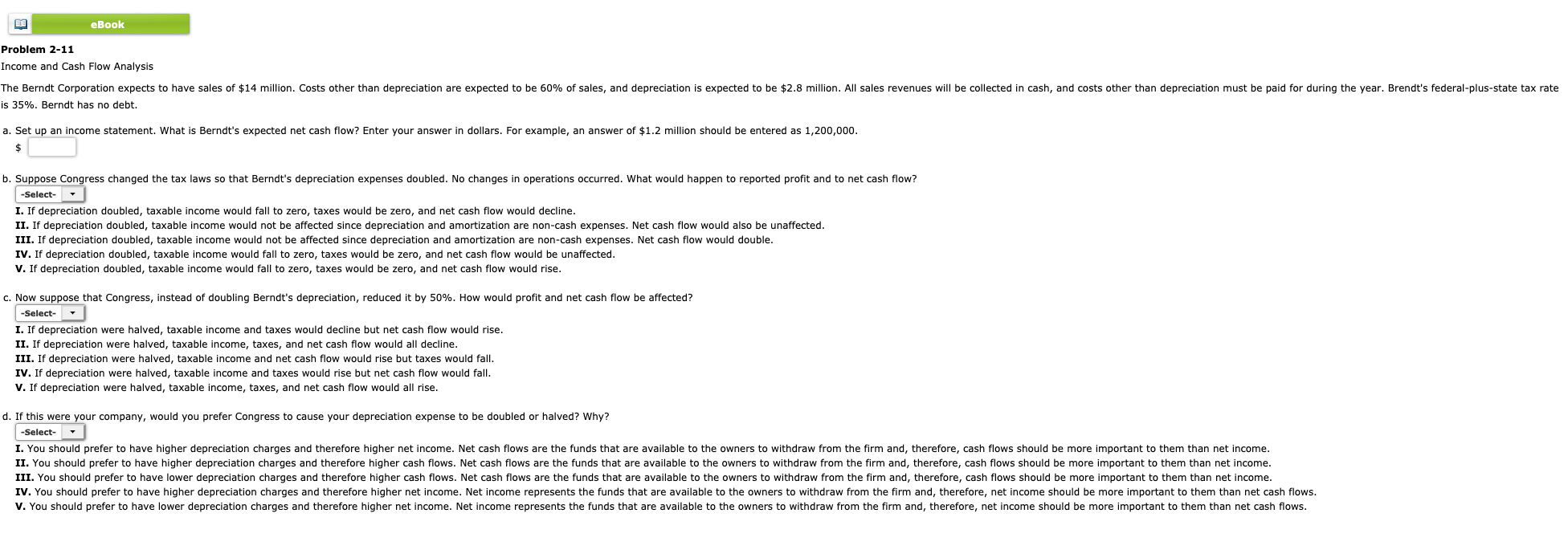

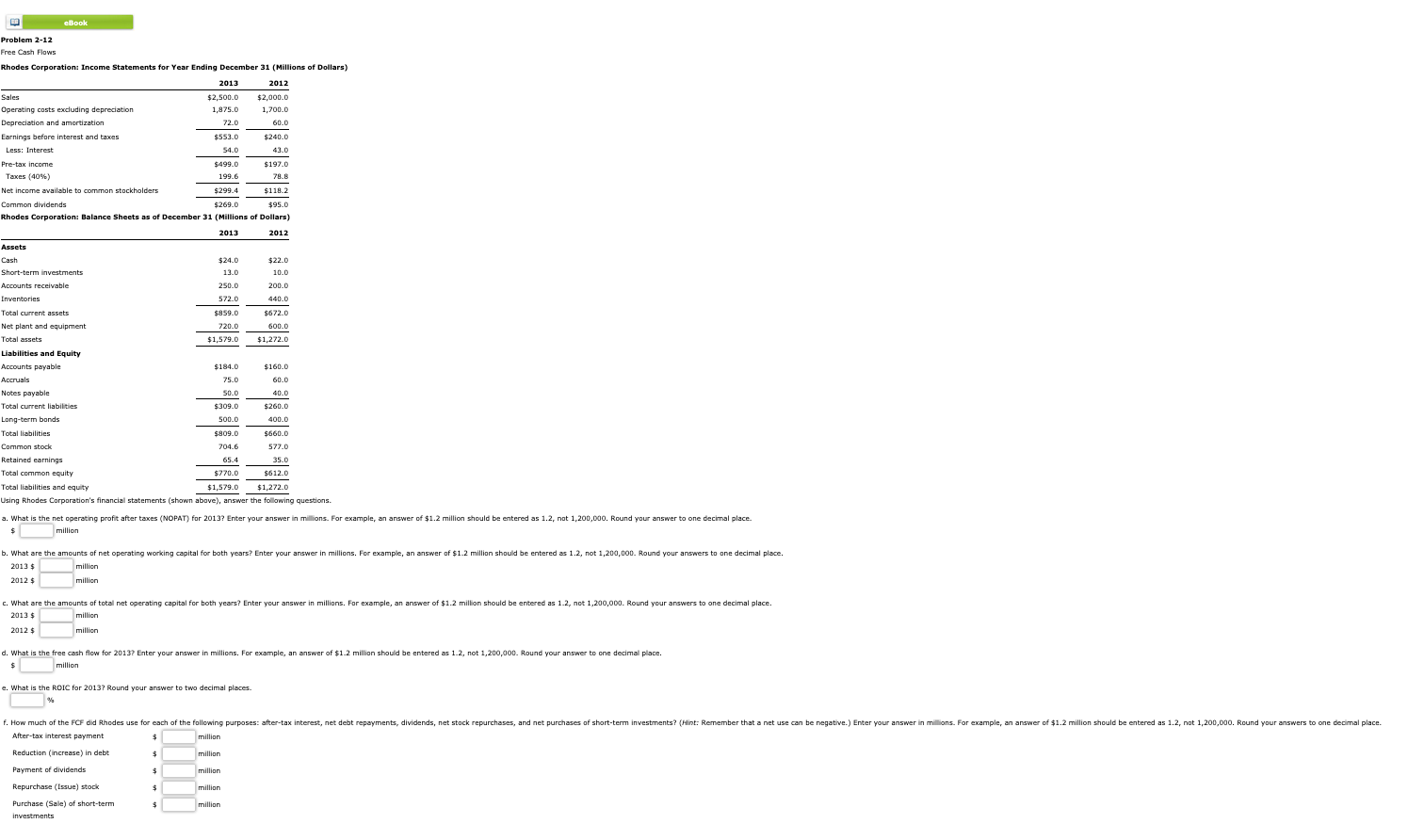

eBook Problem 3-13 Comprehensive Ratio Analysis Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2013 (Thousands of Dollars) Cash $ 225,000 Accounts payable $601,866 Receivables 1,575,000 Notes payable 326,634 Inventories 1,125,000 Other current liabilities 525,000 Total current assets $2,925,000 Total current liabilities $1,453,500 Net fixed assets 1,350,000 Long-term debt 1,068,750 Common equity 1,752,750 Total assets $4,275,000 Total liabilities and equity $4,275,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2013 (Thousands of Dollars) Sales $7,500,000 Cost of goods so 6,375,000 Selling general and administrative expenses 825,000 Earnings before interest and taxes (EBIT) $ 300,000 Interest expense 111,631 Earnings before taxes (EBT) $ 188,369 Federal and state income taxes (40%) 75,348 Net income 113,022 a. Calculate the indicated ratios for Lozano. Round your answers to two decimal places. Ratio Lozano Industry Average Current assets/Current 2.0 liabilities Days sales outstanding* days 35.0 days COGS/Inventory 6.7 Sales/Fixed assets 12.1 Sales/Total assets 3.0 Net income/Sales 1.2% Net income/Total assets 3.6% Net income/Common equity 9.0% Total debt/Total assets (submit 30.0% integer value) Total liabilities/Total assets % 60.0% (submit integer value) *Calculation is based on a 365-day year. b. Construct the extended Du Pont equation for both Lozano and the industry. Round your answers to two decimal places. For the firm, ROE is /% For the industry, ROE is % c. Outline Lozano's strengths and weaknesses as revealed by your analysis blankeBook Problem 2-3 Income statement Molteni Motors Inc. recently reported $3.5 million of net income. Its EBIT was $7.5 million, and its tax rate was 30%. What was its interest expense? Round your answer to the nearest dollar. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000.eBook Problem 2-8 Corporate Tax Liability To complete the assignments listed below, refer to the Table 2-1. The Wendt Corporation had $10.5 million of taxable income. a. What is the company's federal income tax bill for the year? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. $ b. Assume the firm receives an additional $3 million of interest income from some bonds it owns. What is the tax on this interest income? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. $ c. Now assume that Wendt does not receive the interest income but does receive an additional $3 million as dividends on some stock it owns. What is the tax on this dividend income? