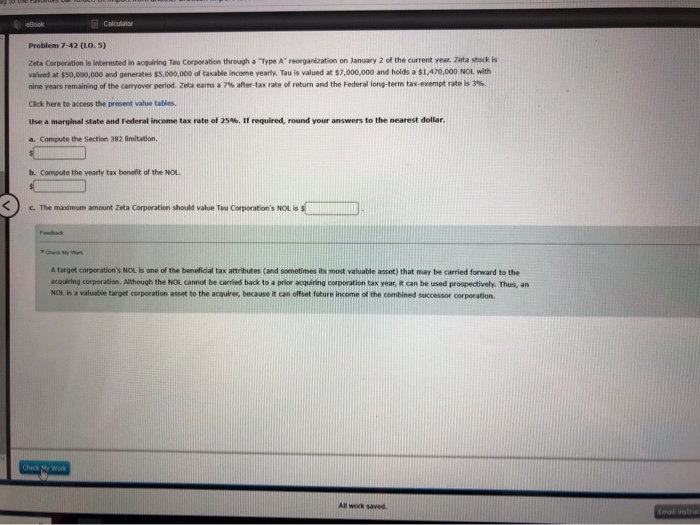

eBook Problem 7-42 (LO. 5) Zeta Corporation is interested in acquiring Corporation through a "Type A reorganization on January 2 of the current year Zeta tekis valed $50,000,000 and generates $5,000,000 of taxable income yearly. Thuis valued at $7,000,000 and holds a $1470,000 NOL with nine years remaining of the carryover period. Zeta s 7 after-tax rate of return and the Federal long-term tax exemptate Click here to access the present value table Use a marginal state and Federal income tax rate of 25%. If required, round your answers to the nearest dollar. a. Compute the section 382 limitation b. Compute the yearly tax benefit of the NOL c. The maximum amount Zeta Corporation should value Tau Corporation's NOLIS A target corporation's NOL is one of the beneficial tax attributes and sometimes its most valuable at that may be carried forward to the acquiring corporation. Although the NOI cannot be carried back to a prior acquiring corporation tax year, it can be used prospectively. Thus, an NOL 18 valuate target corporations to the acquirer, because it can offset future income of the comed o r corporation. Check My Work eBook Problem 7-42 (LO. 5) Zeta Corporation is interested in acquiring Corporation through a "Type A reorganization on January 2 of the current year Zeta tekis valed $50,000,000 and generates $5,000,000 of taxable income yearly. Thuis valued at $7,000,000 and holds a $1470,000 NOL with nine years remaining of the carryover period. Zeta s 7 after-tax rate of return and the Federal long-term tax exemptate Click here to access the present value table Use a marginal state and Federal income tax rate of 25%. If required, round your answers to the nearest dollar. a. Compute the section 382 limitation b. Compute the yearly tax benefit of the NOL c. The maximum amount Zeta Corporation should value Tau Corporation's NOLIS A target corporation's NOL is one of the beneficial tax attributes and sometimes its most valuable at that may be carried forward to the acquiring corporation. Although the NOI cannot be carried back to a prior acquiring corporation tax year, it can be used prospectively. Thus, an NOL 18 valuate target corporations to the acquirer, because it can offset future income of the comed o r corporation. Check My Work