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. $eBook Problem 2-10 Net Cash Flows The Moore Corporation had operating income (EBIT) of $850,000. The company's depreciation expense is $255,000. Moore is 100% equity financed, and it faces a 40% tax rate. 1. What is the company's net income? $ 2. What is its net cash flow? $eBook Problem 2-11 Income and Cash Flow Analysis The Berndt Corporation expects to have sales of $14 million. Costs other than depreciation are expected to be 60% of sales, and depreciation is expected to be $2.8 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Brendt's federal-plus-state tax rate is 35%. Berndt has no debt. a. Set up an income statement. What is Berndt's expected net cash flow? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. $ b. Suppose Congress changed the tax laws so that Berndt's depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? -Select- I. If depreciation doubled, taxable income would fall to zero, taxes would be zero, and net cash flow would decline. II. If depreciation doubled, taxable income would not be affected since depreciation and amortization are non-cash expenses. Net cash flow would also be unaffected. III. If depreciation doubled, taxable income would not be affected since depreciation and amortization are non-cash expenses. Net cash flow would double. IV. If depreciation doubled, taxable income would fall to zero, taxes would be zero, and net cash flow would be unaffected. V. If depreciation doubled, taxable income would fall to zero, taxes would be zero, and net cash flow would rise. c. Now suppose that Congress, instead of doubling Berndt's depreciation, reduced it by 50%. How would profit and net cash flow be affected? -Select- I. If depreciation were halved, taxable income and taxes would decline but net cash flow would rise. II. If depreciation were halved, taxable income, taxes, and net cash flow would all decline. III. If depreciation were halved, taxable income and net cash flow would rise but taxes would fall. IV. If depreciation were halved, taxable income and taxes would rise but net cash flow would fall. V. If depreciation were halved, taxable income, taxes, and net cash flow would all rise. d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why? -Select- I. You should prefer to have higher depreciation charges and therefore higher net income. Net cash flows are the funds that are available to the owners to withdraw from the firm and, therefore, cash flows should be more important to them than net income. IT. You should prefer to have higher depreciation charges and therefore higher cash flows. Net cash flows are the funds that are available to the owners to withdraw from the firm and, therefore, cash flows should be more important to them than net income. III. You should prefer to have lower depreciation charges and therefore higher cash flows. Net cash flows are the funds that are available to the owners to withdraw from the firm and, therefore, cash flows should be more important to them than net income. IV. You should prefer to have higher depreciation charges and therefore higher net income. Net income represents the funds that are available to the owners to withdraw from the firm and, therefore, net income should be more important to them than net cash flows. V. You should prefer to have lower depreciation charges and therefore higher net income. Net income represents the funds that are available to the owners to withdraw from the firm and, therefore, net income should be more important to them than net cash flows.eBook Problem 2-12 Free Cash Flows Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2013 2012 Sales $2,500.0 $2,000.0 perating costs excluding depreciation 1,975.0 1,700.D reciation and amortization 72. Earnings before interest and taxes 553.0 $240.0 Less: Interest Pre-tax income 499.0 $197.0 Taxes (4095) 199.6 78.8 Net income available to common stockholders $299.4 $118. Common dividends $269. $95.0 Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2013 2012 Assets Cash $24.0 $22.0 Short-term investments 13.0 10.0 Accounts receivable 250.D 200.0 Inventories 572.0 440-D Total current assets $959.0 672. Net plant and equipment 720.0 600.D Total assets $1,579.0 1,272. Liabilities and Equity Accounts payable $184.0 $160. Accruals 75.0 60.0 Notes payable SO.D Total current liabilities $309.0 $260.0 Long-term bonds SOD.D 400-0 Total liabilities :909. $660.D Common stock 704.6 577.0 Retained earnings 65.4 35.0 Total common equity $770.0 $612.0 otal liabilities and equity $1,579.0 $1,272.0 Using Rhodes Corporation's financial statements (shown above), answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2013? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to one decimal place. million b. What are the amounts of net operating working capital for both years? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answers to one decimal place. 2013 $ million 2012 $ million . What are the amounts of total net operating capital for both years? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answers to one decimal place. 2013 $ million 2012 $ million d. What is the free cash flow for 20137 Enter your answer in millions. For exar $ million mple, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to one decimal place. e. What is the ROIC for 2013? Round your answer to two decimal places. f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answers to one decimal place. After-tax interest payment million Reduction (increase) in debt million Payment of dividends million Repurchase (Issue) stock million Purchase (Sale) of short-term million investments